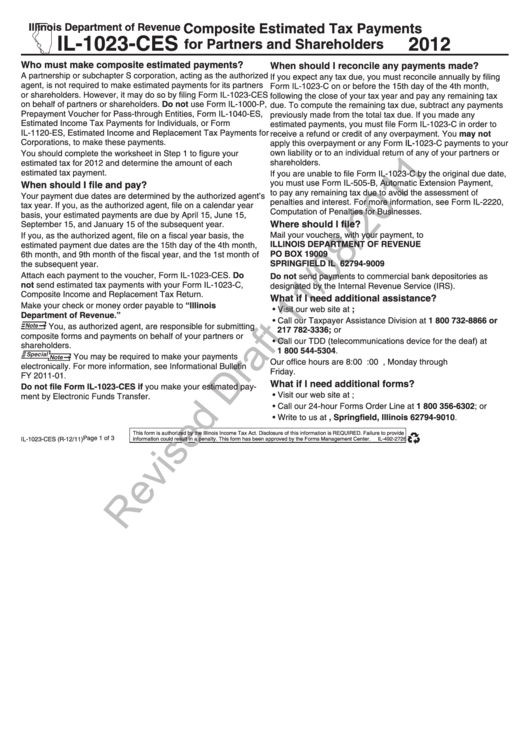

Form Il-1023-Ces Draft - Composite Estimated Tax Payments For Partners And Shareholders - 2012

ADVERTISEMENT

Composite Estimated Tax Payments

Illinois Department of Revenue

IL-1023-CES

2012

for Partners and Shareholders

Who must make composite estimated payments?

When should I reconcile any payments made?

A partnership or subchapter S corporation, acting as the authorized

If you expect any tax due, you must reconcile annually by filing

agent, is not required to make estimated payments for its partners

Form IL-1023-C on or before the 15th day of the 4th month,

or shareholders. However, it may do so by filing Form IL-1023-CES

following the close of your tax year and pay any remaining tax

on behalf of partners or shareholders. Do not use Form IL-1000-P,

due. To compute the remaining tax due, subtract any payments

Prepayment Voucher for Pass-through Entities, Form IL-1040-ES,

previously made from the total tax due. If you made any

Estimated Income Tax Payments for Individuals, or Form

estimated payments, you must file Form IL-1023-C in order to

IL-1120-ES, Estimated Income and Replacement Tax Payments for

receive a refund or credit of any overpayment. You may not

Corporations, to make these payments.

apply this overpayment or any Form IL-1023-C payments to your

own liability or to an individual return of any of your partners or

You should complete the worksheet in Step 1 to figure your

shareholders.

estimated tax for 2012 and determine the amount of each

estimated tax payment.

If you are unable to file Form IL-1023-C by the original due date,

you must use Form IL-505-B, Automatic Extension Payment,

When should I file and pay?

to pay any remaining tax due to avoid the assessment of

Your payment due dates are determined by the authorized agent’s

penalties and interest. For more information, see Form IL-2220,

tax year. If you, as the authorized agent, file on a calendar year

Computation of Penalties for Businesses.

basis, your estimated payments are due by April 15, June 15,

Where should I file?

September 15, and January 15 of the subsequent year.

Mail your vouchers, with your payment, to

If you, as the authorized agent, file on a fiscal year basis, the

ILLINOIS DEPARTMENT OF REVENUE

estimated payment due dates are the 15th day of the 4th month,

PO BOX 19009

6th month, and 9th month of the fiscal year, and the 1st month of

SPRINGFIELD IL 62794-9009

the subsequent year.

Attach each payment to the voucher, Form IL-1023-CES. Do

Do not send payments to commercial bank depositories as

not send estimated tax payments with your Form IL-1023-C,

designated by the Internal Revenue Service (IRS).

Composite Income and Replacement Tax Return.

What if I need additional assistance?

Make your check or money order payable to “Illinois

• Visit our web site at tax.illinois.gov;

Department of Revenue.”

• Call our Taxpayer Assistance Division at 1 800 732-8866 or

You, as authorized agent, are responsible for submitting

217 782-3336; or

composite forms and payments on behalf of your partners or

• Call our TDD (telecommunications device for the deaf) at

shareholders.

1 800 544-5304.

You may be required to make your payments

Our office hours are 8:00 a.m. to 5:00 p.m., Monday through

electronically. For more information, see Informational Bulletin

Friday.

FY 2011-01.

What if I need additional forms?

Do not file Form IL-1023-CES if you make your estimated pay-

• Visit our web site at tax.illinois.gov;

ment by Electronic Funds Transfer.

• Call our 24-hour Forms Order Line at 1 800 356-6302; or

• Write to us at P.O. Box 19010, Springfield, Illinois 62794-9010.

This form is authorized by the Illinois Income Tax Act. Disclosure of this information is REQUIRED. Failure to provide

Page 1 of 3

information could result in a penalty. This form has been approved by the Forms Management Center.

IL-492-2726

IL-1023-CES (R-12/11)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3