Form 44-105 - Withholding Payment Voucher - Iowa Department Of Revenue

ADVERTISEMENT

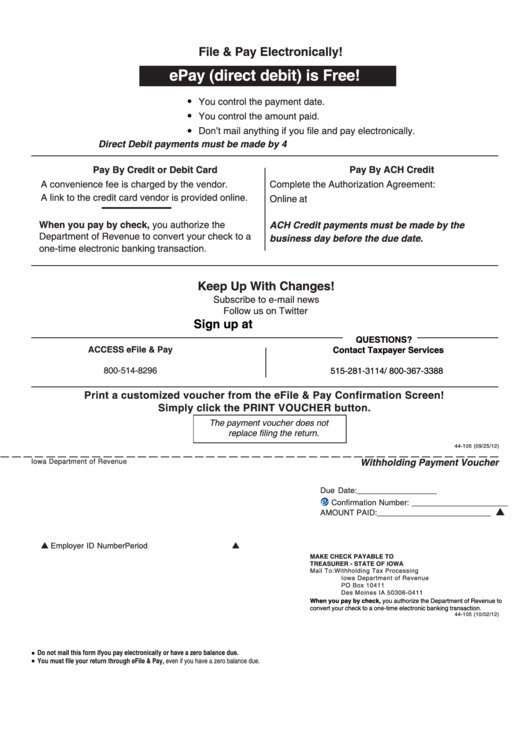

File & Pay Electronically!

ePay (direct debit) is Free!

.

You control the payment date.

.

You control the amount paid.

.

Don’t mail anything if you file and pay electronically.

Direct Debit payments must be made by 4 p.m. Central Time on the due date.

Pay By ACH Credit

Pay By Credit or Debit Card

Complete the Authorization Agreement:

A convenience fee is charged by the vendor.

A link to the credit card vendor is provided online.

Online at

When you pay by check, you authorize the

ACH Credit payments must be made by the

Department of Revenue to convert your check to a

business day before the due date.

one-time electronic banking transaction.

Keep Up With Changes!

Subscribe to e-mail news

Follow us on Twitter

Sign up at

QUESTIONS?

ACCESS eFile & Pay

Contact Taxpayer Services

idr@iowa.gov

800-514-8296

515-281-3114/ 800-367-3388

Print a customized voucher from the eFile & Pay Confirmation Screen!

Simply click the PRINT VOUCHER button.

The payment voucher does not

replace filing the return.

44-105 (09/25/12)

Withholding Payment Voucher

Iowa Department of Revenue

Due Date:__________________

Confirmation Number: ______________________

AMOUNT PAID: __________________________

Employer ID Number

Period

MAKE CHECK PAYABLE TO

TREASURER - STATE OF IOWA

Mail To:

Withholding Tax Processing

Iowa Department of Revenue

PO Box 10411

Des Moines IA 50306-0411

When you pay by check, you authorize the Department of Revenue to

convert your check to a one-time electronic banking transaction.

44-105 (10/02/12)

. .

Do not mail this form if you pay electronically or have a zero balance due.

You must file your return through eFile & Pay, even if you have a zero balance due.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1