Form 13 - Wyoming Sales Tax Return For Occasional Sales - Wyoming Department Of Revenue

ADVERTISEMENT

;;;;

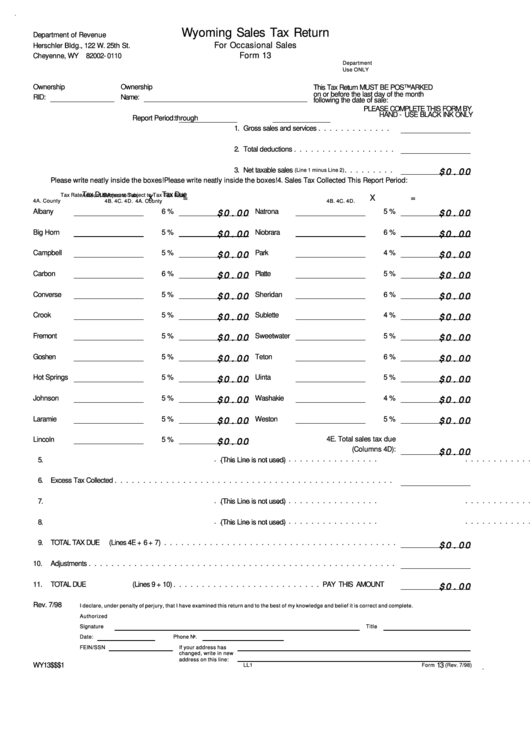

Wyoming Sales Tax Return

«

Department of Revenue

For Occasional Sales

«

Herschler Bldg., 122 W. 25th St.

Form 13

Cheyenne, WY 82002-0110

Department

Use ONLY

Ownership

Ownership

This Tax Return MUST BE POSTMARKED

on or before the last day of the month

RID:

Name:

following the date of sale:

PLEASE COMPLETE THIS FORM BY

HAND - USE BLACK INK ONLY

Report Period:

through

Gross sales and services

.

. .

.

. .

.

.

. .

.

. .

1.

2.

Total deductions

.

.

.

. .

.

. .

.

. .

.

.

. .

.

. .

3.

Net taxable sales

. .

.

.

. .

.

. .

(Line 1 minus Line 2)

$0.00

Please write neatly inside the boxes!

4. Sales Tax Collected This Report Period:

Please write neatly inside the boxes!

Tax Due

Tax Due

Amount Subject to Tax

Tax Rate

Amount Subject to Tax

Tax Rate

X

=

X

=

4A. County

4B.

4C.

4D.

4A. County

4B.

4C.

4D.

Albany

6 %

Natrona

5 %

$0.00

$0.00

Big Horn

5 %

Niobrara

6 %

$0.00

$0.00

Campbell

5 %

Park

4 %

$0.00

$0.00

Carbon

6 %

Platte

5 %

$0.00

$0.00

Converse

5 %

Sheridan

6 %

$0.00

$0.00

Crook

5 %

Sublette

4 %

$0.00

$0.00

Fremont

5 %

Sweetwater

5 %

$0.00

$0.00

Goshen

5 %

Teton

6 %

$0.00

$0.00

Hot Springs

5 %

Uinta

5 %

$0.00

$0.00

Johnson

5 %

Washakie

4 %

$0.00

$0.00

Laramie

5 %

Weston

5 %

$0.00

$0.00

4E. Total sales tax due

Lincoln

5 %

$0.00

(Columns 4D):

$0.00

. .

.

.

. .

.

. .

.

. .

.

.

. .

.

. .

.

. .

.

.

. .

.

. .

. .

.

. .

.

.

. .

.

. .

.

. .

.

.

. .

.

. .

.

. .

.

.

. .

.

. .

5.

(This Line is not used)

6.

Excess Tax Collected

. .

.

.

. .

.

. .

.

. .

.

.

. .

.

. .

.

. .

.

.

. .

.

. .

.

. .

.

.

. .

.

. .

.

. .

.

.

. .

.

. .

. .

.

.

. .

.

. .

.

. .

.

.

. .

.

. .

.

. .

.

.

. .

.

. .

. .

.

. .

.

.

. .

.

. .

.

. .

.

.

. .

.

. .

.

. .

.

.

. .

.

. .

7.

(This Line is not used)

. .

.

.

. .

.

. .

.

. .

.

.

. .

.

. .

.

. .

.

.

. .

.

. .

. .

.

. .

.

.

. .

.

. .

.

. .

.

.

. .

.

. .

.

. .

.

.

. .

.

. .

(This Line is not used)

8.

9.

TOTAL TAX DUE

(Lines 4E + 6 + 7)

.

.

. .

.

.

. .

.

. .

.

. .

.

.

. .

.

. .

.

. .

.

.

. .

.

. .

.

. .

.

.

. .

.

. .

$0.00

10.

Adjustments

.

.

. .

.

. .

.

.

. .

.

. .

.

. .

.

.

. .

.

. .

.

. .

.

.

. .

.

. .

.

. .

.

.

. .

.

. .

.

. .

.

.

. .

.

. .

11.

TOTAL DUE

(Lines 9 + 10)

.

. .

.

. .

.

. .

.

.

. .

.

. .

.

. .

.

.

. .

.

. .

PAY THIS AMOUNT

$0.00

Rev. 7/98

I declare, under penalty of perjury, that I have examined this return and to the best of my knowledge and belief it is correct and complete.

Authorized

Signature

Title

Date:

Phone No.

«

«

FEIN/SSN

If your address has

;;;;

changed, write in new

address on this line:

WY13$$$1

13

LL1

Form

(Rev. 7/98)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1