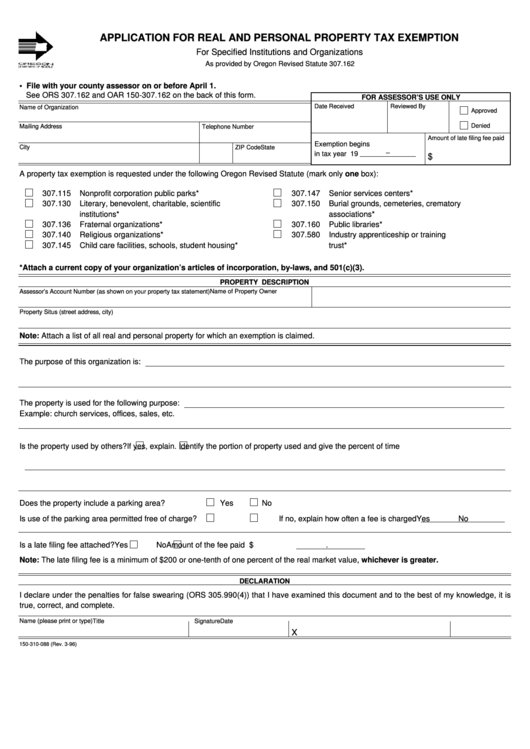

APPLICATION FOR REAL AND PERSONAL PROPERTY TAX EXEMPTION

For Specified Institutions and Organizations

As provided by Oregon Revised Statute 307.162

• File with your county assessor on or before April 1.

See ORS 307.162 and OAR 150-307.162 on the back of this form.

FOR ASSESSOR’S USE ONLY

Date Received

Reviewed By

Name of Organization

Approved

Denied

Mailing Address

Telephone Number

Amount of late filing fee paid

Exemption begins

City

State

ZIP Code

–

in tax year 19

$

A property tax exemption is requested under the following Oregon Revised Statute (mark only one box):

307.115

Nonprofit corporation public parks*

307.147

Senior services centers*

307.130

Literary, benevolent, charitable, scientific

307.150

Burial grounds, cemeteries, crematory

institutions*

associations*

307.136

Fraternal organizations*

307.160

Public libraries*

307.140

Religious organizations*

307.580

Industry apprenticeship or training

307.145

Child care facilities, schools, student housing*

trust*

*Attach a current copy of your organization’s articles of incorporation, by-laws, and 501(c)(3).

PROPERTY DESCRIPTION

Name of Property Owner

Assessor’s Account Number (as shown on your property tax statement)

Property Situs (street address, city)

Note: Attach a list of all real and personal property for which an exemption is claimed.

The purpose of this organization is:

The property is used for the following purpose:

Example: church services, offices, sales, etc.

Is the property used by others?

Yes

No

If yes, explain. Identify the portion of property used and give the percent of time used.

Does the property include a parking area?

Yes

No

Is use of the parking area permitted free of charge?

Yes

No

If no, explain how often a fee is charged

Is a late filing fee attached?

Yes

No

Amount of the fee paid $

.

Note: The late filing fee is a minimum of $200 or one-tenth of one percent of the real market value, whichever is greater.

DECLARATION

I declare under the penalties for false swearing (ORS 305.990(4)) that I have examined this document and to the best of my knowledge, it is

true, correct, and complete.

Name (please print or type)

Title

Signature

Date

X

150-310-088 (Rev. 3-96)

1

1