Instructions for Form FTB 3519

Payment for Automatic Extension for Individuals

General Information

• Credit Card: Use your major credit card. Call 800.272.9829 or go to

, use code 1555. Official Payments Corp. charges a

Mandatory Electronic Payments – You are required to remit all your payments

convenience fee for using this service. Do not mail form FTB 3519 to the FTB.

electronically once you make an estimate or extension payment exceeding $20,000

• Check or Money Order: Using black or blue ink, complete your check or money

or you file an original return with a total tax liability over $80,000 for any taxable

order and the payment form below, mail both to the “Franchise Tax Board.”

year that begins on or after January 1, 2009. Once you meet this threshold, all

Make all checks or money orders payable in U.S. dollars and drawn against a

subsequent payments regardless of amount, tax type, or taxable year must be

U.S. financial institution.

remitted electronically. The first payment that would trigger the mandatory e-pay

Penalties and Interest

requirement does not have to be made electronically. Individuals who do not send

the payment electronically will be subject to a one percent noncompliance penalty.

If you fail to pay your total tax liability by April 17, 2012, you will incur a late

Electronic payments can be made using Web Pay on the Franchise Tax Board’s

payment penalty plus interest. If you pay at least 90% of the tax shown on the

(FTB’s) website, electronic funds withdrawal (EFW) as part of the e-file return, or

return by the original due date of the return, we will waive the penalty based

your credit card. For more information or to obtain the waiver form, go to

on reasonable cause. However, the imposition of interest is mandatory. If, after

ftb.ca.gov and search for mandatory epay.

April 17, 2012, you find that your estimate of tax due was too low, pay the

Use form FTB 3519, Payment for Automatic Extension for Individuals, only if both

additional tax as soon as possible to avoid or minimize further accumulation of

of the following apply:

penalties and interest. Pay your additional tax with another form FTB 3519. If you

• You cannot file your 2011 return by April 17, 2012. Due to the Emancipation

do not file your tax return by October 15, 2012, you will incur a late filing penalty

Day holiday on April 16, 2012, tax returns filed and payments mailed or

plus interest from the original due date of the return. For Fiscal Year Filers, your tax

submitted on April 17, 2012, will be considered timely.

return is due the 15th day of the 10th month following the close of your fiscal year.

Note: Fiscal Year Filers, your return is due the 15th day of the 4th month

Taxpayers Residing or Traveling Outside the USA

following the close of your fiscal year.

• You owe tax for 2011.

If you are residing or traveling outside the USA on April 17, 2012, the deadline

When you file your 2011 return, you can e-file or CalFile. Go to ftb.ca.gov

to file your return and pay the tax is June 15, 2012. Interest will accrue from the

and search for e-file options. If you use form FTB 3519, you may not file

original due date until the date of payment. If you need additional time to file, you

Form 540 2EZ or Short Form 540NR.

will be allowed a six-month extension without filing a request. To qualify for the

extension, file your tax return by December 17, 2012. To avoid any late-payment

Use the worksheet below to determine if you owe tax. If you do not owe tax, do not

penalties, pay your tax liability by June 15, 2012. When filing your tax return,

complete or mail form FTB 3519. However, file your return by October 15, 2012. If

attach a statement to the front indicating that you were “Outside the USA on

you owe tax, choose one of the following payment options:

April 17, 2012.”

• Web Pay: To make a payment online or to schedule a future payment (up to one

year in advance), go to ftb.ca.gov and search for web pay. Do not mail form

FTB 3519 to the FTB.

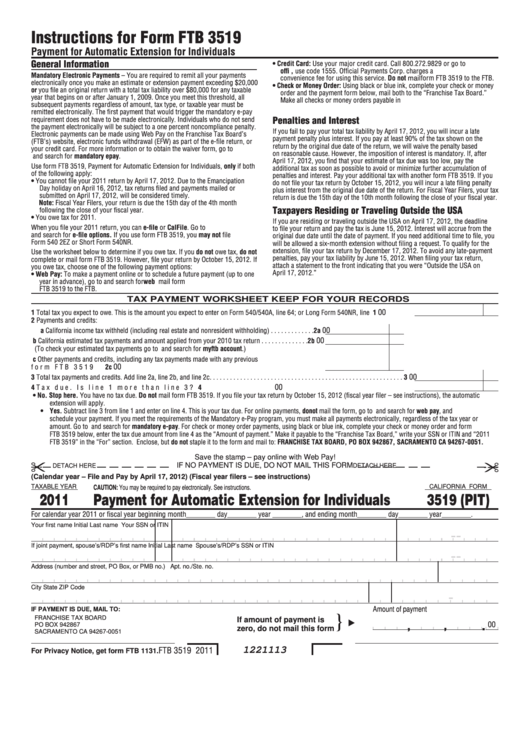

TAX PAYMENT WORKSHEET KEEP FOR YOUR RECORDS

00

1 Total tax you expect to owe. This is the amount you expect to enter on Form 540/540A, line 64; or Long Form 540NR, line 74. . . . . . . . . . . . . . .1

2 Payments and credits:

00

a California income tax withheld (including real estate and nonresident withholding) . . . . . . . . . . . . .2a

00

b California estimated tax payments and amount applied from your 2010 tax return . . . . . . . . . . . . . .2b

(To check your estimated tax payments go to ftb.ca.gov and search for myftb account.)

c Other payments and credits, including any tax payments made with any previous

00

form FTB 3519 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .2c

00

3 Total tax payments and credits. Add line 2a, line 2b, and line 2c . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3

00

4 Tax due. Is line 1 more than line 3? . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 4

• No. Stop here. You have no tax due. Do not mail form FTB 3519. If you file your tax return by October 15, 2012 (fiscal year filer – see instructions), the automatic

extension will apply.

• Yes. Subtract line 3 from line 1 and enter on line 4. This is your tax due. For online payments, do not mail the form, go to ftb.ca.gov and search for web pay, and

schedule your payment. If you meet the requirements of the Mandatory e-Pay program, you must make all payments electronically, regardless of the tax year or

amount. Go to ftb.ca.gov and search for mandatory e-pay. For check or money order payments, using black or blue ink, complete your check or money order and form

FTB 3519 below, enter the tax due amount from line 4 as the “Amount of payment.” Make it payable to the “Franchise Tax Board,” write your SSN or ITIN and “2011

FTB 3519” in the “For” section. Enclose, but do not staple it to the form and mail to: FRANCHISE TAX BOARD, PO BOX 942867, SACRAMENTO CA 94267-0051.

Save the stamp – pay online with Web Pay!

If NO PAYMENT IS DUE, DO NOT MAIL THIS fORM

DETACH HERE

DETACH HERE

(Calendar year – File and Pay by April 17, 2012) (Fiscal year filers – see instructions)

TAXABLE YEAR

CALIfORNIA fORM

CAUTION: You may be required to pay electronically. See instructions.

2011

Payment for Automatic Extension for Individuals

3519 (PIT)

For calendar year 2011 or fiscal year beginning month________ day________ year ________, and ending month________ day________ year________.

Your first name

Initial Last name

Your SSN or ITIN

-

-

If joint payment, spouse’s/RDP’s first name

Initial Last name

Spouse’s/RDP’s SSN or ITIN

-

-

Address (number and street, PO Box, or PMB no.)

Apt. no./Ste. no.

City

State

ZIP Code

-

Amount of payment

IF PAYMENT IS DUE, MAIL TO:

}

fRANCHISE TAX BOARD

If amount of payment is

00

.

,

,

PO BOX 942867

zero, do not mail this form

SACRAMENTO CA 94267-0051

FTB 3519 2011

1221113

For Privacy Notice, get form FTB 1131.

1

1