Form 31-015 - Monthly Sales Tax Instructions And Worksheet - 1998

ADVERTISEMENT

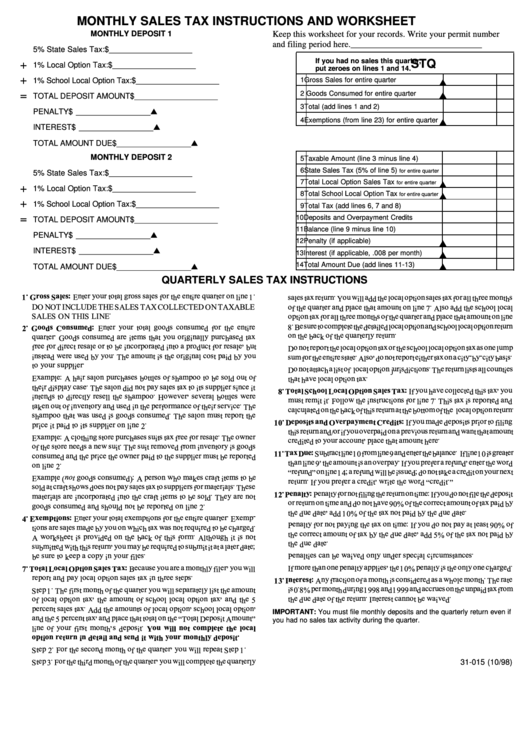

MONTHLY SALES TAX INSTRUCTIONS AND WORKSHEET

MONTHLY DEPOSIT 1

Keep this worksheet for your records. Write your permit number

and filing period here. ______________________________

5% State Sales Tax:

$ ___________________

If you had no sales this quarter,

STQ

+

1% Local Option Tax:

$ ___________________

put zeroes on lines 1 and 14.

+

1% School Local Option Tax: $ ___________________

1 Gross Sales for entire quarter

=

2 Goods Consumed for entire quarter

TOTAL DEPOSIT AMOUNT $ ___________________

3 Total (add lines 1 and 2)

PENALTY

$ _________________

4 Exemptions (from line 23) for entire quarter

INTEREST

$ _________________

TOTAL AMOUNT DUE

$ _________________

MONTHLY DEPOSIT 2

5 Taxable Amount (line 3 minus line 4)

6 State Sales Tax (5% of line 5)

for entire quarter

5% State Sales Tax:

$ ___________________

7 Total Local Option Sales Tax

for entire quarter

+

1% Local Option Tax:

$ ___________________

8 Total School Local Option Tax

for entire quarter

+

1% School Local Option Tax: $ ___________________

9 Total Tax (add lines 6, 7 and 8)

=

10 Deposits and Overpayment Credits

TOTAL DEPOSIT AMOUNT $ ___________________

11 Balance (line 9 minus line 10)

PENALTY

$ _________________

12 Penalty (if applicable)

INTEREST

$ _________________

13 Interest (if applicable, .008 per month)

14 Total Amount Due (add lines 11-13)

TOTAL AMOUNT DUE

$ _________________

QUARTERLY SALES TAX INSTRUCTIONS

IMPORTANT: You must file monthly deposits and the quarterly return even if

you had no sales tax activity during the quarter.

31-015 (10/98)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2