Form 307 - Credit For Employers Of Individuals With Disabilities - 2002

ADVERTISEMENT

*VA0307102000*

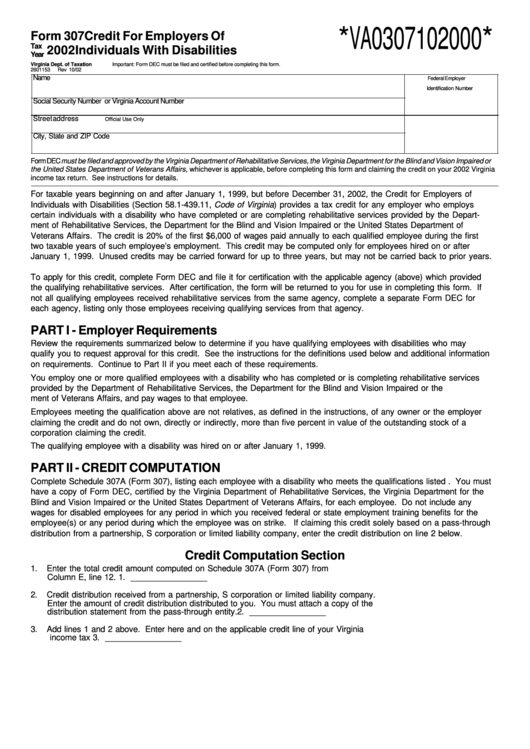

Form 307

Credit For Employers Of

Tax

2002

Individuals With Disabilities

Year

Virginia Dept. of Taxation

Important: Form DEC must be filed and certified before completing this form.

2601153

Rev 10/02

Name

Federal Employer

Identification Number

Social Security Number or Virginia Account Number

Street address

Official Use Only

City, State and ZIP Code

Form DEC must be filed and approved by the Virginia Department of Rehabilitative Services, the Virginia Department for the Blind and Vision Impaired or

the United States Department of Veterans Affairs, whichever is applicable, before completing this form and claiming the credit on your 2002 Virginia

income tax return. See instructions for details.

For taxable years beginning on and after January 1, 1999, but before December 31, 2002, the Credit for Employers of

Individuals with Disabilities (Section 58.1-439.11, Code of Virginia) provides a tax credit for any employer who employs

certain individuals with a disability who have completed or are completing rehabilitative services provided by the Depart-

ment of Rehabilitative Services, the Department for the Blind and Vision Impaired or the United States Department of

Veterans Affairs. The credit is 20% of the first $6,000 of wages paid annually to each qualified employee during the first

two taxable years of such employee’s employment. This credit may be computed only for employees hired on or after

January 1, 1999. Unused credits may be carried forward for up to three years, but may not be carried back to prior years.

To apply for this credit, complete Form DEC and file it for certification with the applicable agency (above) which provided

the qualifying rehabilitative services. After certification, the form will be returned to you for use in completing this form. If

not all qualifying employees received rehabilitative services from the same agency, complete a separate Form DEC for

each agency, listing only those employees receiving qualifying services from that agency.

PART I - Employer Requirements

Review the requirements summarized below to determine if you have qualifying employees with disabilities who may

qualify you to request approval for this credit. See the instructions for the definitions used below and additional information

on requirements. Continue to Part II if you meet each of these requirements.

You employ one or more qualified employees with a disability who has completed or is completing rehabilitative services

provided by the Department of Rehabilitative Services, the Department for the Blind and Vision Impaired or the U.S. Depart-

ment of Veterans Affairs, and pay wages to that employee.

Employees meeting the qualification above are not relatives, as defined in the instructions, of any owner or the employer

claiming the credit and do not own, directly or indirectly, more than five percent in value of the outstanding stock of a

corporation claiming the credit.

The qualifying employee with a disability was hired on or after January 1, 1999.

PART II - CREDIT COMPUTATION

Complete Schedule 307A (Form 307), listing each employee with a disability who meets the qualifications listed . You must

have a copy of Form DEC, certified by the Virginia Department of Rehabilitative Services, the Virginia Department for the

Blind and Vision Impaired or the United States Department of Veterans Affairs, for each employee. Do not include any

wages for disabled employees for any period in which you received federal or state employment training benefits for the

employee(s) or any period during which the employee was on strike. If claiming this credit solely based on a pass-through

distribution from a partnership, S corporation or limited liability company, enter the credit distribution on line 2 below.

Credit Computation Section

1.

Enter the total credit amount computed on Schedule 307A (Form 307) from

Column E, line 12. ............................................................................................................. 1. _________________

2.

Credit distribution received from a partnership, S corporation or limited liability company.

Enter the amount of credit distribution distributed to you. You must attach a copy of the

distribution statement from the pass-through entity. .............................................................. 2. _________________

3.

Add lines 1 and 2 above. Enter here and on the applicable credit line of your Virginia

income tax ....................................................................................................................... 3. _________________

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4