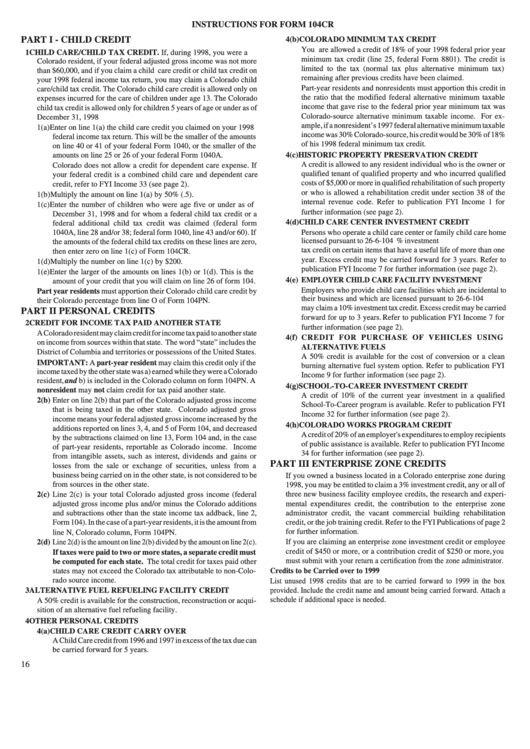

Instructions For Form 104cr - Individual Credit Schedule

ADVERTISEMENT

INSTRUCTIONS FOR FORM 104CR

PART I - CHILD CREDIT

4(b) COLORADO MINIMUM TAX CREDIT

You are allowed a credit of 18% of your 1998 federal prior year

1 CHILD CARE/CHILD TAX CREDIT. If, during 1998, you were a

minimum tax credit (line 25, federal Form 8801). The credit is

Colorado resident, if your federal adjusted gross income was not more

limited to the tax (normal tax plus alternative minimum tax)

than $60,000, and if you claim a child care credit or child tax credit on

remaining after previous credits have been claimed.

your 1998 federal income tax return, you may claim a Colorado child

Part-year residents and nonresidents must apportion this credit in

care/child tax credit. The Colorado child care credit is allowed only on

the ratio that the modified federal alternative minimum taxable

expenses incurred for the care of children under age 13. The Colorado

income that gave rise to the federal prior year minimum tax was

child tax credit is allowed only for children 5 years of age or under as of

Colorado-source alternative minimum taxable income. For ex-

December 31, 1998

ample, if a nonresident’s 1997 federal alternative minimum taxable

1(a) Enter on line 1(a) the child care credit you claimed on your 1998

income was 30% Colorado-source, his credit would be 30% of 18%

federal income tax return. This will be the smaller of the amounts

of his 1998 federal minimum tax credit.

on line 40 or 41 of your federal Form 1040, or the smaller of the

amounts on line 25 or 26 of your federal Form 1040A.

4(c) HISTORIC PROPERTY PRESERVATION CREDIT

A credit is allowed to any resident individual who is the owner or

Colorado does not allow a credit for dependent care expense. If

qualified tenant of qualified property and who incurred qualified

your federal credit is a combined child care and dependent care

costs of $5,000 or more in qualified rehabilitation of such property

credit, refer to FYI Income 33 (see page 2).

or who is allowed a rehabilitation credit under section 38 of the

1(b) Multiply the amount on line 1(a) by 50% (.5).

internal revenue code. Refer to publication FYI Income 1 for

1(c) Enter the number of children who were age five or under as of

further information (see page 2).

December 31, 1998 and for whom a federal child tax credit or a

4(d) CHILD CARE CENTER INVESTMENT CREDIT

federal additional child tax credit was claimed (federal form

1040A, line 28 and/or 38; federal form 1040, line 43 and/or 60). If

Persons who operate a child care center or family child care home

licensed pursuant to 26-6-104 C.R.S may claim a 20% investment

the amounts of the federal child tax credits on these lines are zero,

tax credit on certain items that have a useful life of more than one

then enter zero on line 1(c) of Form 104CR.

year. Excess credit may be carried forward for 3 years. Refer to

1(d) Multiply the number on line 1(c) by $200.

publication FYI Income 7 for further information (see page 2).

1(e) Enter the larger of the amounts on lines 1(b) or 1(d). This is the

4(e) EMPLOYER CHILD CARE FACILITY INVESTMENT

amount of your credit that you will claim on line 26 of form 104.

Employers who provide child care facilities which are incidental to

Part year residents must apportion their Colorado child care credit by

their business and which are licensed pursuant to 26-6-104 C.R.S.

their Colorado percentage from line O of Form 104PN.

may claim a 10% investment tax credit. Excess credit may be carried

PART II PERSONAL CREDITS

forward for up to 3 years. Refer to publication FYI Income 7 for

2 CREDIT FOR INCOME TAX PAID ANOTHER STATE

further information (see page 2).

A Colorado resident may claim credit for income tax paid to another state

4(f) CREDIT FOR PURCHASE OF VEHICLES USING

on income from sources within that state. The word “state” includes the

ALTERNATIVE FUELS

District of Columbia and territories or possessions of the United States.

A 50% credit is available for the cost of conversion or a clean

IMPORTANT: A part-year resident may claim this credit only if the

burning alternative fuel system option. Refer to publication FYI

income taxed by the other state was a) earned while they were a Colorado

Income 9 for further information (see page 2).

resident, and b) is included in the Colorado column on form 104PN. A

4(g) SCHOOL-TO-CAREER INVESTMENT CREDIT

nonresident may not claim credit for tax paid another state.

A credit of 10% of the current year investment in a qualified

2(b) Enter on line 2(b) that part of the Colorado adjusted gross income

School-To-Career program is available. Refer to publication FYI

that is being taxed in the other state. Colorado adjusted gross

Income 32 for further information (see page 2).

income means your federal adjusted gross income increased by the

4(h) COLORADO WORKS PROGRAM CREDIT

additions reported on lines 3, 4, and 5 of Form 104, and decreased

A credit of 20% of an employer's expenditures to employ recipients

by the subtractions claimed on line 13, Form 104 and, in the case

of public assistance is available. Refer to publication FYI Income

of part-year residents, reportable as Colorado income. Income

34 for further information (see page 2).

from intangible assets, such as interest, dividends and gains or

PART III ENTERPRISE ZONE CREDITS

losses from the sale or exchange of securities, unless from a

business being carried on in the other state, is not considered to be

If you owned a business located in a Colorado enterprise zone during

from sources in the other state.

1998, you may be entitled to claim a 3% investment credit, any or all of

2(c) Line 2(c) is your total Colorado adjusted gross income (federal

three new business facility employee credits, the research and experi-

adjusted gross income plus and/or minus the Colorado additions

mental expenditures credit, the contribution to the enterprise zone

and subtractions other than the state income tax addback, line 2,

administrator credit, the vacant commercial building rehabilitation

Form 104). In the case of a part-year residents, it is the amount from

credit, or the job training credit. Refer to the FYI Publications of page 2

for further information.

line N, Colorado column, Form 104PN.

2(d) Line 2(d) is the amount on line 2(b) divided by the amount on line 2(c).

If you are claiming an enterprise zone investment credit or employee

credit of $450 or more, or a contribution credit of $250 or more, you

If taxes were paid to two or more states, a separate credit must

must submit with your return a certification from the zone administrator.

be computed for each state. The total credit for taxes paid other

states may not exceed the Colorado tax attributable to non-Colo-

Credits to be Carried over to 1999

rado source income.

List unused 1998 credits that are to be carried forward to 1999 in the box

3 ALTERNATIVE FUEL REFUELING FACILITY CREDIT

provided. Include the credit name and amount being carried forward. Attach a

schedule if additional space is needed.

A 50% credit is available for the construction, reconstruction or acqui-

sition of an alternative fuel refueling facility.

4 OTHER PERSONAL CREDITS

4(a) CHILD CARE CREDIT CARRY OVER

A Child Care credit from 1996 and 1997 in excess of the tax due can

be carried forward for 5 years.

16

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1