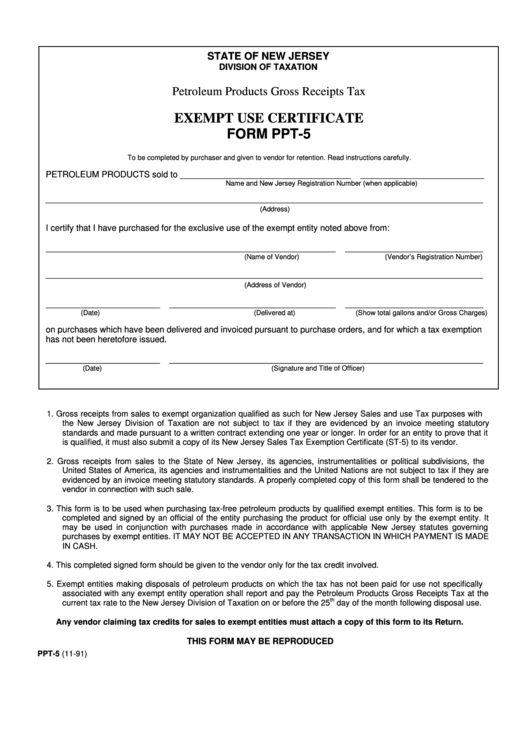

STATE OF NEW JERSEY

DIVISION OF TAXATION

Petroleum Products Gross Receipts Tax

EXEMPT USE CERTIFICATE

FORM PPT-5

To be completed by purchaser and given to vendor for retention. Read instructions carefully.

PETROLEUM PRODUCTS sold to ____________________________________

__________________________

Name and New Jersey Registration Number (when applicable)

____________________________________________________________________________________________

(Address)

I certify that I have purchased for the exclusive use of the exempt entity noted above from:

_____________________________________________________________

_____________________________

(Name of Vendor)

(Vendor’s Registration Number)

____________________________________________________________________________________________

(Address of Vendor)

________________________

___________________________________

_____________________________

(Date)

(Delivered at)

(Show total gallons and/or Gross Charges)

on purchases which have been delivered and invoiced pursuant to purchase orders, and for which a tax exemption

has not been heretofore issued.

________________________

__________________________________________________________________

(Date)

(Signature and Title of Officer)

1.

Gross receipts from sales to exempt organization qualified as such for New Jersey Sales and use Tax purposes with

the New Jersey Division of Taxation are not subject to tax if they are evidenced by an invoice meeting statutory

standards and made pursuant to a written contract extending one year or longer. In order for an entity to prove that it

is qualified, it must also submit a copy of its New Jersey Sales Tax Exemption Certificate (ST-5) to its vendor.

2.

Gross receipts from sales to the State of New Jersey, its agencies, instrumentalities or political subdivisions, the

United States of America, its agencies and instrumentalities and the United Nations are not subject to tax if they are

evidenced by an invoice meeting statutory standards. A properly completed copy of this form shall be tendered to the

vendor in connection with such sale.

3.

This form is to be used when purchasing tax-free petroleum products by qualified exempt entities. This form is to be

completed and signed by an official of the entity purchasing the product for official use only by the exempt entity. It

may be used in conjunction with purchases made in accordance with applicable New Jersey statutes governing

purchases by exempt entities. IT MAY NOT BE ACCEPTED IN ANY TRANSACTION IN WHICH PAYMENT IS MADE

IN CASH.

4.

This completed signed form should be given to the vendor only for the tax credit involved.

5.

Exempt entities making disposals of petroleum products on which the tax has not been paid for use not specifically

associated with any exempt entity operation shall report and pay the Petroleum Products Gross Receipts Tax at the

th

current tax rate to the New Jersey Division of Taxation on or before the 25

day of the month following disposal use.

Any vendor claiming tax credits for sales to exempt entities must attach a copy of this form to its Return.

THIS FORM MAY BE REPRODUCED

PPT-5 (11-91)

1

1