Instructions For Form 104x - Individual Income Tax Return

ADVERTISEMENT

Form 104X is used to correct your Individual income tax return. For more information or any questions pertaining to income,

deductions, modifications, credits, etc., the income tax book for the tax year you are amending may help you or you may

call the Department of Revenue at (303) 232-2446. You can also obtain forms and information from the internet at

HOW TO FILL OUT YOUR RETURN

Complete the first column of Form 104X showing the income,

Protective Claims. If this amended return is being filed to keep

modifications, taxes and credits the way your return was

the statute of limitations open pending the outcome of a court

originally filed or as last corrected by yourself or by the

case or tax determination in another state that affects your

Department of Revenue.

Complete the second column

Colorado return, check the protective claim box under reason

showing the net changes with decreases in brackets. Com-

for filing corrected return.

plete the third column showing the corrected amounts.

Interest rates on additional amounts due or refunds are as

If this amended return is the result of an adjustment made by

follows:

the Internal Revenue Service attach a copy of the federal

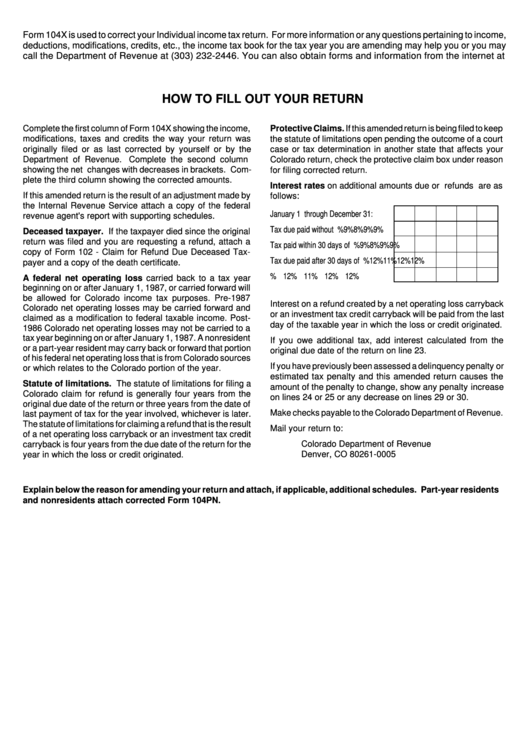

January 1 through December 31: ......

1995 1996 1997 1998 1999

revenue agent's report with supporting schedules.

Tax due paid without billing .................

7%

9%

8%

9%

9%

Deceased taxpayer. If the taxpayer died since the original

return was filed and you are requesting a refund, attach a

Tax paid within 30 days of billing ........

7%

9%

8%

9%

9%

copy of Form 102 - Claim for Refund Due Deceased Tax-

Tax due paid after 30 days of billing ...

10% 12% 11% 12% 12%

payer and a copy of the death certificate.

Refunds ...............................................

10% 12% 11% 12% 12%

A federal net operating loss carried back to a tax year

beginning on or after January 1, 1987, or carried forward will

be allowed for Colorado income tax purposes. Pre-1987

Interest on a refund created by a net operating loss carryback

Colorado net operating losses may be carried forward and

or an investment tax credit carryback will be paid from the last

claimed as a modification to federal taxable income. Post-

day of the taxable year in which the loss or credit originated.

1986 Colorado net operating losses may not be carried to a

tax year beginning on or after January 1, 1987. A nonresident

If you owe additional tax, add interest calculated from the

or a part-year resident may carry back or forward that portion

original due date of the return on line 23.

of his federal net operating loss that is from Colorado sources

If you have previously been assessed a delinquency penalty or

or which relates to the Colorado portion of the year.

estimated tax penalty and this amended return causes the

Statute of limitations. The statute of limitations for filing a

amount of the penalty to change, show any penalty increase

Colorado claim for refund is generally four years from the

on lines 24 or 25 or any decrease on lines 29 or 30.

original due date of the return or three years from the date of

Make checks payable to the Colorado Department of Revenue.

last payment of tax for the year involved, whichever is later.

The statute of limitations for claiming a refund that is the result

Mail your return to:

of a net operating loss carryback or an investment tax credit

carryback is four years from the due date of the return for the

Colorado Department of Revenue

year in which the loss or credit originated.

Denver, CO 80261-0005

Explain below the reason for amending your return and attach, if applicable, additional schedules. Part-year residents

and nonresidents attach corrected Form 104PN.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1