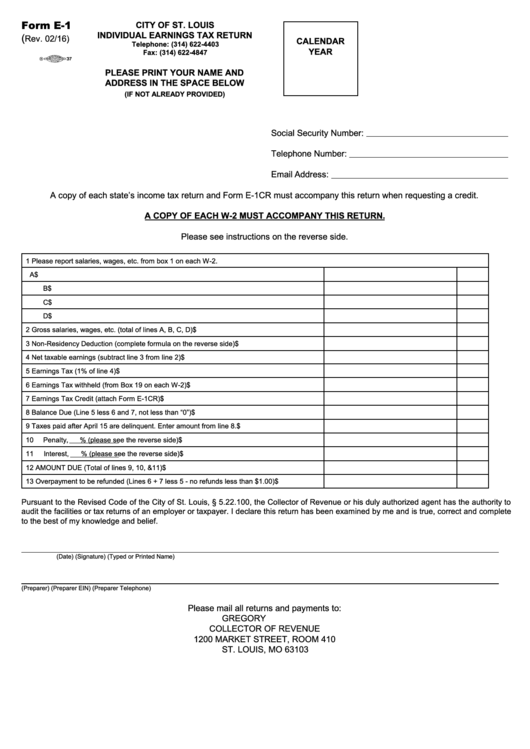

Form E-1

CITY OF ST. LOUIS

INDIVIDUAL EARNINGS TAX RETURN

(

Rev. 02/16)

CALENDAR

Telephone: (314) 622-4403

YEAR

Fax: (314) 622-4847

PLEASE PRINT YOUR NAME AND

ADDRESS IN THE SPACE BELOW

(IF NOT ALREADY PROVIDED)

Social Security Number:

Telephone Number:

Email Address:

A copy of each state’s income tax return and Form E-1CR must accompany this return when requesting a credit.

A COPY OF EACH W-2 MUST ACCOMPANY THIS RETURN.

Please see instructions on the reverse side.

1

Please report salaries, wages, etc. from box 1 on each W-2.

A

$

B

$

C

$

D

$

2

Gross salaries, wages, etc. (total of lines A, B, C, D)

$

3

Non-Residency Deduction (complete formula on the reverse side)

$

4

Net taxable earnings (subtract line 3 from line 2)

$

5

Earnings Tax (1% of line 4)

$

6

Earnings Tax withheld (from Box 19 on each W-2)

$

7

Earnings Tax Credit (attach Form E-1CR)

$

8

Balance Due (Line 5 less 6 and 7, not less than “0”)

$

9

Taxes paid after April 15 are delinquent. Enter amount from line 8.

$

10

Penalty,

% (please see the reverse side)

$

11

Interest,

% (please see the reverse side)

$

12

AMOUNT DUE (Total of lines 9, 10, &11)

$

13

Overpayment to be refunded (Lines 6 + 7 less 5 - no refunds less than $1.00)

$

Pursuant to the Revised Code of the City of St. Louis, § 5.22.100, the Collector of Revenue or his duly authorized agent has the authority to

audit the facilities or tax returns of an employer or taxpayer. I declare this return has been examined by me and is true, correct and complete

to the best of my knowledge and belief.

(Date)

(Signature)

(Typed or Printed Name)

(Preparer)

(Preparer EIN)

(Preparer Telephone)

Please mail all returns and payments to:

GREGORY F.X. DALY

COLLECTOR OF REVENUE

1200 MARKET STREET, ROOM 410

ST. LOUIS, MO 63103

1

1