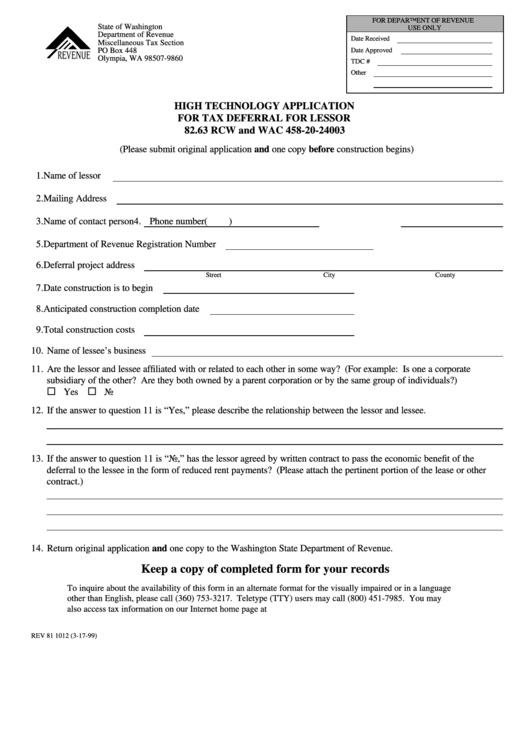

Form Rev 81 1012 - High Technology Application For Tax Deferral For Lessor 82.63 Rcw And Wac 458-20-24003

ADVERTISEMENT

FOR DEPARTMENT OF REVENUE

State of Washington

USE ONLY

Department of Revenue

Date Received

Miscellaneous Tax Section

PO Box 448

Date Approved

Olympia, WA 98507-9860

TDC #

Other

HIGH TECHNOLOGY APPLICATION

FOR TAX DEFERRAL FOR LESSOR

82.63 RCW and WAC 458-20-24003

(Please submit original application and one copy before construction begins)

1. Name of lessor

2. Mailing Address

3. Name of contact person

4. Phone number

(

)

5. Department of Revenue Registration Number

6. Deferral project address

Street

City

County

7. Date construction is to begin

8. Anticipated construction completion date

9. Total construction costs

10. Name of lessee’s business

11. Are the lessor and lessee affiliated with or related to each other in some way? (For example: Is one a corporate

subsidiary of the other? Are they both owned by a parent corporation or by the same group of individuals?)

¨

¨

Yes

No

12. If the answer to question 11 is “Yes,” please describe the relationship between the lessor and lessee.

13. If the answer to question 11 is “No,” has the lessor agreed by written contract to pass the economic benefit of the

deferral to the lessee in the form of reduced rent payments? (Please attach the pertinent portion of the lease or other

contract.)

14. Return original application and one copy to the Washington State Department of Revenue.

Keep a copy of completed form for your records

To inquire about the availability of this form in an alternate format for the visually impaired or in a language

other than English, please call (360) 753-3217. Teletype (TTY) users may call (800) 451-7985. You may

also access tax information on our Internet home page at

REV 81 1012 (3-17-99)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1