Schedule J (Form N-11/n-12/n-15/n-40) - Supplemental Annuities Schedule - 2003

ADVERTISEMENT

Clear Form

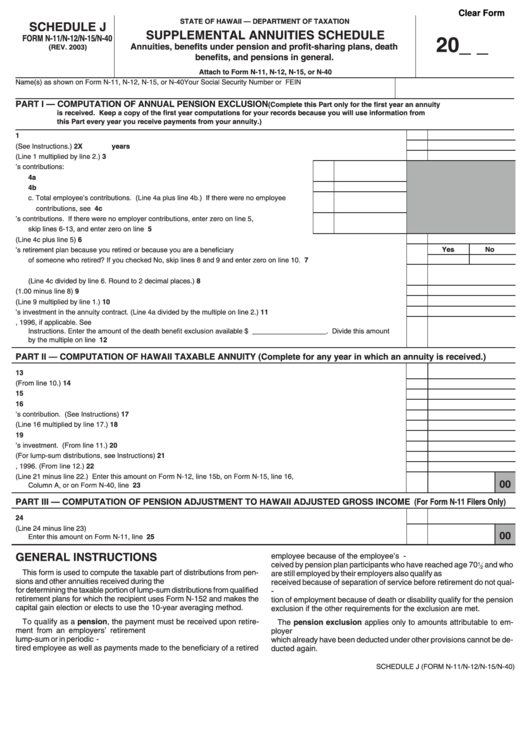

STATE OF HAWAII — DEPARTMENT OF TAXATION

SCHEDULE J

SUPPLEMENTAL ANNUITIES SCHEDULE

FORM N-11/N-12/N-15/N-40

20_ _

Annuities, benefits under pension and profit-sharing plans, death

(REV. 2003)

benefits, and pensions in general.

Attach to Form N-11, N-12, N-15, or N-40

Name(s) as shown on Form N-11, N-12, N-15, or N-40

Your Social Security Number or FEIN

PART I — COMPUTATION OF ANNUAL PENSION EXCLUSION

(Complete this Part only for the first year an annuity

is received. Keep a copy of the first year computations for your records because you will use information from

this Part every year you receive payments from your annuity.)

1. Annual annuity............................................................................................................................................................................

1

2. Multiple. (See Instructions.)........................................................................................................................................................

2

X

years

3. Total expected return. (Line 1 multiplied by line 2.)....................................................................................................................

3

4. Employee’s contributions:

a. Previously taxed contribution................................................................................................

4a

b. Pretax contribution................................................................................................................

4b

c. Total employee’s contributions. (Line 4a plus line 4b.) If there were no employee

contributions, see Instructions. ..............................................................................................

4c

5. Employer’s contributions. If there were no employer contributions, enter zero on line 5,

skip lines 6-13, and enter zero on line 14. .................................................................................

5

6. Total cost of annuity. (Line 4c plus line 5) ..................................................................................................................................

6

Yes

No

7. Is this annuity received as part of an employer’s retirement plan because you retired or because you are a beneficiary

of someone who retired? If you checked No, skip lines 8 and 9 and enter zero on line 10. ......................................................

7

8. Portion of the total cost of the annuity attributable to employee contributions.

(Line 4c divided by line 6. Round to 2 decimal places.) .............................................................................................................

8

9. Exclusion ratio. Portion of the total cost of the annuity attributable to employer contributions. (1.00 minus line 8) .................

9

10. Annual pension exclusion. (Line 9 multiplied by line 1.).............................................................................................................

10

11. Annual exclusion of the employee’s investment in the annuity contract. (Line 4a divided by the multiple on line 2.) ................

11

12. Annual death benefit exclusion for a beneficiary of a plan participant who died before August 21, 1996, if applicable. See

Instructions. Enter the amount of the death benefit exclusion available $ ___________________. Divide this amount

by the multiple on line 2..............................................................................................................................................................

12

PART II — COMPUTATION OF HAWAII TAXABLE ANNUITY (Complete for any year in which an annuity is received.)

13. Amount of annuity received this year. ........................................................................................................................................

13

14. Annual pension exclusion. (From line 10.) .................................................................................................................................

14

15. Line 13 minus line 14. ................................................................................................................................................................

15

16. Enter total amount of annuity dividends received this year. .......................................................................................................

16

17. Portion of total cost of annuity attributable to employee’s contribution. (See Instructions) .......................................................

17

18. Taxable annuity dividends. (Line 16 multiplied by line 17.) ........................................................................................................

18

19. Add lines 15 and 18....................................................................................................................................................................

19

20. Annual recovery of employee’s investment. (From line 11.) .....................................................................................................

20

21. Line 19 minus line 20. (For lump-sum distributions, see Instructions) ......................................................................................

21

22. Death benefit exclusion for a beneficiary of a plan participant who died before August 21, 1996. (From line 12.)....................

22

23. Total taxable annuity. (Line 21 minus line 22.) Enter this amount on Form N-12, line 15b, on Form N-15, line 16,

00

Column A, or on Form N-40, line 8.............................................................................................................................................

23

PART III — COMPUTATION OF PENSION ADJUSTMENT TO HAWAII ADJUSTED GROSS INCOME (For Form N-11 Filers Only)

24. Enter the amount of your annuity received this year that is federally taxable. ...........................................................................

24

25. Pension adjustment to Hawaii Adjusted Gross Income. (Line 24 minus line 23)

00

Enter this amount on Form N-11, line 13 ...................................................................................................................................

25

GENERAL INSTRUCTIONS

employee because of the employee’s death. Required distributions re-

ceived by pension plan participants who have reached age 70

and who

1

2

This form is used to compute the taxable part of distributions from pen-

are still employed by their employers also qualify as pensions. Payments

sions and other annuities received during the year. This form is also used

received because of separation of service before retirement do not qual-

for determining the taxable portion of lump-sum distributions from qualified

ify. Benefits incidental to a retirement plan received on or after termina-

retirement plans for which the recipient uses Form N-152 and makes the

tion of employment because of death or disability qualify for the pension

capital gain election or elects to use the 10-year averaging method.

exclusion if the other requirements for the exclusion are met.

To qualify as a pension, the payment must be received upon retire-

The pension exclusion applies only to amounts attributable to em-

ment from an employers’ retirement plan. It can be received in a

ployer contributions. Amounts attributable to employer contributions

lump-sum or in periodic payments. This includes payments made to a re-

which already have been deducted under other provisions cannot be de-

tired employee as well as payments made to the beneficiary of a retired

ducted again.

SCHEDULE J (FORM N-11/N-12/N-15/N-40)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3