Instructions For Schedule J-Funeral Expenses And Expenses Incurred In Administering Property Subject To Claims

ADVERTISEMENT

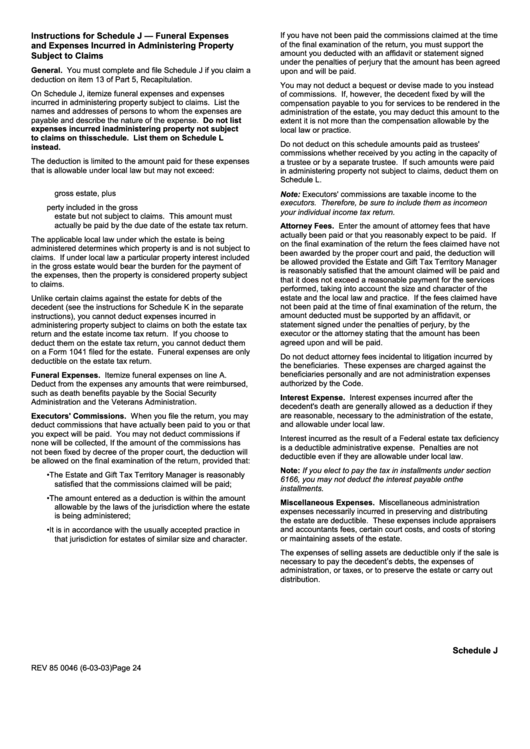

Instructions for Schedule J — Funeral Expenses

If you have not been paid the commissions claimed at the time

of the final examination of the return, you must support the

and Expenses Incurred in Administering Property

amount you deducted with an affidavit or statement signed

Subject to Claims

under the penalties of perjury that the amount has been agreed

General. You must complete and file Schedule J if you claim a

upon and will be paid.

deduction on item 13 of Part 5, Recapitulation.

You may not deduct a bequest or devise made to you instead

On Schedule J, itemize funeral expenses and expenses

of commissions. If, however, the decedent fixed by will the

incurred in administering property subject to claims. List the

compensation payable to you for services to be rendered in the

names and addresses of persons to whom the expenses are

administration of the estate, you may deduct this amount to the

payable and describe the nature of the expense. Do not list

extent it is not more than the compensation allowable by the

expenses incurred in administering property not subject

local law or practice.

to claims on this schedule. List them on Schedule L

Do not deduct on this schedule amounts paid as trustees'

instead.

commissions whether received by you acting in the capacity of

The deduction is limited to the amount paid for these expenses

a trustee or by a separate trustee. If such amounts were paid

that is allowable under local law but may not exceed:

in administering property not subject to claims, deduct them on

Schedule L.

1. The value of property subject to claims included in the

gross estate, plus

Note: Executors' commissions are taxable income to the

executors. Therefore, be sure to include them as income on

2. The amount paid out of property included in the gross

your individual income tax return.

estate but not subject to claims. This amount must

actually be paid by the due date of the estate tax return.

Attorney Fees. Enter the amount of attorney fees that have

actually been paid or that you reasonably expect to be paid. If

The applicable local law under which the estate is being

on the final examination of the return the fees claimed have not

administered determines which property is and is not subject to

been awarded by the proper court and paid, the deduction will

claims. If under local law a particular property interest included

be allowed provided the Estate and Gift Tax Territory Manager

in the gross estate would bear the burden for the payment of

is reasonably satisfied that the amount claimed will be paid and

the expenses, then the property is considered property subject

that it does not exceed a reasonable payment for the services

to claims.

performed, taking into account the size and character of the

estate and the local law and practice. If the fees claimed have

Unlike certain claims against the estate for debts of the

not been paid at the time of final examination of the return, the

decedent (see the instructions for Schedule K in the separate

amount deducted must be supported by an affidavit, or

instructions), you cannot deduct expenses incurred in

statement signed under the penalties of perjury, by the

administering property subject to claims on both the estate tax

executor or the attorney stating that the amount has been

return and the estate income tax return. If you choose to

agreed upon and will be paid.

deduct them on the estate tax return, you cannot deduct them

on a Form 1041 filed for the estate. Funeral expenses are only

Do not deduct attorney fees incidental to litigation incurred by

deductible on the estate tax return.

the beneficiaries. These expenses are charged against the

beneficiaries personally and are not administration expenses

Funeral Expenses. Itemize funeral expenses on line A.

authorized by the Code.

Deduct from the expenses any amounts that were reimbursed,

such as death benefits payable by the Social Security

Interest Expense. Interest expenses incurred after the

Administration and the Veterans Administration.

decedent's death are generally allowed as a deduction if they

are reasonable, necessary to the administration of the estate,

Executors' Commissions. When you file the return, you may

and allowable under local law.

deduct commissions that have actually been paid to you or that

you expect will be paid. You may not deduct commissions if

Interest incurred as the result of a Federal estate tax deficiency

none will be collected, If the amount of the commissions has

is a deductible administrative expense. Penalties are not

not been fixed by decree of the proper court, the deduction will

deductible even if they are allowable under local law.

be allowed on the final examination of the return, provided that:

Note: If you elect to pay the tax in installments under section

• The Estate and Gift Tax Territory Manager is reasonably

6166, you may not deduct the interest payable on the

satisfied that the commissions claimed will be paid;

installments.

• The amount entered as a deduction is within the amount

Miscellaneous Expenses. Miscellaneous administration

allowable by the laws of the jurisdiction where the estate

expenses necessarily incurred in preserving and distributing

is being administered;

the estate are deductible. These expenses include appraisers

and accountants fees, certain court costs, and costs of storing

• It is in accordance with the usually accepted practice in

or maintaining assets of the estate.

that jurisdiction for estates of similar size and character.

The expenses of selling assets are deductible only if the sale is

necessary to pay the decedent’s debts, the expenses of

administration, or taxes, or to preserve the estate or carry out

distribution.

Schedule J

REV 85 0046 (6-03-03)

Page 24

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1