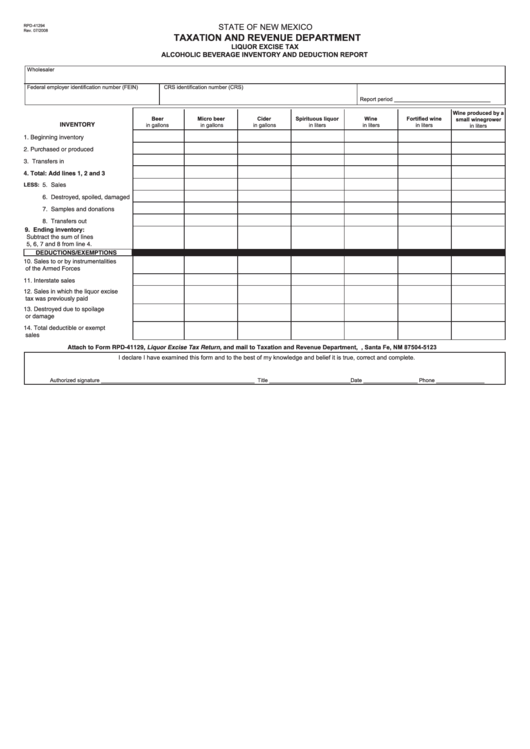

Form Rpd-41294 - Liquor Excise Tax Alcoholic Beverage Inventory And Deduction Report

ADVERTISEMENT

STATE OF NEW MEXICO

RPD-41294

Rev. 07/2008

TAXATION AND REVENUE DEPARTMENT

LIQUOR EXCISE TAX

ALCOHOLIC BEVERAGE INVENTORY AND DEDUCTION REPORT

Wholesaler

Federal employer identification number (FEIN)

CRS identification number (CRS)

Report period ________________________________

Wine produced by a

Beer

Micro beer

Cider

Spirituous liquor

Wine

Fortified wine

small winegrower

INVENTORY

in gallons

in gallons

in gallons

in liters

in liters

in liters

in liters

1.

Beginning inventory

2.

Purchased or produced

3.

Transfers in

4.

Total: Add lines 1, 2 and 3

5. Sales

LESS:

6. Destroyed, spoiled, damaged

7. Samples and donations

8. Transfers out

9.

Ending inventory:

Subtract the sum of lines

5, 6, 7 and 8 from line 4.

DEDUCTIONS/EXEMPTIONS

10. Sales to or by instrumentalities

of the Armed Forces

11. Interstate sales

12. Sales in which the liquor excise

tax was previously paid

13. Destroyed due to spoilage

or damage

14. Total deductible or exempt

sales

Attach to Form RPD-41129, Liquor Excise Tax Return, and mail to Taxation and Revenue Department, P.O. Box 25123, Santa Fe, NM 87504-5123

I declare I have examined this form and to the best of my knowledge and belief it is true, correct and complete.

Authorized signature ___________________________________________________ Title ___________________________Date __________________ Phone ________________

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3