Form Nc-3m - Annual Withholding Reconciliation Return - North Carolina Department Of Revenue

ADVERTISEMENT

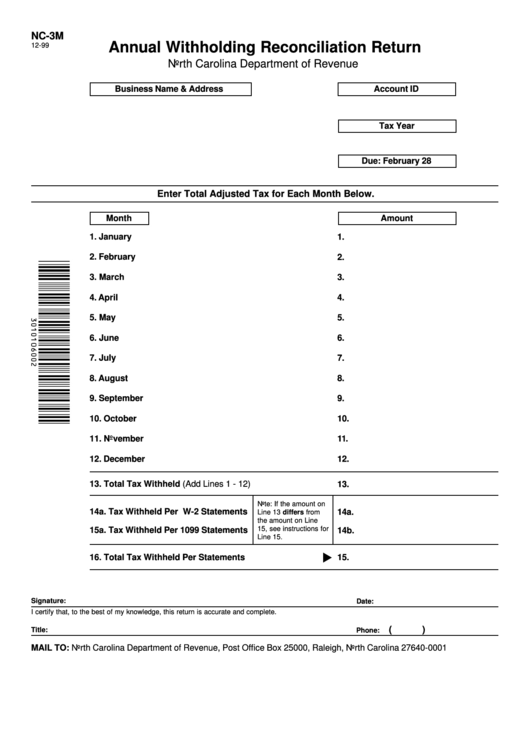

NC-3M

Annual Withholding Reconciliation Return

12-99

North Carolina Department of Revenue

Business Name & Address

Account ID

Tax Year

Due: February 28

Enter Total Adjusted Tax for Each Month Below.

Month

Amount

1. January

1.

2. February

2.

3. March

3.

4. April

4.

5. May

5.

6. June

6.

7. July

7.

8. August

8.

9. September

9.

10. October

10.

11. November

11.

12. December

12.

13. Total Tax Withheld (Add Lines 1 - 12)

13.

Note: If the amount on

14a. Tax Withheld Per W-2 Statements

14a.

Line 13 differs from

the amount on Line

15, see instructions for

15a. Tax Withheld Per 1099 Statements

14b.

Line 15.

16. Total Tax Withheld Per Statements

15.

Signature:

Date:

I certify that, to the best of my knowledge, this return is accurate and complete.

(

)

Title:

Phone:

MAIL TO: North Carolina Department of Revenue, Post Office Box 25000, Raleigh, North Carolina 27640-0001

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1