Instructions For Application For Certificate Of Nonattachment Of Federal Tax Lien - 2004

ADVERTISEMENT

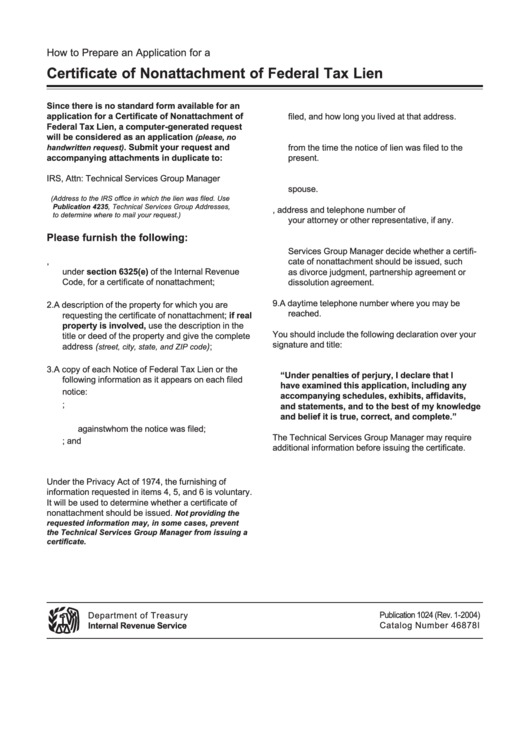

How to Prepare an Application for a

Certificate of Nonattachment of Federal Tax Lien

Since there is no standard form available for an

4. Your address at the time the notice of lien was

application for a Certificate of Nonattachment of

filed, and how long you lived at that address.

Federal Tax Lien, a computer-generated request

will be considered as an application

5. Other residences and the dates you lived at each

(please, no

. Submit your request and

from the time the notice of lien was filed to the

handwritten request)

accompanying attachments in duplicate to:

present.

IRS, Attn: Technical Services Group Manager

6. Your social security number and that of your

spouse.

(Address to the IRS office in which the lien was filed. Use

Publication 4235, Technical Services Group Addresses,

7. The name, address and telephone number of

to determine where to mail your request.)

your attorney or other representative, if any.

Please furnish the following:

8. Any other information that might help the Technical

Services Group Manager decide whether a certifi-

1. The name and address of the person applying,

cate of nonattachment should be issued, such

under section 6325(e) of the Internal Revenue

as divorce judgment, partnership agreement or

Code, for a certificate of nonattachment;

dissolution agreement.

9. A daytime telephone number where you may be

2. A description of the property for which you are

reached.

requesting the certificate of nonattachment; if real

property is involved, use the description in the

You should include the following declaration over your

title or deed of the property and give the complete

signature and title:

address (

);

street, city, state, and ZIP code

3. A copy of each Notice of Federal Tax Lien or the

“Under penalties of perjury, I declare that I

following information as it appears on each filed

have examined this application, including any

notice:

accompanying schedules, exhibits, affidavits,

a. The name of the Internal Revenue Office;

and statements, and to the best of my knowledge

and belief it is true, correct, and complete.”

b. The name and address of the taxpayer

against whom the notice was filed;

The Technical Services Group Manager may require

c. The date and place the notice was filed; and

additional information before issuing the certificate.

d. The serial number shown on the notice of lien.

Under the Privacy Act of 1974, the furnishing of

information requested in items 4, 5, and 6 is voluntary.

It will be used to determine whether a certificate of

nonattachment should be issued.

Not providing the

requested information may, in some cases, prevent

the Technical Services Group Manager from issuing a

certificate.

Publication 1024 (Rev. 1-2004)

Department of Treasury

Catalog Number 46878I

Internal Revenue Service

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1