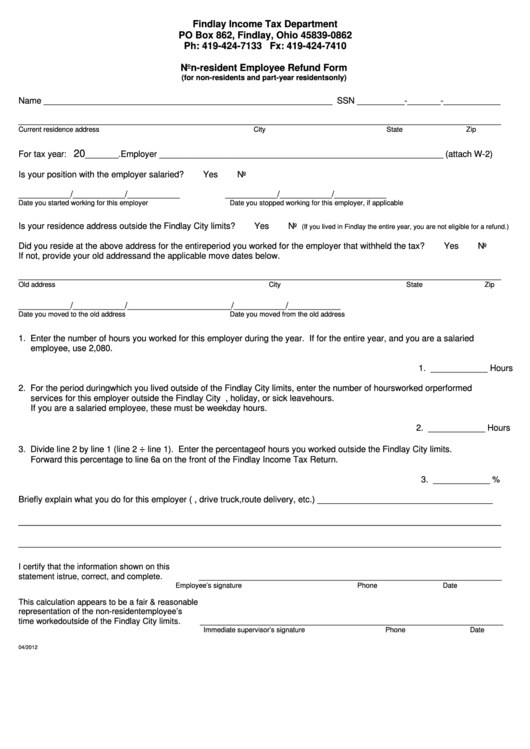

Non-Resident Employee Refund Form - Findlay Income Tax Department

ADVERTISEMENT

Findlay Income Tax Department

PO Box 862, Findlay, Ohio 45839-0862

Ph: 419-424-7133 Fx: 419-424-7410

Non-resident Employee Refund Form

(for non-residents and part-year residents only)

Name _____________________________________________________________ SSN __________-_______-____________

______________________________________________________________________________________________________

Current residence address

City

State

Zip

20

For tax year:

_______.

Employer ____________________________________________________________ (attach W-2)

Is your position with the employer salaried?

Yes

No

___________/___________/___________

___________/___________/___________

Date you started working for this employer

Date you stopped working for this employer, if applicable

Is your residence address outside the Findlay City limits?

Yes

No

(If you lived in Findlay the entire year, you are not eligible for a refund.)

Did you reside at the above address for the entire period you worked for the employer that withheld the tax?

Yes

No

If not, provide your old address and the applicable move dates below.

______________________________________________________________________________________________________

Old address

City

State

Zip

___________/___________/___________

___________/___________/___________

Date you moved to the old address

Date you moved from the old address

1. Enter the number of hours you worked for this employer during the year. If for the entire year, and you are a salaried

employee, use 2,080.

1. ____________ Hours

2. For the period during which you lived outside of the Findlay City limits, enter the number of hours worked or performed

services for this employer outside the Findlay City limits. Do not include vacation, holiday, or sick leave hours.

If you are a salaried employee, these must be weekday hours.

2. ____________ Hours

÷

line 1). Enter the percentage of hours you worked outside the Findlay City limits.

3. Divide line 2 by line 1 (line 2

Forward this percentage to line 6a on the front of the Findlay Income Tax Return.

3. ____________ %

Briefly explain what you do for this employer (i.e., drive truck, route delivery, etc.) _____________________________________

______________________________________________________________________________________________________

______________________________________________________________________________________________________

I certify that the information shown on this

________________________________________________________________

statement is true, correct, and complete.

Employee’s signature

Phone

Date

This calculation appears to be a fair & reasonable

representation of the non-resident employee’s

time worked outside of the Findlay City limits.

________________________________________________________________

Immediate supervisor’s signature

Phone

Date

04/2012

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1