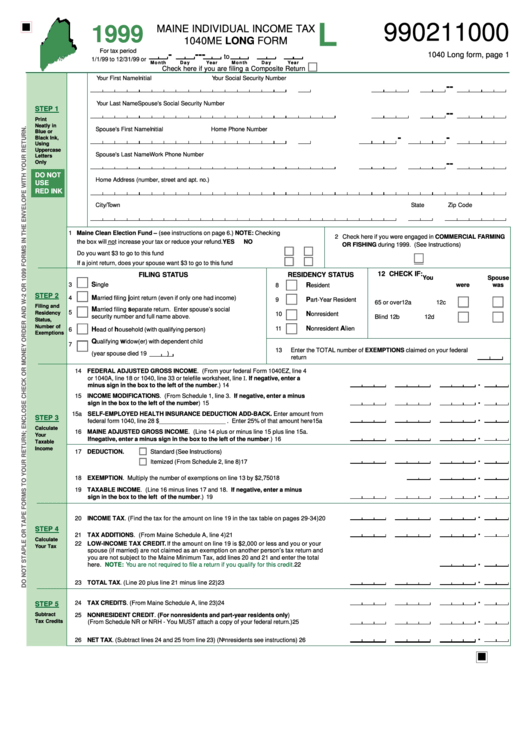

Form 1040me - Maine Individual Income Tax - 1999

ADVERTISEMENT

990211000

MAINE INDIVIDUAL INCOME TAX

1999

1040ME LONG FORM

For tax period

-

-

-

-

1040 Long form, page 1

to

1/1/99 to 12/31/99 or

M o n th

D a y

Year

M o n th

D a y

Year

Check here if you are filing a Composite Return

Your First Name

Initial

Your Social Security Number

-

-

Your Last Name

Spouse's Social Security Number

STEP 1

-

-

Print

Neatly in

Spouse's First Name

Initial

Home Phone Number

Blue or

-

-

Black Ink,

Using

Uppercase

Spouse's Last Name

Work Phone Number

Letters

-

-

Only

DO NOT

Home Address (number, street and apt. no.)

USE

RED INK

City/Town

State

Zip Code

1 Maine Clean Election Fund – (see instructions on page 6.) NOTE: Checking

2 Check here if you were engaged in COMMERCIAL FARMING

the box will not increase your tax or reduce your refund.

YES

NO

OR FISHING during 1999. (See Instructions)

Do you want $3 to go to this fund .......................................................................

If a joint return, does your spouse want $3 to go to this fund ..............................

12 CHECK IF:

FILING STATUS

RESIDENCY STATUS

You

Spouse

S

3

ingle

R

were

was

8

esident

STEP 2

M

j

4

arried filing

oint return (even if only one had income)

P

9

art-Year Resident

65 or over ....................... 12a

12c

Filing and

M

s

arried filing

eparate return. Enter spouse’s social

5

Residency

N

10

onresident

security number and full name above.

Blind ............................... 12b

12d

Status,

Number of

N

Al

11

onresident

ien

H

h

6

ead of

ousehold (with qualifying person)

Exemptions

Q

w

ualifying

idow(er) with dependent child

7

13

Enter the TOTAL number of EXEMPTIONS claimed on your federal

(year spouse died 19

)

return ................................................................................................

14 FEDERAL ADJUSTED GROSS INCOME. (From your federal Form 1040EZ, line 4

or 1040A, line 18 or 1040, line 33 or telefile worksheet, line I. If negative, enter a

.

minus sign in the box to the left of the number.) ..................................................................

14

15 INCOME MODIFICATIONS. (From Schedule 1, line 3. If negative, enter a minus

.

sign in the box to the left of the number) ..............................................................................

15

15a SELF-EMPLOYED HEALTH INSURANCE DEDUCTION ADD-BACK. Enter amount from

.

STEP 3

federal form 1040, line 28 $ ____________________ . Enter 25% of that amount here ........ 15a

Calculate

16 MAINE ADJUSTED GROSS INCOME. (Line 14 plus or minus line 15 plus line 15a.

Your

.

If negative, enter a minus sign in the box to the left of the number.) ..................................

16

Taxable

Income

17 DEDUCTION.

Standard (See Instructions)

.

Itemized (From Schedule 2, line 8) .....................................................

17

.

18 EXEMPTION. Multiply the number of exemptions on line 13 by $2,750 ........................................................................ 18

19 TAXABLE INCOME. (Line 16 minus lines 17 and 18. If negative, enter a minus

.

sign in the box to the left of the number.) ............................................................................

19

.

20 INCOME TAX. (Find the tax for the amount on line 19 in the tax table on pages 29-34) .......

20

STEP 4

.

21 TAX ADDITIONS. (From Maine Schedule A, line 4) ...............................................................

21

Calculate

22 LOW-INCOME TAX CREDIT. If the amount on line 19 is $2,000 or less and you or your

Your Tax

spouse (if married) are not claimed as an exemption on another person’s tax return and

you are not subject to the Maine Minimum Tax, add lines 20 and 21 and enter the total

.

here.

NOTE: You are not required to file a return if you qualify for this credit.

............................................................................... 22

.

23 TOTAL TAX. (Line 20 plus line 21 minus line 22) ....................................................................

23

.

24 TAX CREDITS. (From Maine Schedule A, line 23) ...................................................................

24

STEP 5

Subtract

25 NONRESIDENT CREDIT. (For nonresidents and part-year residents only)

.

Tax Credits

(From Schedule NR or NRH - You MUST attach a copy of your federal return.) ........................

25

.

26 NET TAX. (Subtract lines 24 and 25 from line 23) (Nonresidents see instructions) ...................

26

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2