Instructions For Form Rpd-41307 - Rack Operator Report - New Mexico Department Of Revenue

ADVERTISEMENT

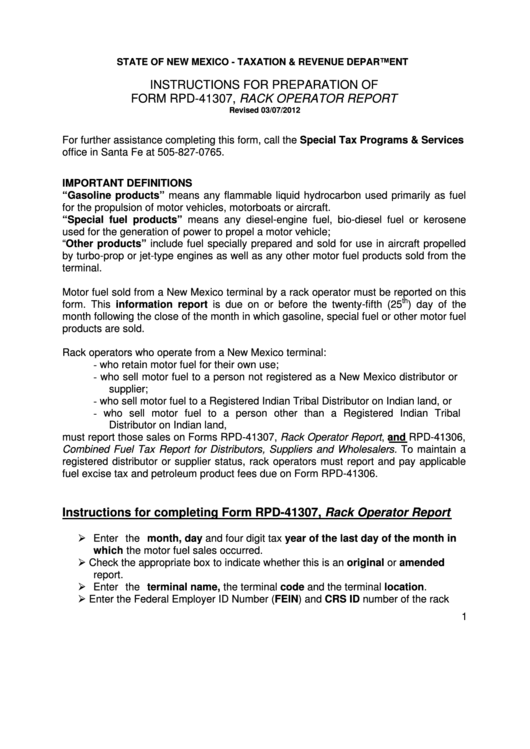

STATE OF NEW MEXICO - TAXATION & REVENUE DEPARTMENT

INSTRUCTIONS FOR PREPARATION OF

FORM RPD-41307, RACK OPERATOR REPORT

Revised 03/07/2012

For further assistance completing this form, call the Special Tax Programs & Services

office in Santa Fe at 505-827-0765.

IMPORTANT DEFINITIONS

“Gasoline products” means any flammable liquid hydrocarbon used primarily as fuel

for the propulsion of motor vehicles, motorboats or aircraft.

“Special fuel products” means any diesel-engine fuel, bio-diesel fuel or kerosene

used for the generation of power to propel a motor vehicle;

“Other products” include fuel specially prepared and sold for use in aircraft propelled

by turbo-prop or jet-type engines as well as any other motor fuel products sold from the

terminal.

Motor fuel sold from a New Mexico terminal by a rack operator must be reported on this

th

form. This information report is due on or before the twenty-fifth (25

) day of the

month following the close of the month in which gasoline, special fuel or other motor fuel

products are sold.

Rack operators who operate from a New Mexico terminal:

-

who retain motor fuel for their own use;

who sell motor fuel to a person not registered as a New Mexico distributor or

-

supplier;

who sell motor fuel to a Registered Indian Tribal Distributor on Indian land, or

-

who sell motor fuel to a person other than a Registered Indian Tribal

-

Distributor on Indian land,

must report those sales on Forms RPD-41307, Rack Operator Report, and RPD-41306,

Combined Fuel Tax Report for Distributors, Suppliers and Wholesalers. To maintain a

registered distributor or supplier status, rack operators must report and pay applicable

fuel excise tax and petroleum product fees due on Form RPD-41306.

Instructions for completing Form RPD-41307, Rack Operator Report

Enter the month, day and four digit tax year of the last day of the month in

which the motor fuel sales occurred.

Check the appropriate box to indicate whether this is an original or amended

report.

Enter the terminal name, the terminal code and the terminal location.

Enter the Federal Employer ID Number (FEIN) and CRS ID number of the rack

1

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10