Instructions For Sales Tax Return - Saint John Parish - Louisiana Department Of Revenue

ADVERTISEMENT

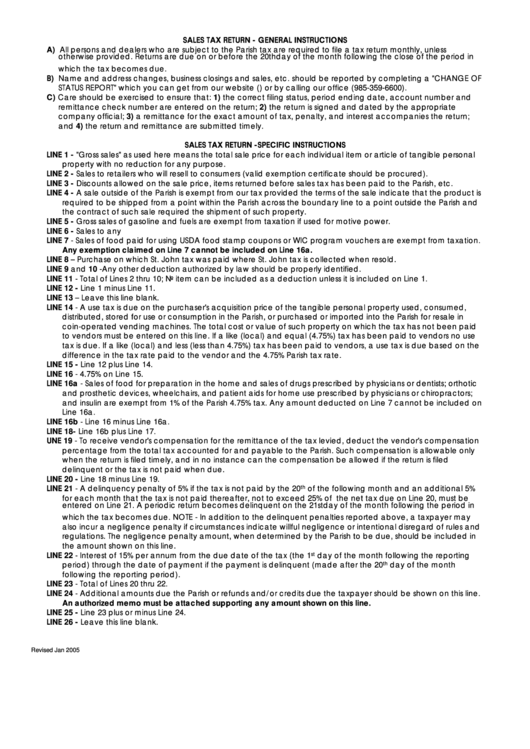

SALES TAX RETURN - GENERAL INSTRUCTIONS

A) All persons and dealers who are subject to the Parish tax are required to file a tax return monthly, unless

otherwise provided. Returns are due on or before the 20th day of the month following the close of the period in

which the tax becomes due.

B) Name and address changes, business closings and sales, etc. should be reported by completing a "CHANGE OF

STATUS REPORT" which you can get from our website ( ) or by calling our office (985-359-6600).

C) Care should be exercised to ensure that: 1) the correct filing status, period ending date, account number and

remittance check number are entered on the return; 2) the return is signed and dated by the appropriate

company official; 3) a remittance for the exact amount of tax, penalty, and interest accompanies the return;

and 4) the return and remittance are submitted timely.

SALES TAX RETURN -SPECIFIC INSTRUCTIONS

LINE 1 - "Gross sales" as used here means the total sale price for each individual item or article of tangible personal

property with no reduction for any purpose.

LINE 2 - Sales to retailers who will resell to consumers (valid exemption certificate should be procured).

LINE 3 - Discounts allowed on the sale price, items returned before sales tax has been paid to the Parish, etc.

LINE 4 - A sale outside of the Parish is exempt from our tax provided the terms of the sale indicate that the product is

required to be shipped from a point within the Parish across the boundary line to a point outside the Parish and

the contract of such sale required the shipment of such property.

LINE 5 - Gross sales of gasoline and fuels are exempt from taxation if used for motive power.

LINE 6 - Sales to any U.S. Government agencies are exempt from taxation.

LINE 7 - Sales of food paid for using USDA food stamp coupons or WlC program vouchers are exempt from taxation.

Any exemption claimed on Line 7 cannot be included on Line 16a.

LINE 8 – Purchase on which St. John tax was paid where St. John tax is collected when resold.

LINE 9 and 10 -Any other deduction authorized by law should be properly identified.

LINE 11 - Total of Lines 2 thru 10; No item can be included as a deduction unless it is included on Line 1.

LINE 12 - Line 1 minus Line 11.

LINE 13 – Leave this line blank.

LINE 14 - A use tax is due on the purchaser's acquisition price of the tangible personal property used, consumed,

distributed, stored for use or consumption in the Parish, or purchased or imported into the Parish for resale in

coin-operated vending machines. The total cost or value of such property on which the tax has not been paid

to vendors must be entered on this line. If a like (local) and equal (4.75%) tax has been paid to vendors no use

tax is due. If a like (local) and less (less than 4.75%) tax has been paid to vendors, a use tax is due based on the

difference in the tax rate paid to the vendor and the 4.75% Parish tax rate.

LINE 15 - Line 12 plus Line 14.

LINE 16 - 4.75% on Line 15.

LINE 16a - Sales of food for preparation in the home and sales of drugs prescribed by physicians or dentists; orthotic

and prosthetic devices, wheelchairs, and patient aids for home use prescribed by physicians or chiropractors;

and insulin are exempt from 1% of the Parish 4.75% tax. Any amount deducted on Line 7 cannot be included on

Line 16a.

LINE 16b - Line 16 minus Line 16a.

LINE 18- Line 16b plus Line 17.

UNE 19 - To receive vendor's compensation for the remittance of the tax levied, deduct the vendor's compensation

percentage from the total tax accounted for and payable to the Parish. Such compensation is allowable only

when the return is filed timely, and in no instance can the compensation be allowed if the return is filed

delinquent or the tax is not paid when due.

LINE 20 - Line 18 minus Line 19.

LINE 21 - A delinquency penalty of 5% if the tax is not paid by the 20

of the following month and an additional 5%

th

for each month that the tax is not paid thereafter, not to exceed 25% of the net tax due on Line 20, must be

entered on Line 21. A periodic return becomes delinquent on the 21st day of the month following the period in

which the tax becomes due. NOTE - In addition to the delinquent penalties reported above, a taxpayer may

also incur a negligence penalty if circumstances indicate willful negligence or intentional disregard of rules and

regulations. The negligence penalty amount, when determined by the Parish to be due, should be included in

the amount shown on this line.

LINE 22 - Interest of 15% per annum from the due date of the tax (the 1

day of the month following the reporting

st

period) through the date of payment if the payment is delinquent (made after the 20

day of the month

th

following the reporting period).

LINE 23 - Total of Lines 20 thru 22.

LINE 24 - Additional amounts due the Parish or refunds and/or credits due the taxpayer should be shown on this line.

An authorized memo must be attached supporting any amount shown on this line.

LINE 25 - Line 23 plus or minus Line 24.

LINE 26 - Leave this line blank.

Revised Jan 2005

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1