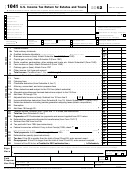

2

Form 1041 (2002)

Page

Charitable Deduction. Do not complete for a simple trust or a pooled income fund.

Schedule A

1

1

Amounts paid or permanently set aside for charitable purposes from gross income (see page 19)

2

2

Tax-exempt income allocable to charitable contributions (see page 19 of the instructions)

3

3

Subtract line 2 from line 1

4

4

Capital gains for the tax year allocated to corpus and paid or permanently set aside for charitable purposes

5

5

Add lines 3 and 4

6

Section 1202 exclusion allocable to capital gains paid or permanently set aside for charitable

6

purposes (see page 19 of the instructions)

7

Charitable deduction. Subtract line 6 from line 5. Enter here and on page 1, line 13

7

Income Distribution Deduction

Schedule B

1

1

Adjusted total income (see page 19 of the instructions)

2

2

Adjusted tax-exempt interest

3

3

Total net gain from Schedule D (Form 1041), line 16, column (1) (see page 20 of the instructions)

4

4

Enter amount from Schedule A, line 4 (reduced by any allocable section 1202 exclusion)

5

5

Capital gains for the tax year included on Schedule A, line 1 (see page 20 of the instructions)

6

Enter any gain from page 1, line 4, as a negative number. If page 1, line 4, is a loss, enter the

6

loss as a positive number

7

7

Distributable net income (DNI). Combine lines 1 through 6. If zero or less, enter -0-

8

If a complex trust, enter accounting income for the tax year as

8

determined under the governing instrument and applicable local law

9

9

Income required to be distributed currently

10

10

Other amounts paid, credited, or otherwise required to be distributed

11

11

Total distributions. Add lines 9 and 10. If greater than line 8, see page 20 of the instructions

12

12

Enter the amount of tax-exempt income included on line 11

13

13

Tentative income distribution deduction. Subtract line 12 from line 11

14

14

Tentative income distribution deduction. Subtract line 2 from line 7. If zero or less, enter -0-

15

Income distribution deduction. Enter the smaller of line 13 or line 14 here and on page 1, line 18

15

Schedule G

Tax Computation (see page 21 of the instructions)

1a

1

Tax:

a

Tax rate schedule or

Schedule D (Form 1041)

1b

b

Tax on lump-sum distributions (attach Form 4972)

1c

c

Alternative minimum tax (from Schedule I, line 56)

1d

d

Total. Add lines 1a through 1c

2a

2a

Foreign tax credit (attach Form 1116)

2b

b Other nonbusiness credits (attach schedule)

c

General business credit. Enter here and check which forms are attached:

2c

Form 3800

Forms (specify)

2d

d

Credit for prior year minimum tax (attach Form 8801)

3

3

Total credits. Add lines 2a through 2d

4

4

Subtract line 3 from line 1d. If zero or less, enter -0-

5

5

Recapture taxes. Check if from:

Form 4255

Form 8611

6

6

Household employment taxes. Attach Schedule H (Form 1040)

7

Total tax. Add lines 4 through 6. Enter here and on page 1, line 23

7

Other Information

Yes

No

1

Did the estate or trust receive tax-exempt income? If “Yes,” attach a computation of the allocation of expenses

Enter the amount of tax-exempt interest income and exempt-interest dividends

$

2

Did the estate or trust receive all or any part of the earnings (salary, wages, and other compensation) of any

individual by reason of a contract assignment or similar arrangement?

At any time during calendar year 2002, did the estate or trust have an interest in or a signature or other authority

3

over a bank, securities, or other financial account in a foreign country?

See page 22 of the instructions for exceptions and filing requirements for Form TD F 90-22.1. If “Yes,” enter

the name of the foreign country

4

During the tax year, did the estate or trust receive a distribution from, or was it the grantor of, or transferor to,

a foreign trust? If “Yes,” the estate or trust may have to file Form 3520. See page 22 of the instructions

5

Did the estate or trust receive, or pay, any qualified residence interest on seller-provided financing? If “Yes,”

see page 22 for required attachment

6

If this is an estate or a complex trust making the section 663(b) election, check here (see page 23)

7

To make a section 643(e)(3) election, attach Schedule D (Form 1041), and check here (see page 23)

8

If the decedent’s estate has been open for more than 2 years, attach an explanation for the delay in closing the estate, and check here

9

Are any present or future trust beneficiaries skip persons? See page 23 of the instructions

1041

Form

(2002)

1

1 2

2 3

3 4

4