4

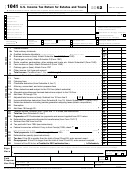

Form 1041 (2002)

Page

Part III—Alternative Minimum Tax

45

$22,500

00

45

Exemption amount

46

46

Enter the amount from line 29

$75,000

00

47

47

Phase-out of exemption amount

48

48

Subtract line 47 from line 46. If zero or less, enter -0-

49

49

Multiply line 48 by 25% (.25)

50

50

Subtract line 49 from line 45. If zero or less, enter -0-

51

51

Subtract line 50 from line 46

52

Go to Part IV of Schedule I to figure line 52 if the estate or trust has a gain on lines 15a and 16

of column (2) of Schedule D (Form 1041) (as refigured for the AMT, if necessary). Otherwise, if

line 51 is—

● $175,000 or less, multiply line 51 by 26% (.26).

● Over $175,000, multiply line 51 by 28% (.28) and subtract $3,500 from the result

52

53

53

Alternative minimum foreign tax credit (see page 28 of the instructions)

54

54

Tentative minimum tax. Subtract line 53 from line 52

55

55

Enter the tax from Schedule G, line 1a (minus any foreign tax credit from Schedule G, line 2a)

56

Alternative minimum tax. Subtract line 55 from line 54. If zero or less, enter -0-. Enter here and

on Schedule G, line 1c

56

Part IV—Line 52 Computation Using Maximum Capital Gains Rates

Caution: If the estate or trust did not complete Part V of Schedule D (Form 1041), see page 29 of the instructions before

completing this part.

57

57

Enter the amount from line 51

58

Enter the amount from Schedule D (Form 1041), line 21, or line 9 of

the Schedule D Tax Worksheet, whichever applies (as refigured for

58

AMT, if necessary)

59

Enter the amount from Schedule D (Form 1041), line 15d, column (2)

59

(as refigured for AMT, if necessary)

60

If you did not complete a Schedule D Tax Worksheet for the regular tax or the AMT, enter the

amount from line 58. Otherwise, add lines 58 and 59 and enter the smaller of that result or the

60

amount from line 4 of the Schedule D Tax Worksheet (as refigured for the AMT, if necessary).

61

61

Subtract line 60 from line 57. If zero or less, enter -0-

If line 61 is $175,000 or less, multiply line 61 by 26% (.26). Otherwise, multiply line 61 by 28%

62

62

(.28) and subtract $3,500 from the result

63

Enter the amount from Schedule D (Form 1041), line 26, or line 16 of the Schedule D Tax

63

Worksheet (as figured for the regular tax)

64

64

Enter the smallest of line 57, line 58, or line 63

65

Enter the estate’s or trust’s allocable portion of qualified 5-year gain,

if any, from Schedule D (Form 1041) line 15c, column (2) (as refigured

65

for the AMT, if necessary).

66

66

Enter the smaller of line 64 or line 65

67

67

Multiply line 66 by 8% (.08)

68

68

Subtract line 66 from line 64

69

69

Multiply line 68 by 10% (.10)

70

70

Enter the smaller of line 57 or line 58

71

71

Enter the amount from line 64

72

72

Subtract line 71 from line 70. If zero or less, enter -0-

73

73

Multiply line 72 by 20% (.20)

74

74

Enter the amount from line 57

75

75

Add lines 61, 64, and 72

76

76

Subtract line 75 from line 74

77

77

Multiply line 76 by 25% (.25)

78

78

Add lines 62, 67, 69, 73, and 77

79

If line 57 is $175,000 or less, multiply line 57 by 26% (.26). Otherwise, multiply line 57 by 28% (.28)

79

and subtract $3,500 from the result

Enter the smaller of line 78 or line 79 here and on line 52

80

80

1041

Form

(2002)

1

1 2

2 3

3 4

4