Form Nc478i - Tax Credit Research And Development - 2004

ADVERTISEMENT

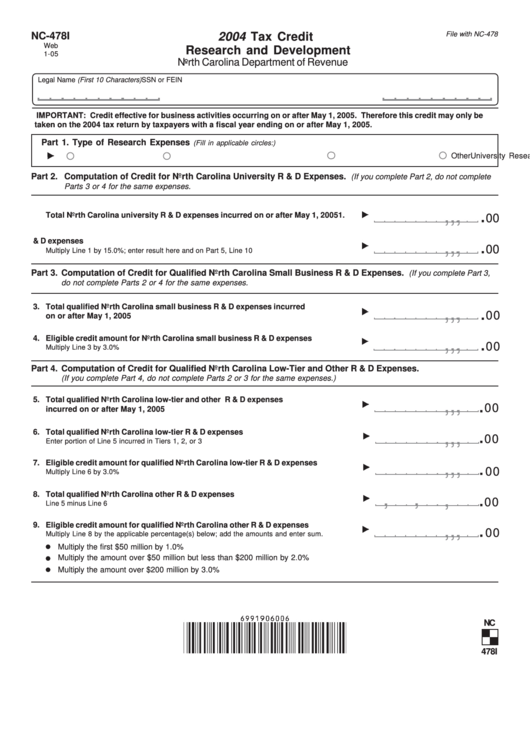

NC-478I

File with NC-478

2004 Tax Credit

Web

Research and Development

1-05

North Carolina Department of Revenue

Legal Name (First 10 Characters)

SSN or FEIN

IMPORTANT: Credit effective for business activities occurring on or after May 1, 2005. Therefore this credit may only be

taken on the 2004 tax return by taxpayers with a fiscal year ending on or after May 1, 2005.

Part 1. Type of Research Expenses

(Fill in applicable circles:)

Small Business

Low-tier Research (Tiers 1, 2, or 3)

University Research

Other

Part 2.

Computation of Credit for North Carolina University R & D Expenses.

(If you complete Part 2, do not complete

Parts 3 or 4 for the same expenses.

,

,

,

.

1.

Total North Carolina university R & D expenses incurred on or after May 1, 2005

00

2. Eligible credit amount for North Carolina university R & D expenses

.

,

,

,

00

Multiply Line 1 by 15.0%; enter result here and on Part 5, Line 10

Part 3.

Computation of Credit for Qualified North Carolina Small Business R & D Expenses.

(If you complete Part 3,

do not complete Parts 2 or 4 for the same expenses.

3.

Total qualified North Carolina small business R & D expenses incurred

,

,

,

.

00

on or after May 1, 2005

4.

Eligible credit amount for North Carolina small business R & D expenses

.

,

,

,

00

Multiply Line 3 by 3.0%

Part 4.

Computation of Credit for Qualified North Carolina Low-Tier and Other R & D Expenses.

(If you complete Part 4, do not complete Parts 2 or 3 for the same expenses.)

5.

Total qualified North Carolina low-tier and other R & D expenses

,

,

,

.

00

incurred on or after May 1, 2005

.

6.

Total qualified North Carolina low-tier R & D expenses

,

,

,

00

Enter portion of Line 5 incurred in Tiers 1, 2, or 3

7.

Eligible credit amount for qualified North Carolina low-tier R & D expenses

,

,

,

.

00

Multiply Line 6 by 3.0%

,

,

8.

Total qualified North Carolina other R & D expenses

,

.

00

Line 5 minus Line 6

9.

Eligible credit amount for qualified North Carolina other R & D expenses

.

,

,

,

00

Multiply Line 8 by the applicable percentage(s) below; add the amounts and enter sum.

Multiply the first $50 million by 1.0%

Multiply the amount over $50 million but less than $200 million by 2.0%

Multiply the amount over $200 million by 3.0%

NC

478I

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2