Instructions For The Requester Of Form W-9 - Request For Taxpayer Identification Number And Certification

ADVERTISEMENT

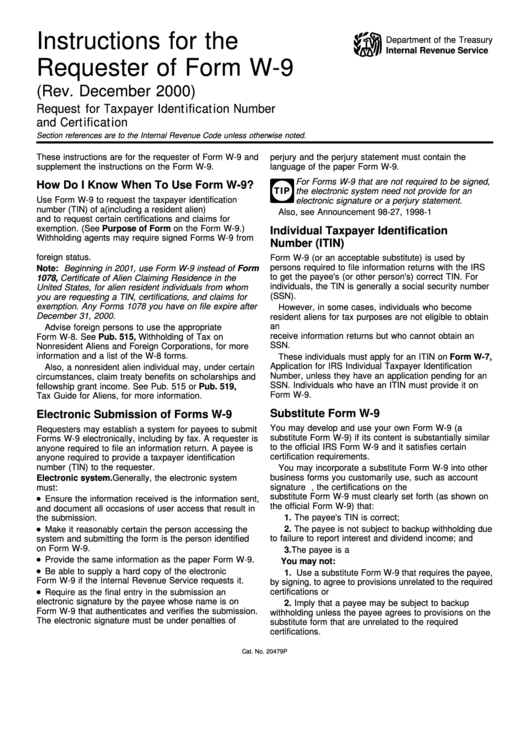

Instructions for the

Department of the Treasury

Internal Revenue Service

Requester of Form W-9

(Rev. December 2000)

Request for Taxpayer Identification Number

and Certification

Section references are to the Internal Revenue Code unless otherwise noted.

These instructions are for the requester of Form W-9 and

perjury and the perjury statement must contain the

supplement the instructions on the Form W-9.

language of the paper Form W-9.

For Forms W-9 that are not required to be signed,

How Do I Know When To Use Form W-9?

TIP

the electronic system need not provide for an

Use Form W-9 to request the taxpayer identification

electronic signature or a perjury statement.

number (TIN) of a U.S. person (including a resident alien)

Also, see Announcement 98-27, 1998-1 C.B. 865.

and to request certain certifications and claims for

exemption. (See Purpose of Form on the Form W-9.)

Individual Taxpayer Identification

Withholding agents may require signed Forms W-9 from

Number (ITIN)

U.S. exempt recipients to overcome any presumptions of

foreign status.

Form W-9 (or an acceptable substitute) is used by

persons required to file information returns with the IRS

Note: Beginning in 2001, use Form W-9 instead of Form

to get the payee's (or other person's) correct TIN. For

1078, Certificate of Alien Claiming Residence in the

individuals, the TIN is generally a social security number

United States, for alien resident individuals from whom

(SSN).

you are requesting a TIN, certifications, and claims for

exemption. Any Forms 1078 you have on file expire after

However, in some cases, individuals who become U.S.

December 31, 2000.

resident aliens for tax purposes are not eligible to obtain

an SSN. This includes certain resident aliens who must

Advise foreign persons to use the appropriate

receive information returns but who cannot obtain an

Form W-8. See Pub. 515, Withholding of Tax on

SSN.

Nonresident Aliens and Foreign Corporations, for more

information and a list of the W-8 forms.

These individuals must apply for an ITIN on Form W-7,

Application for IRS Individual Taxpayer Identification

Also, a nonresident alien individual may, under certain

Number, unless they have an application pending for an

circumstances, claim treaty benefits on scholarships and

SSN. Individuals who have an ITIN must provide it on

fellowship grant income. See Pub. 515 or Pub. 519, U.S.

Form W-9.

Tax Guide for Aliens, for more information.

Substitute Form W-9

Electronic Submission of Forms W-9

You may develop and use your own Form W-9 (a

Requesters may establish a system for payees to submit

substitute Form W-9) if its content is substantially similar

Forms W-9 electronically, including by fax. A requester is

to the official IRS Form W-9 and it satisfies certain

anyone required to file an information return. A payee is

certification requirements.

anyone required to provide a taxpayer identification

number (TIN) to the requester.

You may incorporate a substitute Form W-9 into other

business forms you customarily use, such as account

Electronic system. Generally, the electronic system

signature cards. However, the certifications on the

must:

substitute Form W-9 must clearly set forth (as shown on

Ensure the information received is the information sent,

the official Form W-9) that:

and document all occasions of user access that result in

1. The payee's TIN is correct;

the submission.

2. The payee is not subject to backup withholding due

Make it reasonably certain the person accessing the

to failure to report interest and dividend income; and

system and submitting the form is the person identified

on Form W-9.

3. The payee is a U.S. person.

Provide the same information as the paper Form W-9.

You may not:

Be able to supply a hard copy of the electronic

1. Use a substitute Form W-9 that requires the payee,

Form W-9 if the Internal Revenue Service requests it.

by signing, to agree to provisions unrelated to the required

certifications or

Require as the final entry in the submission an

electronic signature by the payee whose name is on

2. Imply that a payee may be subject to backup

Form W-9 that authenticates and verifies the submission.

withholding unless the payee agrees to provisions on the

The electronic signature must be under penalties of

substitute form that are unrelated to the required

certifications.

Cat. No. 20479P

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1 2

2 3

3