Instructions For Form Nc-478 Series - Summary Of Tax Credit Limited To 50% Of Tax - North Carolina Department Of Revenue

ADVERTISEMENT

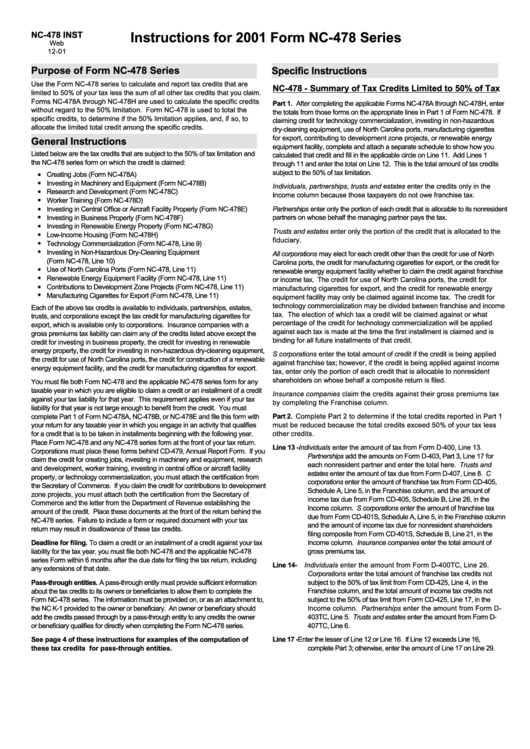

NC-478 INST

Instructions for 2001 Form NC-478 Series

Web

12-01

Purpose of Form NC-478 Series

Specific Instructions

Use the Form NC-478 series to calculate and report tax credits that are

NC-478 - Summary of Tax Credits Limited to 50% of Tax

limited to 50% of your tax less the sum of all other tax credits that you claim.

Forms NC-478A through NC-478H are used to calculate the specific credits

Part 1. After completing the applicable Forms NC-478A through NC-478H, enter

without regard to the 50% limitation. Form NC-478 is used to total the

the totals from those forms on the appropriate lines in Part 1 of Form NC-478. If

specific credits, to determine if the 50% limitation applies, and, if so, to

claiming credit for technology commercialization, investing in non-hazardous

allocate the limited total credit among the specific credits.

dry-cleaning equipment, use of North Carolina ports, manufacturing cigarettes

for export, contributing to development zone projects, or renewable energy

General Instructions

equipment facility, complete and attach a separate schedule to show how you

Listed below are the tax credits that are subject to the 50% of tax limitation and

calculated that credit and fill in the applicable circle on Line 11. Add Lines 1

the NC-478 series form on which the credit is claimed:

through 11 and enter the total on Line 12. This is the total amount of tax credits

subject to the 50% of tax limitation.

•

Creating Jobs (Form NC-478A)

•

Investing in Machinery and Equipment (Form NC-478B)

Individuals, partnerships, trusts and estates enter the credits only in the

•

Research and Development (Form NC-478C)

Income column because those taxpayers do not owe franchise tax.

•

Worker Training (Form NC-478D)

•

Partnerships enter only the portion of each credit that is allocable to its nonresident

Investing in Central Office or Aircraft Facility Property (Form NC-478E)

•

Investing in Business Property (Form NC-478F)

partners on whose behalf the managing partner pays the tax.

•

Investing in Renewable Energy Property (Form NC-478G)

Trusts and estates enter only the portion of the credit that is allocated to the

•

Low-Income Housing (Form NC-478H)

fiduciary.

•

Technology Commercialization (Form NC-478, Line 9)

•

Investing in Non-Hazardous Dry-Cleaning Equipment

All corporations may elect for each credit other than the credit for use of North

(Form NC-478, Line 10)

Carolina ports, the credit for manufacturing cigarettes for export, or the credit for

•

Use of North Carolina Ports (Form NC-478, Line 11)

renewable energy equipment facility whether to claim the credit against franchise

•

Renewable Energy Equipment Facility (Form NC-478, Line 11)

or income tax. The credit for use of North Carolina ports, the credit for

•

Contributions to Development Zone Projects (Form NC-478, Line 11)

manufacturing cigarettes for export, and the credit for renewable energy

•

Manufacturing Cigarettes for Export (Form NC-478, Line 11)

equipment facility may only be claimed against income tax. The credit for

technology commercialization may be divided between franchise and income

Each of the above tax credits is available to individuals, partnerships, estates,

tax. The election of which tax a credit will be claimed against or what

trusts, and corporations except the tax credit for manufacturing cigarettes for

percentage of the credit for technology commercialization will be applied

export, which is available only to corporations. Insurance companies with a

against each tax is made at the time the first installment is claimed and is

gross premiums tax liability can claim any of the credits listed above except the

binding for all future installments of that credit.

credit for investing in business property, the credit for investing in renewable

energy property, the credit for investing in non-hazardous dry-cleaning equipment,

S corporations enter the total amount of credit if the credit is being applied

the credit for use of North Carolina ports, the credit for construction of a renewable

against franchise tax; however, if the credit is being applied against income

energy equipment facility, and the credit for manufacturing cigarettes for export.

tax, enter only the portion of each credit that is allocable to nonresident

shareholders on whose behalf a composite return is filed.

You must file both Form NC-478 and the applicable NC-478 series form for any

taxable year in which you are eligible to claim a credit or an installment of a credit

Insurance companies claim the credits against their gross premiums tax

against your tax liability for that year. This requirement applies even if your tax

by completing the Franchise column.

liability for that year is not large enough to benefit from the credit. You must

Part 2. Complete Part 2 to determine if the total credits reported in Part 1

complete Part 1 of Form NC-478A, NC-478B, or NC-478E and file this form with

your return for any taxable year in which you engage in an activity that qualifies

must be reduced because the total credits exceed 50% of your tax less

for a credit that is to be taken in installments beginning with the following year.

other credits.

Place Form NC-478 and any NC-478 series form at the front of your tax return.

Line 13 - Individuals enter the amount of tax from Form D-400, Line 13.

Corporations must place these forms behind CD-479, Annual Report Form. If you

Partnerships add the amounts on Form D-403, Part 3, Line 17 for

claim the credit for creating jobs, investing in machinery and equipment, research

each nonresident partner and enter the total here. Trusts and

and development, worker training, investing in central office or aircraft facility

estates enter the amount of tax due from Form D-407, Line 8. C

property, or technology commercialization, you must attach the certification from

corporations enter the amount of franchise tax from Form CD-405,

the Secretary of Commerce. If you claim the credit for contributions to development

Schedule A, Line 5, in the Franchise column, and the amount of

zone projects, you must attach both the certification from the Secretary of

income tax due from Form CD-405, Schedule B, Line 26, in the

Commerce and the letter from the Department of Revenue establishing the

Income column. S corporations enter the amount of franchise tax

amount of the credit. Place these documents at the front of the return behind the

due from Form CD-401S, Schedule A, Line 5, in the Franchise column

NC-478 series. Failure to include a form or required document with your tax

and the amount of income tax due for nonresident shareholders

return may result in disallowance of these tax credits.

filing composite from Form CD-401S, Schedule B, Line 21, in the

Deadline for filing. To claim a credit or an installment of a credit against your tax

Income column. Insurance companies enter the total amount of

gross premiums tax.

liability for the tax year, you must file both NC-478 and the applicable NC-478

series Form within 6 months after the due date for filing the tax return, including

Line 14 - Individuals enter the amount from Form D-400TC, Line 26.

any extensions of that date.

Corporations enter the total amount of franchise tax credits not

subject to the 50% of tax limit from Form CD-425, Line 4, in the

Pass-through entities. A pass-through entity must provide sufficient information

about the tax credits to its owners or beneficiaries to allow them to complete the

Franchise column, and the total amount of income tax credits not

Form NC-478 series. The information must be provided on, or as an attachment to,

subject to the 50% of tax limit from Form CD-425, Line 17, in the

the NC K-1 provided to the owner or beneficiary. An owner or beneficiary should

Income column. Partnerships enter the amount from Form D-

403TC, Line 5. Trusts and estates enter the amount from Form D-

add the credits passed through by a pass-through entity to any credits the owner

or beneficiary qualifies for directly when completing the Form NC-478 series.

407TC, Line 6.

Line 17 -

Enter the lesser of Line 12 or Line 16. If Line 12 exceeds Line 16,

See page 4 of these instructions for examples of the computation of

complete Part 3; otherwise, enter the amount of Line 17 on Line 29.

these tax credits for pass-through entities.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4