Instructions For Form Hs-131 - Vermont Homestead Declaration

ADVERTISEMENT

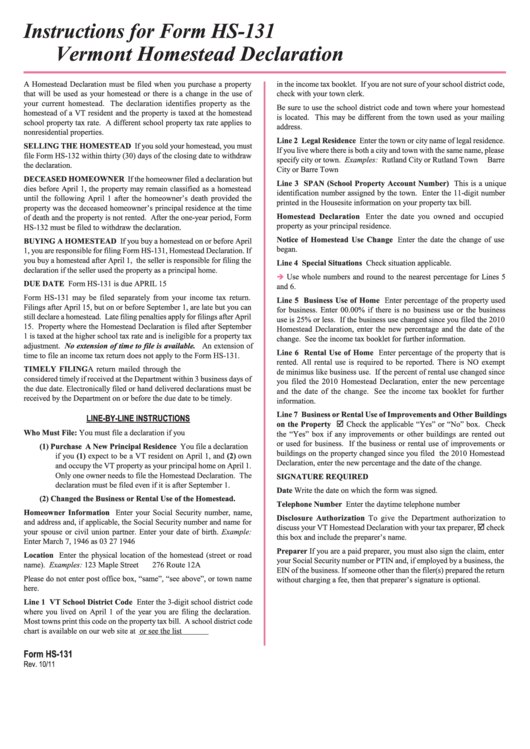

Instructions for Form HS-131

Vermont Homestead Declaration

A Homestead Declaration must be filed when you purchase a property

in the income tax booklet . If you are not sure of your school district code,

that will be used as your homestead or there is a change in the use of

check with your town clerk .

your current homestead . The declaration identifies property as the

Be sure to use the school district code and town where your homestead

homestead of a VT resident and the property is taxed at the homestead

is located . This may be different from the town used as your mailing

school property tax rate . A different school property tax rate applies to

address .

nonresidential properties .

Line 2 Legal Residence Enter the town or city name of legal residence .

SELLING THE HOMESTEAD If you sold your homestead, you must

If you live where there is both a city and town with the same name, please

file Form HS-132 within thirty (30) days of the closing date to withdraw

specify city or town . Examples: Rutland City or Rutland Town

Barre

the declaration .

City or Barre Town

DECEASED HOMEOWNER If the homeowner filed a declaration but

Line 3 SPAN (School Property Account Number) This is a unique

dies before April 1, the property may remain classified as a homestead

identification number assigned by the town . Enter the 11-digit number

until the following April 1 after the homeowner’s death provided the

printed in the Housesite information on your property tax bill .

property was the deceased homeowner’s principal residence at the time

Homestead Declaration Enter the date you owned and occupied

of death and the property is not rented . After the one-year period, Form

property as your principal residence .

HS-132 must be filed to withdraw the declaration .

Notice of Homestead Use Change Enter the date the change of use

BUYING A HOMESTEAD If you buy a homestead on or before April

began .

1, you are responsible for filing Form HS-131, Homestead Declaration . If

you buy a homestead after April 1, the seller is responsible for filing the

Line 4 Special Situations Check situation applicable .

declaration if the seller used the property as a principal home .

Use whole numbers and round to the nearest percentage for Lines 5

è

DUE DATE Form HS-131 is due APRIL 15

and 6 .

Form HS-131 may be filed separately from your income tax return .

Line 5 Business Use of Home Enter percentage of the property used

Filings after April 15, but on or before September 1, are late but you can

for business . Enter 00 .00% if there is no business use or the business

still declare a homestead . Late filing penalties apply for filings after April

use is 25% or less . If the business use changed since you filed the 2010

15 . Property where the Homestead Declaration is filed after September

Homestead Declaration, enter the new percentage and the date of the

1 is taxed at the higher school tax rate and is ineligible for a property tax

change . See the income tax booklet for further information .

adjustment . No extension of time to file is available. An extension of

Line 6 Rental Use of Home Enter percentage of the property that is

time to file an income tax return does not apply to the Form HS-131 .

rented . All rental use is required to be reported . There is NO exempt

TIMELY FILING A return mailed through the U .S . Post Office is

de minimus like business use . If the percent of rental use changed since

considered timely if received at the Department within 3 business days of

you filed the 2010 Homestead Declaration, enter the new percentage

the due date . Electronically filed or hand delivered declarations must be

and the date of the change . See the income tax booklet for further

received by the Department on or before the due date to be timely .

information .

Line 7 Business or Rental Use of Improvements and Other Buildings

LINE-BY-LINE INSTRUCTIONS

on the Property

Check the applicable “Yes” or “No” box . Check

þ

Who Must File: You must file a declaration if you

the “Yes” box if any improvements or other buildings are rented out

or used for business . If the business or rental use of improvements or

(1) Purchase A New Principal Residence You file a declaration

buildings on the property changed since you filed the 2010 Homestead

if you (1) expect to be a VT resident on April 1, and (2) own

Declaration, enter the new percentage and the date of the change .

and occupy the VT property as your principal home on April 1 .

Only one owner needs to file the Homestead Declaration . The

SIGNATURE REQUIRED

declaration must be filed even if it is after September 1 .

Date Write the date on which the form was signed .

(2) Changed the Business or Rental Use of the Homestead.

Telephone Number Enter the daytime telephone number

Homeowner Information Enter your Social Security number, name,

Disclosure Authorization To give the Department authorization to

and address and, if applicable, the Social Security number and name for

discuss your VT Homestead Declaration with your tax preparer,

check

þ

your spouse or civil union partner . Enter your date of birth . Example:

this box and include the preparer’s name .

Enter March 7, 1946 as 03 27 1946

Preparer If you are a paid preparer, you must also sign the claim, enter

Location Enter the physical location of the homestead (street or road

your Social Security number or PTIN and, if employed by a business, the

name) . Examples: 123 Maple Street

276 Route 12A

EIN of the business . If someone other than the filer(s) prepared the return

Please do not enter post office box, “same”, “see above”, or town name

without charging a fee, then that preparer’s signature is optional .

here .

Line 1 VT School District Code Enter the 3-digit school district code

where you lived on April 1 of the year you are filing the declaration .

Most towns print this code on the property tax bill . A school district code

chart is available on our web site at or see the list

Form HS-131

Rev. 10/11

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1