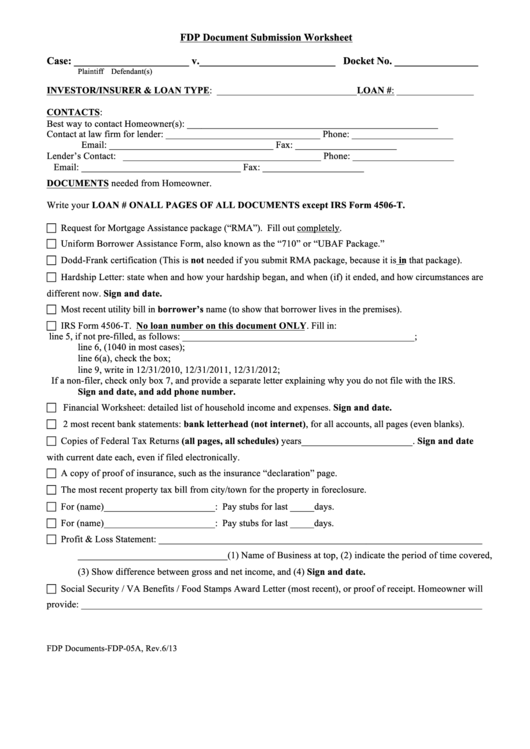

FDP Document Submission Worksheet

Case: ______________________ v.__________________________ Docket No. ________________

Plaintiff

Defendant(s)

INVESTOR/INSURER & LOAN TYPE: _____________________________ LOAN #: ________________

CONTACTS:

Best way to contact Homeowner(s): ____________________________________________________

Contact at law firm for lender: ________________________________ Phone: _____________________

Email: __________________________________ Fax: _____________________

Lender’s Contact: _________________________________________ Phone: _____________________

Email: _________________________________ Fax: _____________________

DOCUMENTS needed from Homeowner.

Write your LOAN # ON ALL PAGES OF ALL DOCUMENTS except IRS Form 4506-T.

Request for Mortgage Assistance package (“RMA”). Fill out completely.

Uniform Borrower Assistance Form, also known as the “710” or “UBAF Package.”

Dodd-Frank certification (This is not needed if you submit RMA package, because it is in that package).

Hardship Letter: state when and how your hardship began, and when (if) it ended, and how circumstances are

different now. Sign and date.

Most recent utility bill in borrower’s name (to show that borrower lives in the premises).

IRS Form 4506-T. No loan number on this document ONLY. Fill in:

line 5, if not pre-filled, as follows: ________________________________________________;

line 6, (1040 in most cases);

line 6(a), check the box;

line 9, write in 12/31/2010, 12/31/2011, 12/31/2012;

If a non-filer, check only box 7, and provide a separate letter explaining why you do not file with the IRS.

Sign and date, and add phone number.

Financial Worksheet: detailed list of household income and expenses. Sign and date.

2 most recent bank statements: bank letterhead (not internet), for all accounts, all pages (even blanks).

Copies of Federal Tax Returns (all pages, all schedules) years_______________________. Sign and date

with current date each, even if filed electronically.

A copy of proof of insurance, such as the insurance “declaration” page.

The most recent property tax bill from city/town for the property in foreclosure.

For (name)_______________________: Pay stubs for last _____days.

For (name)_______________________: Pay stubs for last _____days.

Profit & Loss Statement: ___________________________________________________________________

_______________________________(1) Name of Business at top, (2) indicate the period of time covered,

(3) Show difference between gross and net income, and (4) Sign and date.

Social Security / VA Benefits / Food Stamps Award Letter (most recent), or proof of receipt. Homeowner will

provide: ___________________________________________________________________________________

FDP Documents-FDP-05A, Rev.6/13

1

1 2

2