RESET

PRINT

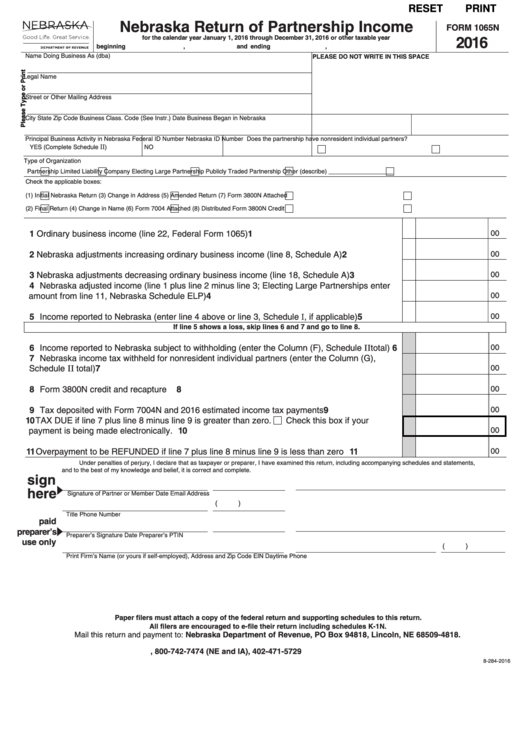

Nebraska Return of Partnership Income

FORM 1065N

2016

for the calendar year January 1, 2016 through December 31, 2016 or other taxable year

beginning

,

and ending

,

Name Doing Business As (dba)

PLEASE DO NOT WRITE IN THIS SPACE

Legal Name

Street or Other Mailing Address

City

State

Zip Code Business Class. Code (See Instr.)

Date Business Began in Nebraska

Principal Business Activity in Nebraska

Federal ID Number

Nebraska ID Number

Does the partnership have nonresident individual partners?

II

YES (Complete Schedule

)

NO

Type of Organization

Partnership

Limited Liability Company

Electing Large Partnership

Publicly Traded Partnership

Other (describe) ___________________

Check the applicable boxes:

(1)

Initial Nebraska Return

(3)

Change in Address

(5)

Amended Return

(7)

Form 3800N Attached

(2)

Final Return

(4)

Change in Name

(6)

Form 7004 Attached

(8)

Distributed Form 3800N Credit

1 Ordinary business income (line 22, Federal Form 1065) ..............................................................

1

00

2 Nebraska adjustments increasing ordinary business income (line 8, Schedule A) .......................

2

00

3 Nebraska adjustments decreasing ordinary business income (line 18, Schedule A) ....................

3

00

4 Nebraska adjusted income (line 1 plus line 2 minus line 3; Electing Large Partnerships enter

4

amount from line 11, Nebraska Schedule ELP) .............................................................................

00

5 Income reported to Nebraska (enter line 4 above or line 3, Schedule I, if applicable) ..................

5

00

If line 5 shows a loss, skip lines 6 and 7 and go to line 8.

6 Income reported to Nebraska subject to withholding (enter the Column (F), Schedule II total)....

6

00

7 Nebraska income tax withheld for nonresident individual partners (enter the Column (G),

Schedule II total) ...........................................................................................................................

7

00

8 Form 3800N credit and recapture .................................................................................................

8

00

9 Tax deposited with Form 7004N and 2016 estimated income tax payments .................................

9

00

10 TAX DUE if line 7 plus line 8 minus line 9 is greater than zero.

Check this box if your

payment is being made electronically. ........................................................................................... 10

00

11 Overpayment to be REFUNDED if line 7 plus line 8 minus line 9 is less than zero ...................... 11

00

Under penalties of perjury, I declare that as taxpayer or preparer, I have examined this return, including accompanying schedules and statements,

and to the best of my knowledge and belief, it is correct and complete.

sign

here

Signature of Partner or Member

Date

Email Address

(

)

Title

Phone Number

paid

preparer’s

Preparer’s Signature

Date

Preparer’s PTIN

use only

(

)

Print Firm’s Name (or yours if self-employed), Address and Zip Code

EIN

Daytime Phone

Paper filers must attach a copy of the federal return and supporting schedules to this return.

All filers are encouraged to e-file their return including schedules K-1N.

Mail this return and payment to: Nebraska Department of Revenue, PO Box 94818, Lincoln, NE 68509-4818.

revenue.nebraska.gov, 800-742-7474 (NE and IA), 402-471-5729

8-284-2016

1

1 2

2 3

3 4

4 5

5