Form Nyc-245 - Activities Report Of Business And General Corporations - 2016

ADVERTISEMENT

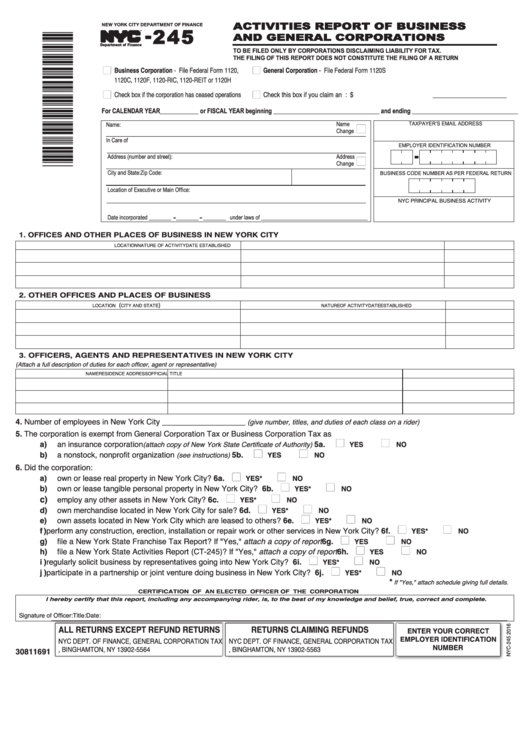

- 245

AC T I V IT IE S R E P OR T OF BUS INE S S

NEW YORK CITY DEPARTMENT OF FINANCE

A N D GE NE R A L C OR P OR AT I ONS

TM

Department of Finance

T O B E F I L E D O N LY B Y C O R P O R AT I O N S D I S C L A I M I N G L I A B I L I T Y F O R TA X .

THE FILING OF THIS REPORT DOES NOT CONSTITUTE THE FILING OF A RETURN

n

Business Corporation - File Federal Form 1120,

n

General Corporation - File Federal Form 1120S

1120C, 1120F, 1120-rIC, 1120-rEIT or 1120H

n

n

Check box if the corporation has ceased operations

Check this box if you claim an overpayment. refund Amount: $ ___________________

For CALENDAR YEAR ____________ or FISCAL YEAR beginning _________________________________ and ending _________________________________

Name

n

Name:

TAXPAYER’S EMAIL ADDRESS

Change

In Care of

EMPLOYER IDENTIFICATION NUMBER

Address (number and street):

Address

n

Change

City and State:

Zip Code:

BUSINESS CODE NUMBER AS PER FEDERAL RETURN

Location of Executive or Main Office:

NYC PrINCIPAl BUSINESS ACTIVITY

Date incorporated ________ -________ - ________ under laws of ______________________________________

1. OFFICES AND OTHER PLACES OF BUSINESS IN NEW YORK CITY

lOCATION

NATUrE OF ACTIVITY

DATE ESTABlISHED

2. OTHER OFFICES AND PLACES OF BUSINESS

(

)

lOCATION

CITY AND STATE

NATUrE OF ACTIVITY

DATE ESTABlISHED

3. OFFICERS, AGENTS AND REPRESENTATIVES IN NEW YORK CITY

(Attach a full description of duties for each officer, agent or representative)

NAME

rESIDENCE ADDrESS

OFFICIAl TITlE

4. Number of employees in New York City ___________________

(give number, titles, and duties of each class on a rider)

5. The corporation is exempt from general Corporation Tax or Business Corporation Tax as

a)

5a.

n

n

an insurance corporation

YES

NO

(attach copy of New York State Certificate of Authority) ......................................................

n

n

b)

5b.

a nonstock, nonprofit organization

YES

NO

(see instructions).................................................................................................

6. Did the corporation:

a)

own or lease real property in New York City? .............................................................................................. 6a.

n

n

YES*

NO

n

n

b)

own or lease tangible personal property in New York City? ........................................................................ 6b.

YES*

NO

c)

n

n

employ any other assets in New York City?................................................................................................. 6c.

YES*

NO

d)

own merchandise located in New York City for sale? .................................................................................. 6d.

n

n

YES*

NO

e)

own assets located in New York City which are leased to others? .............................................................. 6e.

n

n

YES*

NO

f )

6f.

n

n

perform any construction, erection, installation or repair work or other services in New York City?............

YES*

NO

g)

file a New York State Franchise Tax report? If "Yes," attach a copy of report. ........................................... 6g.

n

n

YES

NO

n

n

h)

file a New York State Activities report (CT-245)? If "Yes," attach a copy of report. .................................... 6h.

YES

NO

i )

6i.

n

n

regularly solicit business by representatives going into New York City? .....................................................

YES*

NO

j )

6j.

n

n

participate in a partnership or joint venture doing business in New York City? ...........................................

YES*

NO

*

If "Yes," attach schedule giving full details.

C E R T I F I C AT I O N O F A N E L E C T E D O F F I C E R O F T H E C O R P O R AT I O N

I hereby certify that this report, including any accompanying rider, is, to the best of my knowledge and belief, true, correct and complete.

Signature of Officer:

Title:

Date:

ALL RETURNS EXCEPT REFUND RETURNS

RETURNS CLAIMING REFUNDS

ENTER YOUR CORRECT

EMPLOYER IDENTIFICATION

NYC DEPT. OF FINANCE, gENErAl COrPOrATION TAx

NYC DEPT. OF FINANCE, gENErAl COrPOrATION TAx

NUMBER

30811691

P.O. BOx 5564, BINgHAMTON, NY 13902-5564

P.O. BOx 5563, BINgHAMTON, NY 13902-5563

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1