Form Nh-1065 Instructions - Business Profits Tax Return

ADVERTISEMENT

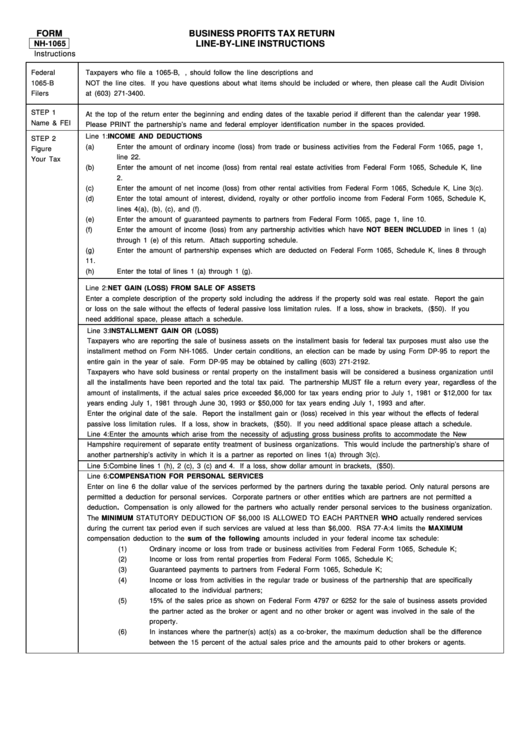

FORM

BUSINESS PROFITS TAX RETURN

LINE-BY-LINE INSTRUCTIONS

NH-1065

Instructions

Federal

Taxpayers who file a 1065-B, U.S. Return of Income for Electing Large Partnerships, should follow the line descriptions and

1065-B

NOT the line cites. If you have questions about what items should be included or where, then please call the Audit Division

Filers

at (603) 271-3400.

STEP 1

At the top of the return enter the beginning and ending dates of the taxable period if different than the calendar year 1998.

Name & FEI

Please PRINT the partnership’s name and federal employer identification number in the spaces provided.

Line 1:

INCOME AND DEDUCTIONS

STEP 2

(a)

Enter the amount of ordinary income (loss) from trade or business activities from the Federal Form 1065, page 1,

Figure

line 22.

Your Tax

(b)

Enter the amount of net income (loss) from rental real estate activities from Federal Form 1065, Schedule K, line

2.

(c)

Enter the amount of net income (loss) from other rental activities from Federal Form 1065, Schedule K, Line 3(c).

(d)

Enter the total amount of interest, dividend, royalty or other portfolio income from Federal Form 1065, Schedule K,

lines 4(a), (b), (c), and (f).

(e)

Enter the amount of guaranteed payments to partners from Federal Form 1065, page 1, line 10.

(f)

Enter the amount of income (loss) from any partnership activities which have NOT BEEN INCLUDED in lines 1 (a)

through 1 (e) of this return. Attach supporting schedule.

(g)

Enter the amount of partnership expenses which are deducted on Federal Form 1065, Schedule K, lines 8 through

11.

(h)

Enter the total of lines 1 (a) through 1 (g).

Line 2:

NET GAIN (LOSS) FROM SALE OF ASSETS

Enter a complete description of the property sold including the address if the property sold was real estate. Report the gain

or loss on the sale without the effects of federal passive loss limitation rules. If a loss, show in brackets, e.g. ($50). If you

need additional space, please attach a schedule.

Line 3:

INSTALLMENT GAIN OR (LOSS)

Taxpayers who are reporting the sale of business assets on the installment basis for federal tax purposes must also use the

installment method on Form NH-1065. Under certain conditions, an election can be made by using Form DP-95 to report the

entire gain in the year of sale. Form DP-95 may be obtained by calling (603) 271-2192.

Taxpayers who have sold business or rental property on the installment basis will be considered a business organization until

all the installments have been reported and the total tax paid. The partnership MUST file a return every year, regardless of the

amount of installments, if the actual sales price exceeded $6,000 for tax years ending prior to July 1, 1981 or $12,000 for tax

years ending July 1, 1981 through June 30, 1993 or $50,000 for tax years ending July 1, 1993 and after.

Enter the original date of the sale. Report the installment gain or (loss) received in this year without the effects of federal

passive loss limitation rules. If a loss, show in brackets, e.g. ($50). If you need additional space please attach a schedule.

Line 4:

Enter the amounts which arise from the necessity of adjusting gross business profits to accommodate the New

Hampshire requirement of separate entity treatment of business organizations. This would include the partnership’s share of

another partnership’s activity in which it is a partner as reported on lines 1(a) through 3(c).

Line 5:

Combine lines 1 (h), 2 (c), 3 (c) and 4. If a loss, show dollar amount in brackets, e.g. ($50).

Line 6:

COMPENSATION FOR PERSONAL SERVICES

Enter on line 6 the dollar value of the services performed by the partners during the taxable period. Only natural persons are

permitted a deduction for personal services. Corporate partners or other entities which are partners are not permitted a

deduction. Compensation is only allowed for the partners who actually render personal services to the business organization.

The MINIMUM STATUTORY DEDUCTION OF $6,000 IS ALLOWED TO EACH PARTNER WHO actually rendered services

during the current tax period even if such services are valued at less than $6,000. RSA 77-A:4 limits the MAXIMUM

compensation deduction to the sum of the following amounts included in your federal income tax schedule:

(1)

Ordinary income or loss from trade or business activities from Federal Form 1065, Schedule K;

(2)

Income or loss from rental properties from Federal Form 1065, Schedule K;

(3)

Guaranteed payments to partners from Federal Form 1065, Schedule K;

(4)

Income or loss from activities in the regular trade or business of the partnership that are specifically

allocated to the individual partners;

(5)

15% of the sales price as shown on Federal Form 4797 or 6252 for the sale of business assets provided

the partner acted as the broker or agent and no other broker or agent was involved in the sale of the

property.

(6)

In instances where the partner(s) act(s) as a co-broker, the maximum deduction shall be the difference

between the 15 percent of the actual sales price and the amounts paid to other brokers or agents.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3