Form Ucs 3 - Employer Account Change

ADVERTISEMENT

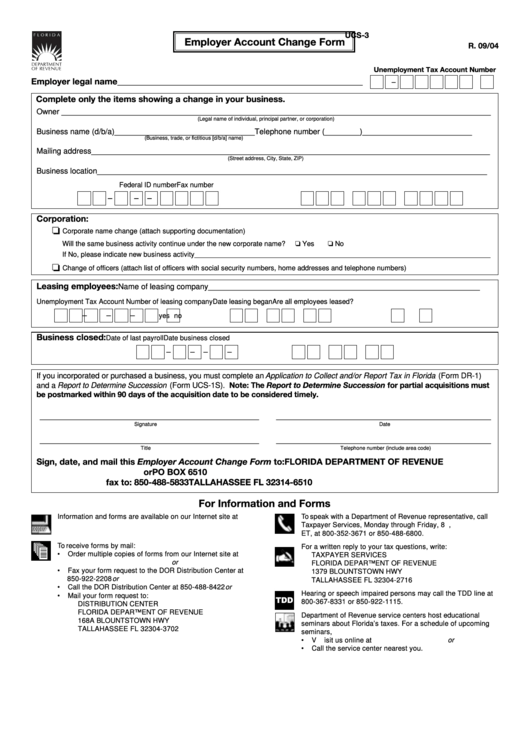

UCS-3

Employer Account Change Form

R. 09/04

Unemployment Tax Account Number

Employer legal name ________________________________________________________

–

Complete only the items showing a change in your business.

Owner __________________________________________________________________________________________________

(Legal name of individual, principal partner, or corporation)

Business name (d/b/a) ________________________________

Telephone number (________) _________________________

(Business, trade, or fictitious [d/b/a] name)

Mailing address ___________________________________________________________________________________________

(Street address, City, State, ZIP)

Business location _________________________________________________________________________________________

Federal ID number

Fax number

–

–

–

Corporation:

Corporate name change (attach supporting documentation)

Will the same business activity continue under the new corporate name?

Yes

No

If No, please indicate new business activity ____________________________________________________________________________

Change of officers (attach list of officers with social security numbers, home addresses and telephone numbers)

Leasing employees:

Name of leasing company ______________________________________________________________

Unemployment Tax Account Number of leasing company

Date leasing began

Are all employees leased?

–

–

–

yes

no

Business closed:

Date of last payroll

Date business closed

–

–

–

–

If you incorporated or purchased a business, you must complete an Application to Collect and/or Report Tax in Florida (Form DR-1)

and a Report to Determine Succession (Form UCS-1S). Note: The Report to Determine Succession for partial acquisitions must

be postmarked within 90 days of the acquisition date to be considered timely.

__________________________________________________

_________________________________________________

Signature

Date

__________________________________________________

_________________________________________________

Title

Telephone number (include area code)

Sign, date, and mail this Employer Account Change Form to:

FLORIDA DEPARTMENT OF REVENUE

or

PO BOX 6510

fax to: 850-488-5833

TALLAHASSEE FL 32314-6510

For Information and Forms

Information and forms are available on our Internet site at

To speak with a Department of Revenue representative, call

Taxpayer Services, Monday through Friday, 8 a.m. to 7 p.m.,

ET, at 800-352-3671 or 850-488-6800.

To receive forms by mail:

For a written reply to your tax questions, write:

•

Order multiple copies of forms from our Internet site at

TAXPAYER SERVICES

/forms or

FLORIDA DEPARTMENT OF REVENUE

•

Fax your form request to the DOR Distribution Center at

1379 BLOUNTSTOWN HWY

850-922-2208 or

TALLAHASSEE FL 32304-2716

•

Call the DOR Distribution Center at 850-488-8422 or

Hearing or speech impaired persons may call the TDD line at

•

Mail your form request to:

800-367-8331 or 850-922-1115.

DISTRIBUTION CENTER

FLORIDA DEPARTMENT OF REVENUE

Department of Revenue service centers host educational

168A BLOUNTSTOWN HWY

seminars about Florida’s taxes. For a schedule of upcoming

TALLAHASSEE FL 32304-3702

seminars,

•

Visit us online at or

•

Call the service center nearest you.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1