Instructions For Michigan Business Tax (Mbt) Election Of Refund Or Carryforward Of Credits Form 4584

ADVERTISEMENT

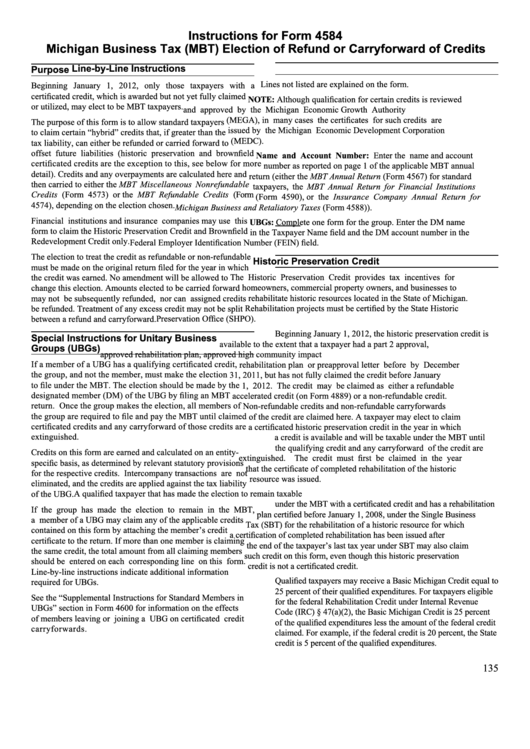

Instructions for Form 4584

Michigan Business Tax (MBT) Election of Refund or Carryforward of Credits

Line-by-Line Instructions

Purpose

Lines not listed are explained on the form.

Beginning January 1, 2012, only those taxpayers with a

certificated credit, which is awarded but not yet fully claimed

NOTE: Although qualification for certain credits is reviewed

or utilized, may elect to be MBT taxpayers.

and approved by the Michigan Economic Growth Authority

(MEGA), in many cases the certificates for such credits are

The purpose of this form is to allow standard taxpayers

issued by the Michigan Economic Development Corporation

to claim certain “hybrid” credits that, if greater than the

(MEDC).

tax liability, can either be refunded or carried forward to

offset future liabilities (historic preservation and brownfield

Name and Account Number: Enter the name and account

certificated credits are the exception to this, see below for more

number as reported on page 1 of the applicable MBT annual

detail). Credits and any overpayments are calculated here and

return (either the MBT Annual Return (Form 4567) for standard

then carried to either the MBT Miscellaneous Nonrefundable

taxpayers, the MBT Annual Return for Financial Institutions

Credits (Form 4573) or the MBT Refundable Credits (Form

(Form 4590), or the Insurance Company Annual Return for

4574), depending on the election chosen.

Michigan Business and Retaliatory Taxes (Form 4588)).

Financial institutions and insurance companies may use this

UBGs: Complete one form for the group. Enter the DM name

form to claim the Historic Preservation Credit and Brownfield

in the Taxpayer Name field and the DM account number in the

Redevelopment Credit only.

Federal Employer Identification Number (FEIN) field.

The election to treat the credit as refundable or non-refundable

Historic Preservation Credit

must be made on the original return filed for the year in which

The Historic Preservation Credit provides tax incentives for

the credit was earned. No amendment will be allowed to

homeowners, commercial property owners, and businesses to

change this election. Amounts elected to be carried forward

rehabilitate historic resources located in the State of Michigan.

may not be subsequently refunded, nor can assigned credits

be refunded. Treatment of any excess credit may not be split

Rehabilitation projects must be certified by the State Historic

between a refund and carryforward.

Preservation Office (SHPO).

Beginning January 1, 2012, the historic preservation credit is

Special Instructions for Unitary Business

available to the extent that a taxpayer had a part 2 approval,

Groups (UBGs)

approved rehabilitation plan, approved high community impact

If a member of a UBG has a qualifying certificated credit,

rehabilitation plan or preapproval letter before by December

the group, and not the member, must make the election

31, 2011, but has not fully claimed the credit before January

to file under the MBT. The election should be made by the

1, 2012. The credit may be claimed as either a refundable

designated member (DM) of the UBG by filing an MBT

accelerated credit (on Form 4889) or a non-refundable credit.

return. Once the group makes the election, all members of

Non-refundable credits and non-refundable carryforwards

the group are required to file and pay the MBT until claimed

of the credit are claimed here. A taxpayer may elect to claim

certificated credits and any carryforward of those credits are

a certificated historic preservation credit in the year in which

extinguished.

a credit is available and will be taxable under the MBT until

the qualifying credit and any carryforward of the credit are

Credits on this form are earned and calculated on an entity-

extinguished. The credit must first be claimed in the year

specific basis, as determined by relevant statutory provisions

that the certificate of completed rehabilitation of the historic

for the respective credits. Intercompany transactions are not

resource was issued.

eliminated, and the credits are applied against the tax liability

A qualified taxpayer that has made the election to remain taxable

of the UBG.

under the MBT with a certificated credit and has a rehabilitation

If the group has made the election to remain in the MBT,

plan certified before January 1, 2008, under the Single Business

a member of a UBG may claim any of the applicable credits

Tax (SBT) for the rehabilitation of a historic resource for which

contained on this form by attaching the member’s credit

a certification of completed rehabilitation has been issued after

certificate to the return. If more than one member is claiming

the end of the taxpayer’s last tax year under SBT may also claim

the same credit, the total amount from all claiming members

such credit on this form, even though this historic preservation

should be entered on each corresponding line on this form.

credit is not a certificated credit.

Line-by-line instructions indicate additional information

Qualified taxpayers may receive a Basic Michigan Credit equal to

required for UBGs.

25 percent of their qualified expenditures. For taxpayers eligible

See the “Supplemental Instructions for Standard Members in

for the federal Rehabilitation Credit under Internal Revenue

UBGs” section in Form 4600 for information on the effects

Code (IRC) § 47(a)(2), the Basic Michigan Credit is 25 percent

of members leaving or joining a UBG on certificated credit

of the qualified expenditures less the amount of the federal credit

carryforwards.

claimed. For example, if the federal credit is 20 percent, the State

credit is 5 percent of the qualified expenditures.

135

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5