Idaho Sales Tax Return Form

ADVERTISEMENT

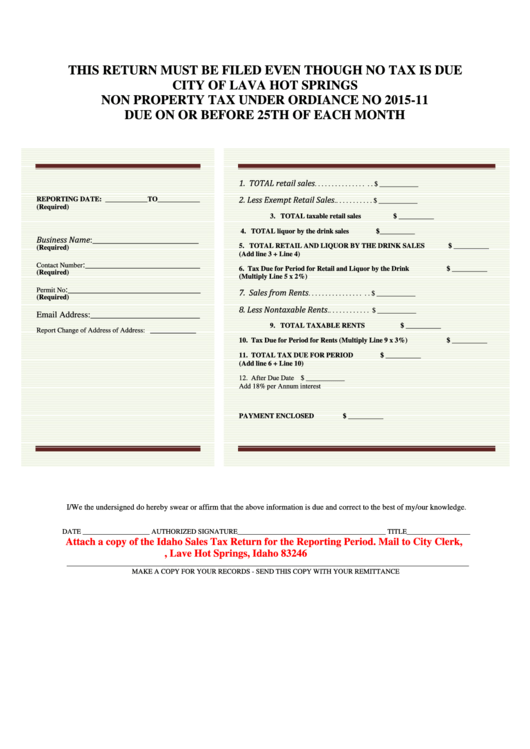

THIS RETURN MUST BE FILED EVEN THOUGH NO TAX IS DUE

CITY OF LAVA HOT SPRINGS

NON PROPERTY TAX UNDER ORDIANCE NO 2015-11

DUE ON OR BEFORE 25TH OF EACH MONTH

1. TOTAL retail sales

. . . . . . . . . . . . . . . . . $ ___________

2. Less Exempt Retail Sales

REPORTING DATE: ____________TO____________

.. . . . . . . . . . . $ ___________

(Required)

3. TOTAL taxable retail sales

$ __________

4. TOTAL liquor by the drink sales

$__________

Business Name:________________________

5. TOTAL RETAIL AND LIQUOR BY THE DRINK SALES

$ __________

(Required)

(Add line 3 + Line 4)

:__________________________

Contact Number

6. Tax Due for Period for Retail and Liquor by the Drink

$ __________

(Required)

(Multiply Line 5 x 2%)

:______________________________

Permit No

7. Sales from Rents

. . . . . . . . . . . . . . . . . . $ ___________

(Required)

8. Less Nontaxable Rents

.. . . . . . . . . . . . $ ___________

Email Address:_________________________

9. TOTAL TAXABLE RENTS

$ __________

Report Change of Address of Address: _____________

10. Tax Due for Period for Rents (Multiply Line 9 x 3%)

$ __________

11. TOTAL TAX DUE FOR PERIOD

$ __________

(Add line 6 + Line 10)

12. After Due Date

$ ___________

Add 18% per Annum interest

PAYMENT ENCLOSED

$ __________

I/We the undersigned do hereby swear or affirm that the above information is due and correct to the best of my/our knowledge

.

DATE ___________________ AUTHORIZED SIGNATURE__________________________________________ TITLE__________________

Attach a copy of the Idaho Sales Tax Return for the Reporting Period. Mail to City Clerk,

P.O. Box 187, Lave Hot Springs, Idaho 83246

__________________________________________________________________________________________________________________

MAKE A COPY FOR YOUR RECORDS - SEND THIS COPY WITH YOUR REMITTANCE

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1