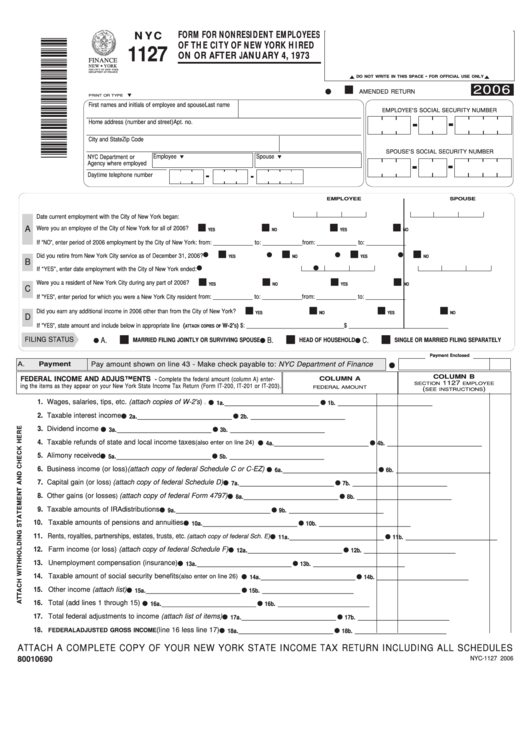

Form Nyc-1127 - For Nonresident Employees Of The City Of New York Hired On Or After January 4, 1973 - 2006

ADVERTISEMENT

FORM FOR NONRESIDENT EMPLOYEES

N Y C

OF THE CITY OF NEW YORK HIRED

1127

ON OR AFTER JANUARY 4, 1973

FINANCE

NEW YORK

THE CITY OF NEW YORK

DEPARTMENT OF FINANCE

n y c . g o v / f i n a n c e

-

DO NOT WRITE IN THIS SPACE

FOR OFFICIAL USE ONLY

2006

AMENDED RETURN

PRINT OR TYPE

First names and initials of employee and spouse

Last name

EMPLOYEE'S SOCIAL SECURITY NUMBER

Home address (number and street)

Apt. no.

City and State

Zip Code

SPOUSE'S SOCIAL SECURITY NUMBER

Employee

Spouse

NYC Department or

Agency where employed

Daytime telephone number

EMPLOYEE

SPOUSE

Date current employment with the City of New York began:

.................................................................................................

A

Were you an employee of the City of New York for all of 2006?

........................................................................................

YES

NO

YES

NO

If "NO", enter period of 2006 employment by the City of New York:

from: _____________ to: _____________

from: _____________ to: _____________

.................................................................................

Did you retire from New York City service as of December 31, 2006?

............................................................................

YES

NO

YES

NO

B

If “YES”, enter date employment with the City of New York ended:

...................................................................................

Were you a resident of New York City during any part of 2006?

........................................................................................

YES

NO

YES

NO

C

If "YES", enter period for which you were a New York City resident

from: _____________ to: _____________

from: _____________ to: _____________

.................................................................................

Did you earn any additional income in 2006 other than from the City of New York?

............................................

YES

NO

YES

NO

D

$: ________________________________

$ _________________________________

If "YES", state amount and include below in appropriate line (

W-2'

)

.........................................

ATTACH COPIES OF

S

FILING STATUS

A.

B.

C.

MARRIED FILING JOINTLY OR SURVIVING SPOUSE

HEAD OF HOUSEHOLD

SINGLE OR MARRIED FILING SEPARATELY

Payment Enclosed

A.

Payment

Pay amount shown on line 43 - Make check payable to: NYC Department of Finance

COLUMN B

FEDERAL INCOME AND ADJUSTMENTS

- Complete the federal amount (column A) enter-

COLUMN A

1127

SECTION

EMPLOYEE

ing the items as they appear on your New York State Income Tax Return (Form IT-200, IT-201 or IT-203).

FEDERAL AMOUNT

(

)

SEE INSTRUCTIONS

1. Wages, salaries, tips, etc. (attach copies of W-2's)

. ............................................

1a. _______________________________

1b. _______________________________

2. Taxable interest income

.............................................................................................

2a. _______________________________

2b. _______________________________

3. Dividend income

..........................................................................................................

3a. _______________________________

3b. _______________________________

4. Taxable refunds of state and local income taxes

(also enter on line 24) .............

4a. _______________________________

4b. _______________________________

5. Alimony received

..........................................................................................................

5a. _______________________________

5b. _______________________________

6. Business income (or loss) (attach copy of federal Schedule C or C-EZ)

........

6a. _______________________________

6b. _______________________________

7. Capital gain (or loss

(attach copy of federal Schedule D)

)

.................................

7a. _______________________________

7b. _______________________________

8. Other gains (or losses

(attach copy of federal Form 4797)

)

..............................

8a. _______________________________

8b. _______________________________

9. Taxable amounts of IRA distributions

......................................................................

9a. _______________________________

9b. _______________________________

10. Taxable amounts of pensions and annuities

..........................................................

10a. _______________________________

10b. ______________________________

11. Rents, royalties, partnerships, estates, trusts, etc.

(attach copy of federal Sch. E) .....

11a. _______________________________

11b. ______________________________

12. Farm income (or loss) (attach copy of federal Schedule F)

..............................

12a. _______________________________

12b. ______________________________

13. Unemployment compensation (insurance)

.............................................................

13a. _______________________________

13b. ______________________________

14. Taxable amount of social security benefits

(also enter on line 26) .......................

14a. _______________________________

14b. ______________________________

15. Other income (attach list)

..........................................................................................

15a. _______________________________

15b. ______________________________

16. Total (add lines 1 through 15)

..................................................................................

16a. _______________________________

16b. ______________________________

17. Total federal adjustments to income (attach list of items)

..................................

17a. _______________________________

17b. ______________________________

18.

(line 16 less line 17)

.................................

FEDERAL ADJUSTED GROSS INCOME

18a. _______________________________

18b. ______________________________

ATTACH A COMPLETE COPY OF YOUR NEW YORK STATE INCOME TAX RETURN INCLUDING ALL SCHEDULES

80010690

NYC-1127 2006

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3