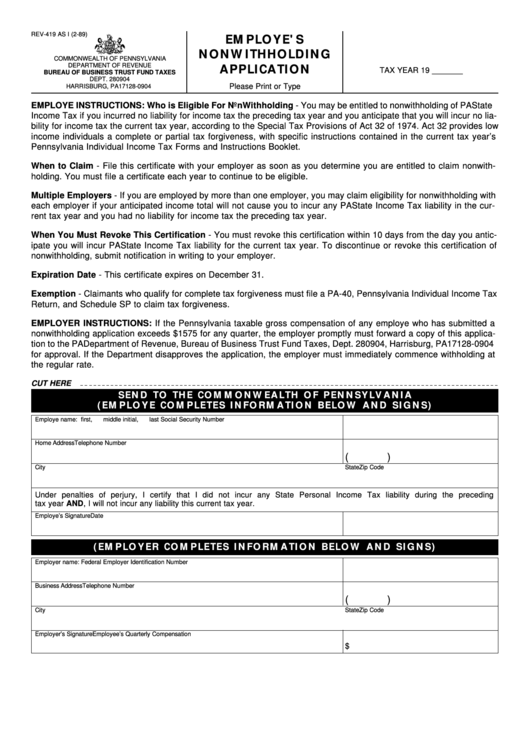

REV-419 AS I (2-89)

EMPLOYE'S

NONWITHHOLDING

COMMONWEALTH OF PENNSYLVANIA

DEPARTMENT OF REVENUE

APPLICATION

TAX YEAR 19 _______

BUREAU OF BUSINESS TRUST FUND TAXES

DEPT. 280904

Please Print or Type

HARRISBURG, PA 17128-0904

EMPLOYE INSTRUCTIONS: Who is Eligible For NonWithholding - You may be entitled to nonwithholding of PA State

Income Tax if you incurred no liability for income tax the preceding tax year and you anticipate that you will incur no lia-

bility for income tax the current tax year, according to the Special Tax Provisions of Act 32 of 1974. Act 32 provides low

income individuals a complete or partial tax forgiveness, with specific instructions contained in the current tax year’s

Pennsylvania Individual Income Tax Forms and Instructions Booklet.

When to Claim - File this certificate with your employer as soon as you determine you are entitled to claim nonwith-

holding. You must file a certificate each year to continue to be eligible.

Multiple Employers - If you are employed by more than one employer, you may claim eligibility for nonwithholding with

each employer if your anticipated income total will not cause you to incur any PA State Income Tax liability in the cur-

rent tax year and you had no liability for income tax the preceding tax year.

When You Must Revoke This Certification - You must revoke this certification within 10 days from the day you antic-

ipate you will incur PA State Income Tax liability for the current tax year. To discontinue or revoke this certification of

nonwithholding, submit notification in writing to your employer.

Expiration Date - This certificate expires on December 31.

Exemption - Claimants who qualify for complete tax forgiveness must file a PA-40, Pennsylvania Individual Income Tax

Return, and Schedule SP to claim tax forgiveness.

EMPLOYER INSTRUCTIONS: If the Pennsylvania taxable gross compensation of any employe who has submitted a

nonwithholding application exceeds $1575 for any quarter, the employer promptly must forward a copy of this applica-

tion to the PA Department of Revenue, Bureau of Business Trust Fund Taxes, Dept. 280904, Harrisburg, PA 17128-0904

for approval. If the Department disapproves the application, the employer must immediately commence withholding at

the regular rate.

CUT HERE

SEND TO THE COMMONWEALTH OF PENNSYLVANIA

(EMPLOYE COMPLETES INFORMATION BELOW AND SIGNS)

Employe name: first,

middle initial,

last

Social Security Number

Home Address

Telephone Number

(

)

City

State

Zip Code

Under penalties of perjury, I certify that I did not incur any State Personal Income Tax liability during the preceding

tax year AND, I will not incur any liability this current tax year.

Employe’s Signature

Date

(EMPLOYER COMPLETES INFORMATION BELOW AND SIGNS)

Employer name:

Federal Employer Identification Number

Business Address

Telephone Number

(

)

City

State

Zip Code

Employer’s Signature

Employee’s Quarterly Compensation

$

1

1