Instructions For Completing The Reinstatement Application - Florida Division Of Corporations

ADVERTISEMENT

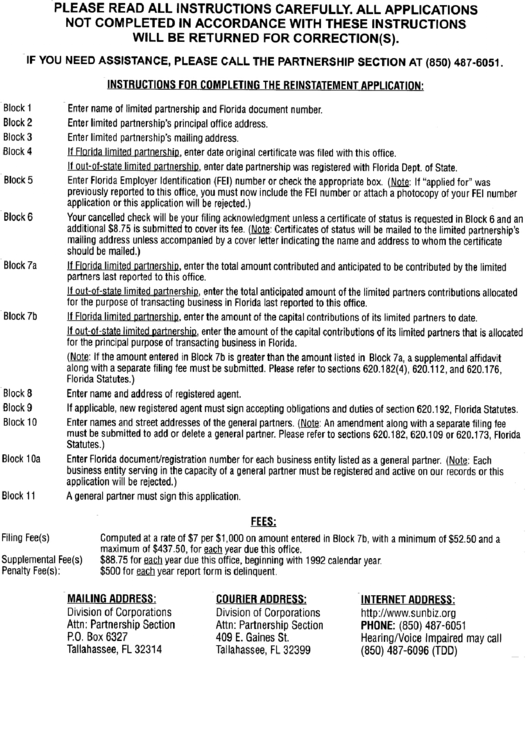

PLEASE READ ALL INSTRUCTIONS CAREFULLY. ALL APPLICATIONS

NOT COMPLETED IN ACCORDANCE WITH THESE INSTRUCTIONS

WILL BE RETURNED FOR CORRECTION(S).

IF YOU NEED ASSISTANCE, PLEASE CALL THE PARTNERSHIP SECTION AT (850) 487-6051.

INSTRUCTIONS FOR COMPLETING THE REINSTATEMENT APPLICATION:

Block 1

Block 2

Block 3

Block 4

Block 5

Block 6

Block 7a

Block 7b

Block 8

Block 9

Block 10

Block lOa

Block 11

Enter name of limited partnership and Florida document number.

Enter limited partnership's principal office address.

Enter limited partnership's mailing address.

If Florida limited partnership, enter date original certificate was filed with this office.

If out-of-state limited partnership, enter date partnership was registered with Florida Dept. of State.

Enter Florida Employer Identification (FEI) number or check the appropriate box. (Note: If "applied for" was

previously reported to this office, you must now include the FEI number or attach a photocopy of your FEI number

application or this application will be rejected.)

Your cancelled check will be your filing acknowledgment unless a certificate of status is requested in Block 6 and an

additional $8.75 is submitted to cover its fee. (Note: Certificates of status will be mailed to the limited partnership's

mailing address unless accompanied by a cover letter indicating the name and address to whom the certificate

should be mailed.)

If Florida limited l)artnershi.D, enter the total amount contributed and anticipated to be contributed by the limited

partners last reported to this office.

If out-of-state limited partnership, enter the total anticipated amount of the limited partners contributions allocated

for the purpose of transacting business in Florida last reported to this office.

If Florida limited partnership, enter the amount of the capital contributions of its limited partners to date.

If out-of-state limited partnership, enter the amount of the capital contributions of its limited partners that is allocated

for the principal purpose of transacting business in Florida.

(Note: If the amount entered in Block 7b is greater than the amount listed in Block 7a, a supplemental affidavit

along with a separate filing fee must be submitted. Please refer to sections 620.182(4), 620.112, and 620.176,

Florida Statutes.)

Enter name and address of registered agent.

If applicable, new registered agent must sign accepting obligations and duties of section 620.192, Florida Statutes.

Enter names and street addresses of the general partners. (Note: An amendment along with a separate filing fee

must be submitted to add or delete a general partner. Please refer to sections 620.182, 620.109 or 620.173, Florida

Statutes.)

Enter Florida document/registration number for each business entity listed as a general partner. (Note: Each

business entity serving in the capacity of a general partner must be registered and active on our records or this

application will be rejected.)

A general partner must sign this application.

Filing Fee(s)

Supplemental Fee(s)

Penalty Fee(s):

FEES:

Computed at a rate of $7 per $1,000 on amount entered in Block 7b, with a minimum of $52.50 and a

maximum of $437.50, for each year due this office.

$88.75 for each year due this office, beginning with 1992 calendar year.

$500 for each year report form is delinquent.

MAILING ADDRESS:

Division of Corporations

Attn: Partnership Section

P.O. Box 6327

Tallahassee, FL 32314

COURIER ADDRESS:

Division of Corporations

Attn: Partnership Section

409 E. Gaines St.

Tallahassee, FL 32399

INTERNET ADDRESS:

n

PHONE: (850) 487-6051

Hearing/Voice Impaired may call

(850) 487-6096 (TDD)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1