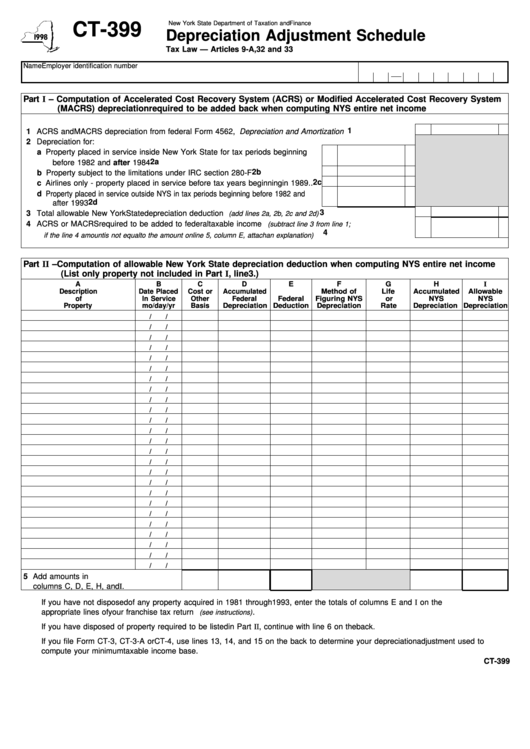

New York State Department of Taxation and Finance

CT-399

Depreciation Adjustment Schedule

Tax Law — Articles 9-A, 32 and 33

Name

Employer identification number

Part I – Computation of Accelerated Cost Recovery System (ACRS) or Modified Accelerated Cost Recovery System

(MACRS) depreciation required to be added back when computing NYS entire net income

1

1 ACRS and MACRS depreciation from federal Form 4562, Depreciation and Amortization . . . . . . . . . . . . . . . . . . .

2 Depreciation for:

a Property placed in service inside New York State for tax periods beginning

before 1982 and after 1984. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2a

b Property subject to the limitations under IRC section 280-F . . . . . . . . . . . . . . . . . . . 2b

c Airlines only - property placed in service before tax years beginning in 1989 . . 2c

d Property placed in service outside NYS in tax periods beginning before 1982 and

after 1993 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2d

3

3 Total allowable New York State depreciation deduction

. . . . . . . . . . . . . . . . . . . . . . . . . . .

(add lines 2a, 2b, 2c and 2d)

4 ACRS or MACRS required to be added to federal taxable income

(subtract line 3 from line 1;

4

. . . . . . . . . . . . . . . . . . . . . . . . . .

if the line 4 amount is not equal to the amount on line 5, column E, attach an explanation)

Part II – Computation of allowable New York State depreciation deduction when computing NYS entire net income

(List only property not included in Part I, line 3.)

A

B

C

D

E

F

G

H

I

Description

Date Placed

Cost or

Accumulated

Method of

Life

Accumulated

Allowable

of

In Service

Other

Federal

Federal

Figuring NYS

or

NYS

NYS

Property

mo/day/yr

Basis

Depreciation

Deduction

Depreciation

Rate

Depreciation

Depreciation

/

/

/

/

/

/

/

/

/

/

/

/

/

/

/

/

/

/

/

/

/

/

/

/

/

/

/

/

/

/

/

/

/

/

/

/

/

/

/

/

/

/

/

/

/

/

/

/

/

/

5 Add amounts in

columns C, D, E, H, and I.

If you have not disposed of any property acquired in 1981 through 1993, enter the totals of columns E and I on the

appropriate lines of your franchise tax return

.

(see instructions)

If you have disposed of property required to be listed in Part II, continue with line 6 on the back.

If you file Form CT-3, CT-3-A or CT-4, use lines 13, 14, and 15 on the back to determine your depreciation adjustment used to

compute your minimum taxable income base.

CT-399

1

1 2

2