Taxpayer'S Worksheet - Vermont - 2016

ADVERTISEMENT

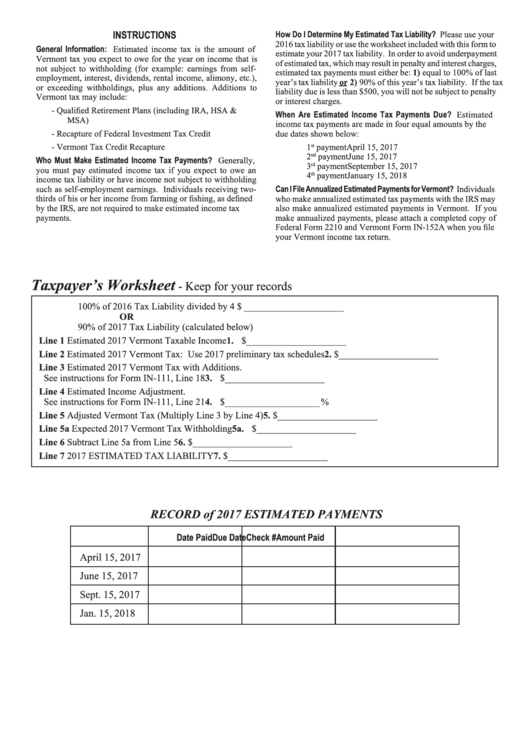

INSTRUCTIONS

How Do I Determine My Estimated Tax Liability? Please use your

2016 tax liability or use the worksheet included with this form to

General Information: Estimated income tax is the amount of

estimate your 2017 tax liability. In order to avoid underpayment

Vermont tax you expect to owe for the year on income that is

of estimated tax, which may result in penalty and interest charges,

not subject to withholding (for example: earnings from self-

estimated tax payments must either be: 1) equal to 100% of last

employment, interest, dividends, rental income, alimony, etc.),

year’s tax liability or 2) 90% of this year’s tax liability. If the tax

or exceeding withholdings, plus any additions. Additions to

liability due is less than $500, you will not be subject to penalty

Vermont tax may include:

or interest charges.

-

Qualified Retirement Plans (including IRA, HSA &

When Are Estimated Income Tax Payments Due? Estimated

MSA)

income tax payments are made in four equal amounts by the

-

Recapture of Federal Investment Tax Credit

due dates shown below:

-

Vermont Tax Credit Recapture

1

payment . . . . . . . . . . . . April 15, 2017

st

2

payment . . . . . . . . . . . . June 15, 2017

nd

Who Must Make Estimated Income Tax Payments? Generally,

3

payment . . . . . . . . . . . . September 15, 2017

rd

you must pay estimated income tax if you expect to owe an

4

payment . . . . . . . . . . . . January 15, 2018

th

income tax liability or have income not subject to withholding

Can I File Annualized Estimated Payments for Vermont? Individuals

such as self-employment earnings. Individuals receiving two-

thirds of his or her income from farming or fishing, as defined

who make annualized estimated tax payments with the IRS may

by the IRS, are not required to make estimated income tax

also make annualized estimated payments in Vermont. If you

payments.

make annualized payments, please attach a completed copy of

Federal Form 2210 and Vermont Form IN-152A when you file

your Vermont income tax return.

Taxpayer’s Worksheet

- Keep for your records

100% of 2016 Tax Liability divided by 4 $ _____________________

OR

90% of 2017 Tax Liability (calculated below)

Line 1

Estimated 2017 Vermont Taxable Income . . . . . . . . . . . . . . . . . . . . . . . . . . . 1. $_____________________

Line 2

Estimated 2017 Vermont Tax: Use 2017 preliminary tax schedules . . . . . . . 2. $_____________________

Line 3

Estimated 2017 Vermont Tax with Additions.

See instructions for Form IN-111, Line 18 . . . . . . . . . . . . . . . . . . . . . . . . . . . 3. $_____________________

Line 4

Estimated Income Adjustment.

See instructions for Form IN-111, Line 21 . . . . . . . . . . . . . . . . . . . . . . . . . . . 4. $____________________ %

Line 5

Adjusted Vermont Tax (Multiply Line 3 by Line 4) . . . . . . . . . . . . . . . . . . . . 5. $_____________________

Line 5a Expected 2017 Vermont Tax Withholding . . . . . . . . . . . . . . . . . . . . . . . . . . 5a. $_____________________

Line 6

Subtract Line 5a from Line 5 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 6. $_____________________

Line 7

2017 ESTIMATED TAX LIABILITY . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 7. $_____________________

RECORD of 2017 ESTIMATED PAYMENTS

Due Date

Date Paid

Check #

Amount Paid

April 15, 2017

June 15, 2017

Sept. 15, 2017

Jan. 15, 2018

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2