Form N-288c Instructions

ADVERTISEMENT

FORM N-288C INSTRUCTIONS

(REV. 2001)

refund of the amount withheld. The name and

General Instructions

NOTE: Under Section 235-111, Hawaii

identification number entered MUST be the same as

Revised Statutes, any claim for credit or

the name and identification number entered for the

Purpose of Form

refund of an overpayment of taxes must be

transferor/seller on Form N-288A, or as corrected on

Use Form N-288C to apply for a refund of the

filed within three years from the due date of

the copy of the notification you returned to the

amount withheld on dispositions by nonresident

the return, or within two years from the time

Department of Taxation. If the transferor/seller was

persons of Hawaii real property interests which is

the tax was paid, whichever is later.

issued an individual taxpayer identification number

in excess of 1) the transferor/seller’s tax liability for

(ITIN) by the IRS, enter the ITIN.

the transaction, or 2) the adjusted amount

Where To Send Form N-288C

Also, enter the information describing the Hawaii

required to be withheld as approved on Form

File Form N-288C with the appropriate taxation

real property transaction. In b, enter the address and

N-288B. Form N-288C should be filed if the

district office listed on the front of the form.

description of the property. Include the tax map key

Hawaii income tax return (Form N-15, N-20, N-30,

Specific Instructions

number.

N-35, or N-40) for the year is not yet available. If

available, the transferor/seller should file the

Line 2. Enter the gross sales price from the sale.

NOTE: Before you begin to fill in Form

appropriate tax return instead of filing Form

Attach a copy of your closing escrow statement from

N-288C, you should review the notification

N-288C. Also, Form N-288C will be rejected if it is

your sale of this property.

you received from the Department of

filed after the due date of the tax return.

Taxation that we have received your

Line 3. In general, the cost or adjusted basis is the

IMPORTANT: If Form N-288C was filed,

withholding payment to make sure that the

cost of the property plus purchase commissions and

the transferor/seller must still file a Hawaii

information contained in it is correct. If any

improvements, minus depreciation (if applicable).

income tax return (Form N-15, N-20, N-30,

information is not correct, please return a

Increase the cost or other basis by any expense of

N-35, or N-40) after the end of the taxable

copy of the notification to the Department of

sale, such as commissions and state transfer taxes.

year, report the entire income for the year

Taxation with the corrected information.

Complete the schedule below and enter the amount

(from other sources as well as the

from line 4 onto the front of Form N-288C, line 3.

At the top of Form N-288C, enter the taxable

transaction), and pay any additional tax

year of the transferor/seller if it is other than a

Line 4. Line 2 minus line 3. However, if you are

due on the income or request a refund.

calendar year.

reporting the gain under the installment method,

Who May File an Application

Also, enter the name, address, and identification

attach a separate sheet showing the principal

number (social security number or federal I.D.

The transferor/seller may file Form N-288C.

payments received during the taxable year and the

number), if any, of the transferor/seller applying for a

gross profit percentage. Multiply the amount of the

principal payments by the gross profit percentage

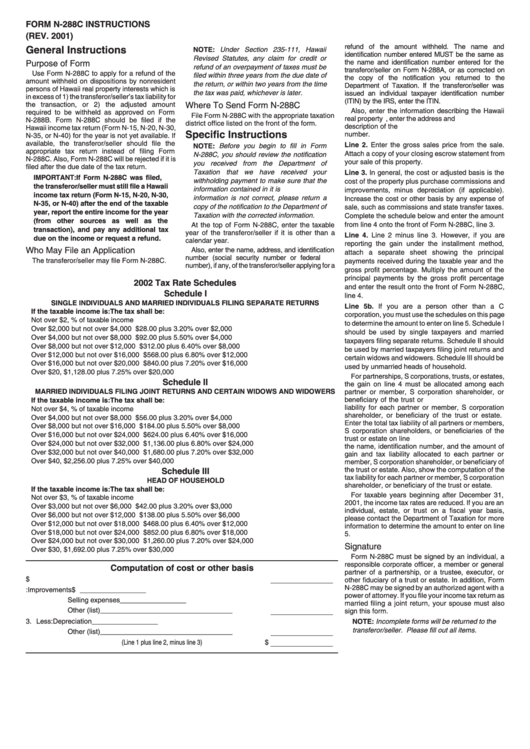

2002 Tax Rate Schedules

and enter the result onto the front of Form N-288C,

Schedule I

line 4.

SINGLE INDIVIDUALS AND MARRIED INDIVIDUALS FILING SEPARATE RETURNS

Line 5b. If you are a person other than a C

If the taxable income is:

The tax shall be:

corporation, you must use the schedules on this page

Not over $2,000..................................................................1.40% of taxable income

to determine the amount to enter on line 5. Schedule I

Over $2,000 but not over $4,000 .......................................$28.00 plus 3.20% over $2,000

should be used by single taxpayers and married

Over $4,000 but not over $8,000 .......................................$92.00 plus 5.50% over $4,000

taxpayers filing separate returns. Schedule II should

Over $8,000 but not over $12,000 .....................................$312.00 plus 6.40% over $8,000

be used by married taxpayers filing joint returns and

Over $12,000 but not over $16,000 ...................................$568.00 plus 6.80% over $12,000

certain widows and widowers. Schedule III should be

Over $16,000 but not over $20,000 ...................................$840.00 plus 7.20% over $16,000

used by unmarried heads of household.

Over $20,000 .....................................................................$1,128.00 plus 7.25% over $20,000

For partnerships, S corporations, trusts, or estates,

Schedule II

the gain on line 4 must be allocated among each

MARRIED INDIVIDUALS FILING JOINT RETURNS AND CERTAIN WIDOWS AND WIDOWERS

partner or member, S corporation shareholder, or

beneficiary of the trust or estate. Calculate the tax

If the taxable income is:

The tax shall be:

liability for each partner or member, S corporation

Not over $4,000..................................................................1.40% of taxable income

shareholder, or beneficiary of the trust or estate.

Over $4,000 but not over $8,000 .......................................$56.00 plus 3.20% over $4,000

Enter the total tax liability of all partners or members,

Over $8,000 but not over $16,000 .....................................$184.00 plus 5.50% over $8,000

S corporation shareholders, or beneficiaries of the

Over $16,000 but not over $24,000 ...................................$624.00 plus 6.40% over $16,000

trust or estate on line 5. Attach a schedule showing

Over $24,000 but not over $32,000 ...................................$1,136.00 plus 6.80% over $24,000

the name, identification number, and the amount of

Over $32,000 but not over $40,000 ...................................$1,680.00 plus 7.20% over $32,000

gain and tax liability allocated to each partner or

Over $40,000 .....................................................................$2,256.00 plus 7.25% over $40,000

member, S corporation shareholder, or beneficiary of

the trust or estate. Also, show the computation of the

Schedule III

tax liability for each partner or member, S corporation

HEAD OF HOUSEHOLD

shareholder, or beneficiary of the trust or estate.

If the taxable income is:

The tax shall be:

For taxable years beginning after December 31,

Not over $3,000..................................................................1.40% of taxable income

2001, the income tax rates are reduced. If you are an

Over $3,000 but not over $6,000 .......................................$42.00 plus 3.20% over $3,000

individual, estate, or trust on a fiscal year basis,

Over $6,000 but not over $12,000 .....................................$138.00 plus 5.50% over $6,000

please contact the Department of Taxation for more

Over $12,000 but not over $18,000 ...................................$468.00 plus 6.40% over $12,000

information to determine the amount to enter on line

Over $18,000 but not over $24,000 ...................................$852.00 plus 6.80% over $18,000

5.

Over $24,000 but not over $30,000 ...................................$1,260.00 plus 7.20% over $24,000

Signature

Over $30,000 .....................................................................$1,692.00 plus 7.25% over $30,000

Form N-288C must be signed by an individual, a

responsible corporate officer, a member or general

Computation of cost or other basis

partner of a partnership, or a trustee, executor, or

1. Purchase price of property

$

other fiduciary of a trust or estate. In addition, Form

N-288C may be signed by an authorized agent with a

2. Add:

Improvements

$ _________________

power of attorney. If you file your income tax return as

Selling expenses

_________________

married filing a joint return, your spouse must also

Other (list) _________________

_________________

sign this form.

3. Less:

Depreciation

_________________

NOTE: Incomplete forms will be returned to the

transferor/seller. Please fill out all items.

Other (list) _________________

_________________

4. Adjusted basis of property. (Line 1 plus line 2, minus line 3)

$

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1