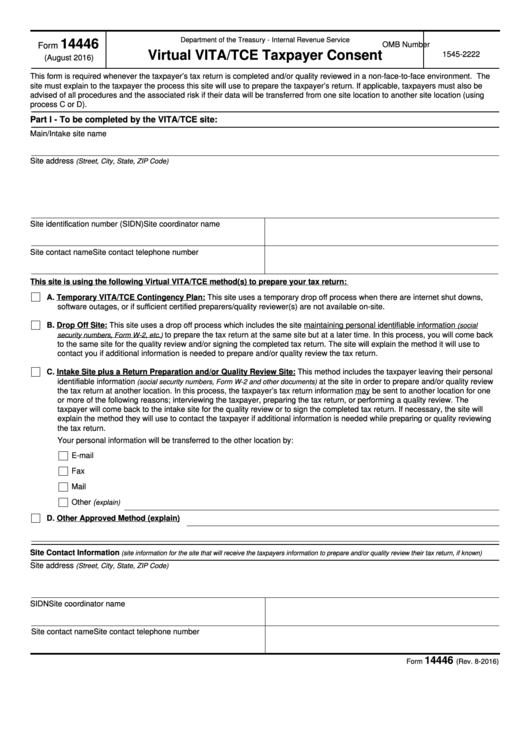

Department of the Treasury - Internal Revenue Service

14446

OMB Number

Form

Virtual VITA/TCE Taxpayer Consent

1545-2222

(August 2016)

This form is required whenever the taxpayer’s tax return is completed and/or quality reviewed in a non-face-to-face environment. The

site must explain to the taxpayer the process this site will use to prepare the taxpayer’s return. If applicable, taxpayers must also be

advised of all procedures and the associated risk if their data will be transferred from one site location to another site location (using

process C or D).

Part I - To be completed by the VITA/TCE site:

Main/Intake site name

Site address

(Street, City, State, ZIP Code)

Site identification number (SIDN)

Site coordinator name

Site contact name

Site contact telephone number

This site is using the following Virtual VITA/TCE method(s) to prepare your tax return:

A. Temporary VITA/TCE Contingency Plan: This site uses a temporary drop off process when there are internet shut downs,

software outages, or if sufficient certified preparers/quality reviewer(s) are not available on-site.

B. Drop Off Site: This site uses a drop off process which includes the site maintaining personal identifiable information

(social

to prepare the tax return at the same site but at a later time. In this process, you will come back

security numbers, Form W-2, etc.)

to the same site for the quality review and/or signing the completed tax return. The site will explain the method it will use to

contact you if additional information is needed to prepare and/or quality review the tax return.

C. Intake Site plus a Return Preparation and/or Quality Review Site: This method includes the taxpayer leaving their personal

identifiable information

at the site in order to prepare and/or quality review

(social security numbers, Form W-2 and other documents)

the tax return at another location. In this process, the taxpayer’s tax return information may be sent to another location for one

or more of the following reasons; interviewing the taxpayer, preparing the tax return, or performing a quality review. The

taxpayer will come back to the intake site for the quality review or to sign the completed tax return. If necessary, the site will

explain the method they will use to contact the taxpayer if additional information is needed while preparing or quality reviewing

the tax return.

Your personal information will be transferred to the other location by:

E-mail

Fax

Mail

Other (

explain)

D. Other Approved Method (explain)

Site Contact Information

(site information for the site that will receive the taxpayers information to prepare and/or quality review their tax return, if known)

Site address

(Street, City, State, ZIP Code)

SIDN

Site coordinator name

Site contact name

Site contact telephone number

14446

Catalog Number 60989A

Form

(Rev. 8-2016)

1

1 2

2