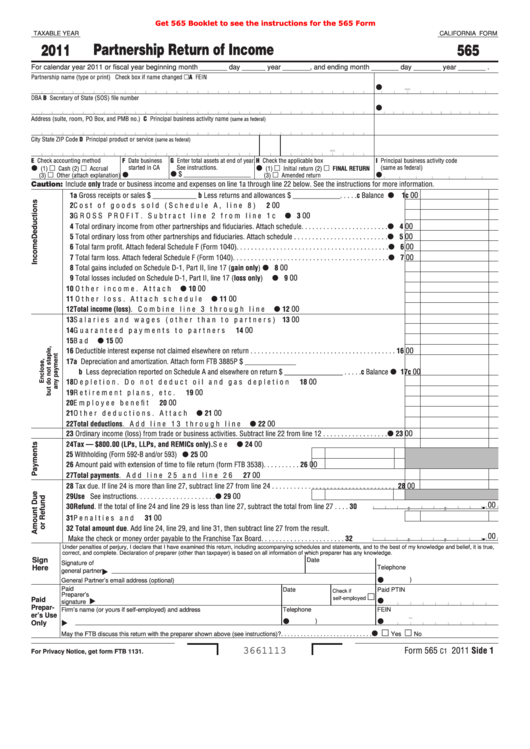

Get 565 Booklet to see the instructions for the 565 Form

TAXABLE YEAR

CALIFORNIA FORM

Partnership Return of Income

2011

565

For calendar year 2011 or fiscal year beginning month _______ day ______ year _______, and ending month _______ day _______ year _______ .

Partnership name (type or print)

Check box if name changed

A FEIN

I

DBA

B Secretary of State (SOS) file number

I

Address (suite, room, PO Box, and PMB no.)

C Principal business activity name

(same as federal)

City

State

ZIP Code

D Principal product or service

(same as federal)

E Check accounting method

F Date business

G Enter total assets at end of year.

H Check the applicable box

I Principal business activity code

started in CA

See instructions.

(same as federal)

(1)

Cash (2)

Accrual

(1)

Initial return (2)

FINAL RETURN

$ ___________________

(3)

Other (attach explanation)

(3)

Amended return

Caution: Include only trade or business income and expenses on line 1a through line 22 below. See the instructions for more information.

I

� a Gross receipts or sales $ ____________ b Less returns and allowances $ _____________. . . . . c Balance

�c

00

00

2 Cost of goods sold (Schedule A, line 8) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

2

I

00

3 GrOSS PrOFIt. Subtract line 2 from line 1c . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

3

I

00

4 total ordinary income from other partnerships and fiduciaries. Attach schedule . . . . . . . . . . . . . . . . . . . . . . . .

4

I

00

5 total ordinary loss from other partnerships and fiduciaries. Attach schedule . . . . . . . . . . . . . . . . . . . . . . . . . .

5

I

00

6 total farm profit. Attach federal Schedule F (Form 1040). . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

6

I

7 total farm loss. Attach federal Schedule F (Form 1040). . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

7

00

I

00

8 total gains included on Schedule D-1, Part II, line 17 (gain only) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

8

I

00

9 total losses included on Schedule D-1, Part II, line 17 (loss only) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

9

I

00

�0 Other income. Attach schedule. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

�0

I

00

�� Other loss. Attach schedule . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

��

I

�2 Total income (loss). Combine line 3 through line 11 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

�2

00

00

�3 Salaries and wages (other than to partners). . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

�3

00

�4 Guaranteed payments to partners . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

�4

I

�5 Bad debts . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

�5

00

�6 Deductible interest expense not claimed elsewhere on return . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

�6

00

�7 a Depreciation and amortization. Attach form FtB 3885P $ ______________

I

00

b Less depreciation reported on Schedule A and elsewhere on return $ ________________ . . . . . c Balance

�7c

00

�8 Depletion. Do not deduct oil and gas depletion . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

�8

00

�9 retirement plans, etc. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

�9

20 Employee benefit programs . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

20

00

I

00

2� Other deductions. Attach schedule. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

2�

I

00

22 Total deductions. Add line 13 through line 21 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

22

I

00

23 Ordinary income (loss) from trade or business activities. Subtract line 22 from line 12 . . . . . . . . . . . . . . . . . .

23

I

00

24 Tax — $800.00 (LPs, LLPs, and REMICs only). See instructions. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

24

I

00

25 Withholding (Form 592-B and/or 593). . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

25

00

26 Amount paid with extension of time to file return (form FtB 3538) . . . . . . . . . .

26

27 Total payments. Add line 25 and line 26 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

27

00

00

28 tax due. If line 24 is more than line 27, subtract line 27 from line 24 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

28

I

00

29 Use Tax. This is not a total line. See instructions. . . . . . . . . . . . . . . . . . . . . .

29

.

,

,

00

30 Refund. If the total of line 24 and line 29 is less than line 27, subtract the total from line 27 . . . . 30

00

3� Penalties and interest . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

3�

32 Total amount due. Add line 24, line 29, and line 31, then subtract line 27 from the result.

.

,

,

00

Make the check or money order payable to the Franchise tax Board . . . . . . . . . . . . . . . . . . . . . . . 32

Under penalties of perjury, I declare that I have examined this return, including accompanying schedules and statements, and to the best of my knowledge and belief, it is true,

correct, and complete. Declaration of preparer (other than taxpayer) is based on all information of which preparer has any knowledge.

Sign

Date

Signature of

Here

Telephone

general partner

I

(

)

General Partner’s email address (optional)

Paid

Date

Paid PTIN

Check if

I

Preparer’s

self-employed

Paid

signature

Prepar-

Telephone

FEIN

Firm’s name (or yours if self-employed) and address

-

I

I

er’s Use

(

)

Only

I

May the FTB discuss this return with the preparer shown above (see instructions)?. . . . . . . . . . . . . . . . . . . . . . . . . . . .

Yes

No

Form 565

2011 Side �

3661113

C1

For Privacy Notice, get form FTB 1131.

1

1 2

2 3

3 4

4