Affidavit Of True Consideration And Exemption For Existing Encumbrance - County Of Beaufort

ADVERTISEMENT

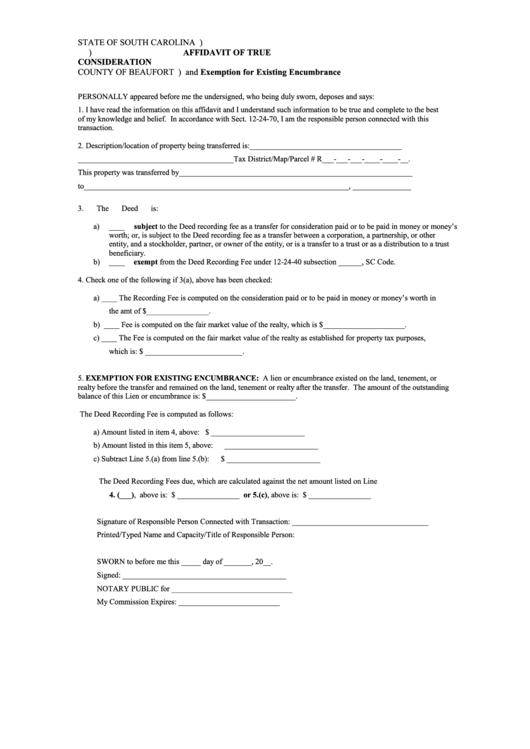

STATE OF SOUTH CAROLINA

)

)

AFFIDAVIT OF TRUE

CONSIDERATION

COUNTY OF BEAUFORT

)

and Exemption for Existing Encumbrance

PERSONALLY appeared before me the undersigned, who being duly sworn, deposes and says:

1.

I have read the information on this affidavit and I understand such information to be true and complete to the best

of my knowledge and belief. In accordance with Sect. 12-24-70, I am the responsible person connected with this

transaction.

2.

Description/location of property being transferred is:_______________________________________

________________________________________Tax District/Map/Parcel # R___-___-___-____-____-__.

This property was transferred by____________________________________________________________

to____________________________________________________________________, _______________

3.

The Deed is:

a)

____ subject to the Deed recording fee as a transfer for consideration paid or to be paid in money or money’s

worth; or, is subject to the Deed recording fee as a transfer between a corporation, a partnership, or other

entity, and a stockholder, partner, or owner of the entity, or is a transfer to a trust or as a distribution to a trust

beneficiary.

b)

____ exempt from the Deed Recording Fee under 12-24-40 subsection ______, SC Code.

4.

Check one of the following if 3(a), above has been checked:

a)

____ The Recording Fee is computed on the consideration paid or to be paid in money or money’s worth in

the amt of $________________.

b)

____ Fee is computed on the fair market value of the realty, which is $_____________________.

c)

____ The Fee is computed on the fair market value of the realty as established for property tax purposes,

which is: $ _________________________.

5.

EXEMPTION FOR EXISTING ENCUMBRANCE: A lien or encumbrance existed on the land, tenement, or

realty before the transfer and remained on the land, tenement or realty after the transfer. The amount of the outstanding

balance of this Lien or encumbrance is: $_______________________.

The Deed Recording Fee is computed as follows:

a)

Amount listed in item 4, above: $ ________________________

b)

Amount listed in this item 5, above:

________________________

c)

Subtract Line 5.(a) from line 5.(b):

$ ________________________

The Deed Recording Fees due, which are calculated against the net amount listed on Line

4. (___), above is: $ ________________

or 5.(c), above is: $ ________________

Signature of Responsible Person Connected with Transaction: ___________________________________

Printed/Typed Name and Capacity/Title of Responsible Person:

SWORN to before me this _____ day of _______, 20__.

Signed: __________________________________________

NOTARY PUBLIC for _______________________________

My Commission Expires: __________________________

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1