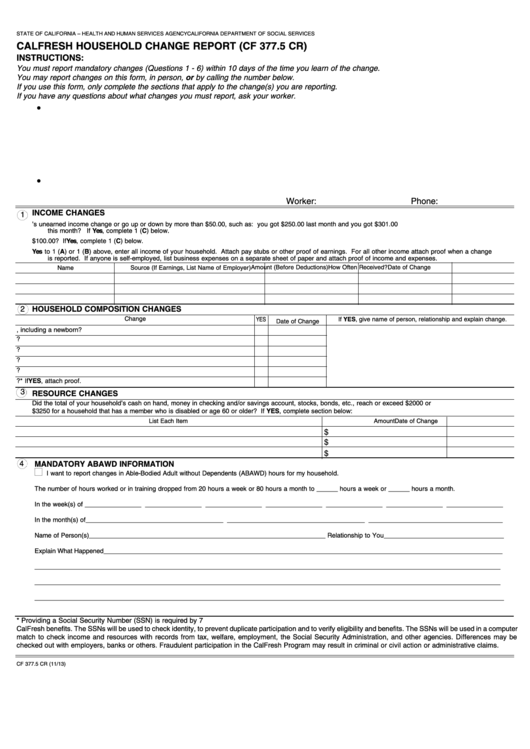

STATE OF CALIFORNIA – HEALTH AND HUMAN SERVICES AGENCY

CALIFORNIA DEPARTMENT OF SOCIAL SERVICES

CALFRESH HOUSEHOLD CHANGE REPORT (CF 377.5 CR)

INSTRUCTIONS:

You must report mandatory changes (Questions 1 - 6) within 10 days of the time you learn of the change.

You may report changes on this form, in person, or by calling the number below.

If you use this form, only complete the sections that apply to the change(s) you are reporting.

If you have any questions about what changes you must report, ask your worker.

•

•

Worker:

Phone:

INCOME CHANGES

1

A.

Did the source of your household’s unearned income change or go up or down by more than $50.00, such as: you got $250.00 last month and you got $301.00

this month? If Yes, complete 1 (C) below.

B.

Did the source of earned income for any household member change or go up or down by more than $100.00? If Yes, complete 1 (C) below.

C.

If Yes to 1 (A) or 1 (B) above, enter all income of your household. Attach pay stubs or other proof of earnings. For all other income attach proof when a change

is reported. If anyone is self-employed, list business expenses on a separate sheet of paper and attach proof of income and expenses.

Amount (Before Deductions)

How Often Received?

Date of Change

Name

Source (If Earnings, List Name of Employer)

2

HOUSEHOLD COMPOSITION CHANGES

Change

YES

If YES, give name of person, relationship and explain change.

Date of Change

A.

Did anyone move into your home, including a newborn?

B.

Did anyone move out of your home or die?

C.

Did you move in with someone else?

D.

Did anyone get married?

E.

Did anyone become disabled or recover from a disability?

F.

Did anyone get a new Social Security Number?* If YES, attach proof.

3

RESOURCE CHANGES

Did the total of your household’s cash on hand, money in checking and/or savings account, stocks, bonds, etc., reach or exceed $2000 or

$3250 for a household that has a member who is disabled or age 60 or older? If YES, complete section below:

List Each Item

Amount

Date of Change

$

$

$

4

MANDATORY ABAWD INFORMATION

■

I want to report changes in Able-Bodied Adult without Dependents (ABAWD) hours for my household.

The number of hours worked or in training dropped from 20 hours a week or 80 hours a month to ______ hours a week or ______ hours a month.

In the week(s) of ________________ ________________ ________________ ________________ ________________ ________________ ________________

In the month(s) of_______________________________________ _______________________________________ ______________________________________

Name of Person(s)___________________________________________________________________ Relationship to You__________________________________

Explain What Happened_________________________________________________________________________________________________________________

____________________________________________________________________________________________________________________________________

____________________________________________________________________________________________________________________________________

_____________________________________________________________________________________________________________________________________

* Providing a Social Security Number (SSN) is required by 7 U.S. Code Section 2025E. Anyone who refuses to provide an SSN will be disqualified from receiving

CalFresh benefits. The SSNs will be used to check identity, to prevent duplicate participation and to verify eligibility and benefits. The SSNs will be used in a computer

match to check income and resources with records from tax, welfare, employment, the Social Security Administration, and other agencies. Differences may be

checked out with employers, banks or others. Fraudulent participation in the CalFresh Program may result in criminal or civil action or administrative claims.

CF 377.5 CR (11/13)

1

1 2

2