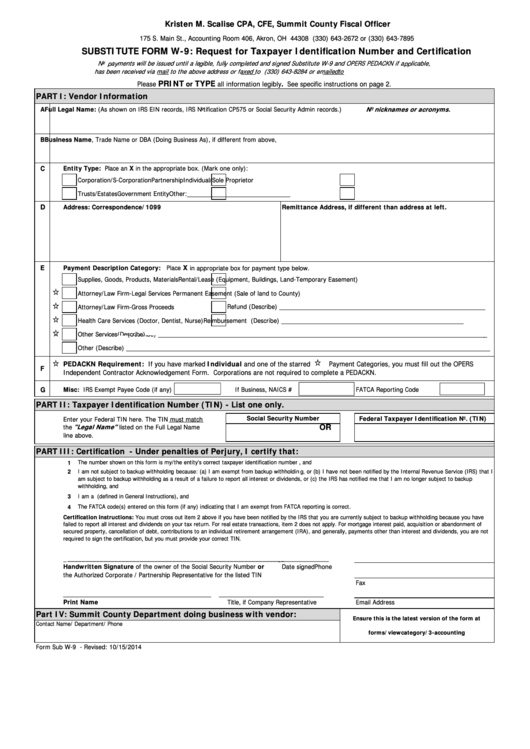

Kristen M. Scalise CPA, CFE, Summit County Fiscal Officer

175 S. Main St., Accounting Room 406, Akron, OH 44308 (330) 643-2672 or (330) 643-7895

SUBSTITUTE FORM W-9: Request for Taxpayer Identification Number and Certification

No payments will be issued until a legible, fully completed and signed Substitute W-9 and OPERS PEDACKN if applicable,

has been received via mail to the above address or faxed to (330) 643-8284 or emailed to fiscalfinance@summitoh.net.

PRINT

TYPE

Please

or

all information legibly. See specific instructions on page 2.

PART I: Vendor Information

A

Full Legal Name: (As shown on IRS EIN records, IRS Notification CP575 or Social Security Admin records.)

No nicknames or acronyms.

B

Business Name, Trade Name or DBA (Doing Business As), if different from above,

C

Entity Type: Place an X in the appropriate box. (Mark one only):

Corporation/S-Corporation

Partnership

Individual/Sole Proprietor

Trusts/Estates

Government Entity

Other:______________________________

D

Address: Correspondence/1099

Remittance Address, if different than address at left.

E

X

Payment Description Category: Place

in appropriate box for payment type below.

Supplies, Goods, Products, Materials

Rental/Lease (Equipment, Buildings, Land-Temporary Easement)

Attorney/Law Firm-Legal Services

Permanent Easement (Sale of land to County)

Refund (Describe) ____________________________________________________________

Attorney/Law Firm-Gross Proceeds

Health Care Services (Doctor, Dentist, Nurse)

Reimbursement (Describe) _____________________________________________________

Other Services

Other Services

(Describe)

(Describe) ________________________________________________________________________________________________

Other (Describe) __________________________________________________________________________________________________________

PEDACKN Requirement: If you have marked Individual and one of the starred

Payment Categories, you must fill out the OPERS

F

Independent Contractor Acknowledgement Form. Corporations are not required to complete a PEDACKN.

G

Misc: IRS Exempt Payee Code (if any)

If Business, NAICS #

FATCA Reporting Code

PART II: Taxpayer Identification Number (TIN) - List one only.

Social Security Number

Federal Taxpayer Identification No. (TIN)

Enter your Federal TIN here. The TIN must match

OR

"Legal Name"

the

listed on the Full Legal Name

line above.

PART III: Certification - Under penalties of Perjury, I certify that:

The number shown on this form is my/the entity's correct taxpayer identification number , and

1

2

I am not subject to backup withholding because: (a) I am exempt from backup withholding, or (b) I have not been notified by the Internal Revenue Service (IRS) that I

am subject to backup withholding as a result of a failure to report all interest or dividends, or (c) the IRS has notified me that I am no longer subject to backup

withholding, and

I am a U.S. citizen or other U.S. person (defined in General Instructions), and

3

4

The FATCA code(s) entered on this form (if any) indicating that I am exempt from FATCA reporting is correct.

Certification instructions: You must cross out item 2 above if you have been notified by the IRS that you are currently subject to backup withholding because you have

failed to report all interest and dividends on your tax return. For real estate transactions, item 2 does not apply. For mortgage interest paid, acquisition or abandonment of

secured property, cancellation of debt, contributions to an individual retirement arrangement (IRA), and generally, payments other than interest and dividends, you are not

required to sign the certification, but you must provide your correct TIN.

_____________

______________________________________________________________

Handwritten Signature of the owner of the Social Security Number or

Date signed

Phone

the Authorized Corporate / Partnership Representative for the listed TIN

Fax

_________________________________________

_____________________________

Print Name

Title, if Company Representative

Email Address

Part IV: Summit County Department doing business with vendor:

Ensure this is the latest version of the form at

Contact Name/ Department/ Phone

https://fiscalportal.summitoh.net/index.php/

forms/viewcategory/3-accounting

Form Sub W-9 - Revised: 10/15/2014

1

1 2

2