Form Wv/it-105 - West Virginia State Tax Department W-2 And 1099-R Transmitter Summary Report

ADVERTISEMENT

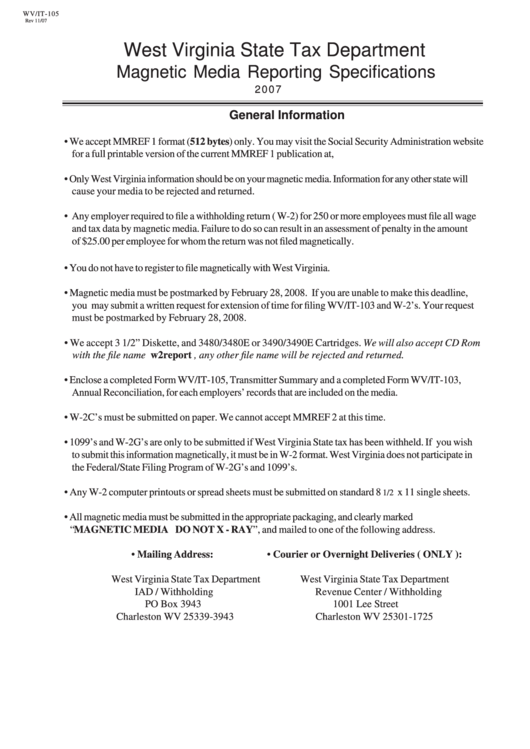

WV/IT-105

Rev 11/07

West Virginia State Tax Department

Magnetic Media Reporting Specifications

2007

General Information

• We accept MMREF 1 format (512 bytes) only. You may visit the Social Security Administration website

for a full printable version of the current MMREF 1 publication at, .

• Only West Virginia information should be on your magnetic media. Information for any other state will

cause your media to be rejected and returned.

• Any employer required to file a withholding return ( W-2) for 250 or more employees must file all wage

and tax data by magnetic media. Failure to do so can result in an assessment of penalty in the amount

of $25.00 per employee for whom the return was not filed magnetically.

• You do not have to register to file magnetically with West Virginia.

• Magnetic media must be postmarked by February 28, 2008. If you are unable to make this deadline,

you may submit a written request for extension of time for filing WV/IT-103 and W-2’s. Your request

must be postmarked by February 28, 2008.

• We accept 3 1/2” Diskette, and 3480/3480E or 3490/3490E Cartridges. We will also accept CD Rom

with the file name w2report , any other file name will be rejected and returned.

• Enclose a completed Form WV/IT-105, Transmitter Summary and a completed Form WV/IT-103,

Annual Reconciliation, for each employers’ records that are included on the media.

• W-2C’s must be submitted on paper. We cannot accept MMREF 2 at this time.

• 1099’s and W-2G’s are only to be submitted if West Virginia State tax has been withheld. If you wish

to submit this information magnetically, it must be in W-2 format. West Virginia does not participate in

the Federal/State Filing Program of W-2G’s and 1099’s.

• Any W-2 computer printouts or spread sheets must be submitted on standard 8

x 11 single sheets.

1/2

• All magnetic media must be submitted in the appropriate packaging, and clearly marked

“MAGNETIC MEDIA DO NOT X - RAY”, and mailed to one of the following address.

• Mailing Address:

• Courier or Overnight Deliveries ( ONLY ):

West Virginia State Tax Department

West Virginia State Tax Department

IAD / Withholding

Revenue Center / Withholding

PO Box 3943

1001 Lee Street

Charleston WV 25339-3943

Charleston WV 25301-1725

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4