Business Tax Return Form/schedule Y Business Allocation Formula - City Of Cincinnati - 2002

ADVERTISEMENT

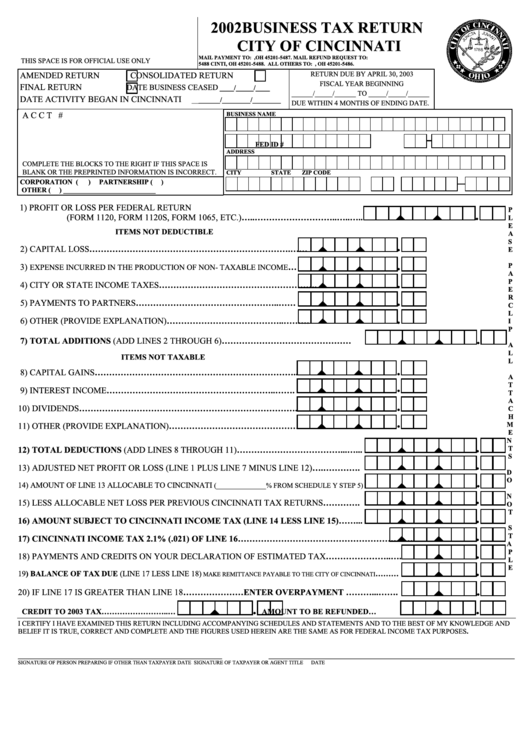

2002 BUSINESS TAX RETURN

CITY OF CINCINNATI

MAIL PAYMENT TO: P.O. BOX 5487 CINTI, OH 45201-5487. MAIL REFUND REQUEST TO: P.O.BOX

THIS SPACE IS FOR OFFICIAL USE ONLY

5488 CINTI, OH 45201-5488. ALL OTHERS TO: P.O. BOX 5486 CINTI, OH 45201-5486.

AMENDED RETURN

CONSOLIDATED RETURN

RETURN DUE BY APRIL 30, 2003

FISCAL YEAR BEGINNING

FINAL RETURN

DATE BUSINESS CEASED

____/_____/____

______/_____/______ TO _____/_____/______

DATE ACTIVITY BEGAN IN CINCINNATI

________/________/________

DUE WITHIN 4 MONTHS OF ENDING DATE.

ACCT #

BUSINESS NAME

FED ID #

ADDRESS

COMPLETE THE BLOCKS TO THE RIGHT IF THIS SPACE IS

BLANK OR THE PREPRINTED INFORMATION IS INCORRECT.

CITY

STATE

ZIP CODE

CORPORATION (

)

PARTNERSHIP (

)

OTHER (

) __________________________

1) PROFIT OR LOSS PER FEDERAL RETURN

P

(FORM 1120, FORM 1120S, FORM 1065, ETC.)…..………………………..…..…..

L

E

ITEMS NOT DEDUCTIBLE

A

S

2) CAPITAL LOSS…………………………………………………………….……

E

P

3)

…

EXPENSE INCURRED IN THE PRODUCTION OF NON- TAXABLE INCOME

A

P

4) CITY OR STATE INCOME TAXES……………………………………………….

E

R

5) PAYMENTS TO PARTNERS…………………………………………..……

C

L

6) OTHER (PROVIDE EXPLANATION)…………………………………..………

I

P

7) TOTAL ADDITIONS (ADD LINES 2 THROUGH 6)……………………………………….....

A

L

ITEMS NOT TAXABLE

L

8) CAPITAL GAINS……………………………………………………………..

A

T

9) INTEREST INCOME…………………………………………………..…….

T

A

10) DIVIDENDS………………………………………………………………….

C

H

M

11) OTHER (PROVIDE EXPLANATION)………………………………………

E

N

T

12) TOTAL DEDUCTIONS (ADD LINES 8 THROUGH 11)………………………………...…...

S

13) ADJUSTED NET PROFIT OR LOSS (LINE 1 PLUS LINE 7 MINUS LINE 12)….………….

D

O

14) AMOUNT OF LINE 13 ALLOCABLE TO CINCINNATI

(______________% FROM SCHEDULE Y STEP 5)

N

15) LESS ALLOCABLE NET LOSS PER PREVIOUS CINCINNATI TAX RETURNS………….

O

T

16) AMOUNT SUBJECT TO CINCINNATI INCOME TAX (LINE 14 LESS LINE 15)……...

S

T

17) CINCINNATI INCOME TAX 2.1% (.021) OF LINE 16………………………………………………….…

A

P

18) PAYMENTS AND CREDITS ON YOUR DECLARATION OF ESTIMATED TAX…………………..….

L

E

19) BALANCE OF TAX DUE (LINE 17 LESS LINE 18)

………

MAKE REMITTANCE PAYABLE TO THE CITY OF CINCINNATI

20) IF LINE 17 IS GREATER THAN LINE 18…………………ENTER OVERPAYMENT ………...…….

CREDIT TO 2003 TAX……………………..…

AMOUNT TO BE REFUNDED…

I CERTIFY I HAVE EXAMINED THIS RETURN INCLUDING ACCOMPANYING SCHEDULES AND STATEMENTS AND TO THE BEST OF MY KNOWLEDGE AND

BELIEF IT IS TRUE, CORRECT AND COMPLETE AND THE FIGURES USED HEREIN ARE THE SAME AS FOR FEDERAL INCOME TAX PURPOSES.

_______________________________________

_______________________________________________

SIGNATURE OF PERSON PREPARING IF OTHER THAN TAXPAYER

DATE

SIGNATURE OF TAXPAYER OR AGENT

TITLE

DATE

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2