F

1998

1998

39

39

1998

39

1998

1998

39

39

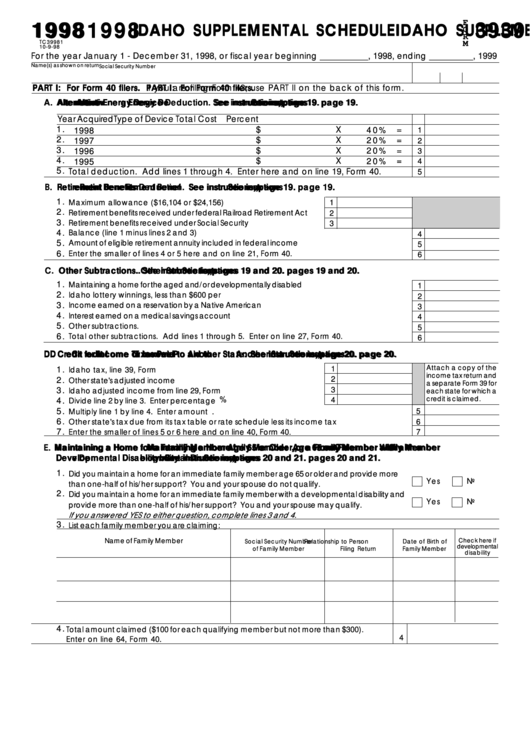

IDAHO SUPPLEMENTAL SCHEDULE

IDAHO SUPPLEMENTAL SCHEDULE

IDAHO SUPPLEMENTAL SCHEDULE

IDAHO SUPPLEMENTAL SCHEDULE

IDAHO SUPPLEMENTAL SCHEDULE

O

R

TC39981

M

10-9-98

For the year January 1 - December 31, 1998, or fiscal year beginning ___________, 1998, ending __________, 1999

Name(s) as shown on return

Social Security Number

PART I: For Form 40 filers.

PART I: For Form 40 filers.

PART I: For Form 40 filers. If you are filing Form 43, use PART II on the back of this form.

PART I: For Form 40 filers.

PART I: For Form 40 filers.

A. A. A. A. A. Alter

Alter

Alter

Alterna

Alter

na

na

na

nativ

tiv

tiv

tiv

tive Ener

e Ener

e Ener

e Ener

e Energy De

gy De

gy De

gy De

gy Device Deduction.

vice Deduction.

vice Deduction.

vice Deduction.

vice Deduction. See instr

See instr

See instr

See instr

See instructions

uctions

uctions

uctions

uctions, , , , , page 19.

page 19.

page 19.

page 19.

page 19.

Year Acquired

Type of Device

Total Cost

Percent

1 .

$

X

=

4 0 %

1

1998

2 .

$

X

2 0 %

=

1997

2

3 .

$

X

2 0 %

=

1996

3

4 .

$

X

=

2 0 %

1995

4

5 .

Total deduction. Add lines 1 through 4. Enter here and on line 19, Form 40.

5

B. B. B. B. B. Retir

Retir

Retir

Retirement Benef

Retir

ement Benef

ement Benef

ement Benef

ement Benefits Deduction.

its Deduction.

its Deduction.

its Deduction.

its Deduction. See instr

See instr

See instr

See instr

See instructions

uctions

uctions

uctions

uctions, , , , , page 19.

page 19.

page 19.

page 19.

page 19.

1 .

Maximum allowance ($16,104 or $24,156). ...........................................

1

2 .

Retirement benefits received under federal Railroad Retirement Act .....

2

3 .

Retirement benefits received under Social Security ................................

3

4 .

Balance (line 1 minus lines 2 and 3) ................................................................................................

4

5 .

Amount of eligible retirement annuity included in federal income .................................................

5

6 .

Enter the smaller of lines 4 or 5 here and on line 21, Form 40.

6

C.

C. C.

C. C. Other Subtractions

Other Subtractions

Other Subtractions

Other Subtractions

Other Subtractions. . . . . See instr

See instr

See instr

See instr

See instructions

uctions

uctions

uctions

uctions, , , , , pages 19 and 20.

pages 19 and 20.

pages 19 and 20.

pages 19 and 20.

pages 19 and 20.

1 .

Maintaining a home for the aged and/or developmentally disabled ...............................................

1

2 .

Idaho lottery winnings, less than $600 per prize ...........................................................................

2

3 .

Income earned on a reservation by a Native American ..................................................................

3

4 .

Interest earned on a medical savings account ................................................................................

4

5 .

Other subtractions. Identify. ...........................................................................................................

5

6 .

Total other subtractions. Add lines 1 through 5. Enter on line 27, Form 40.

6

D D D D D . . . . . Cr

Cr

Cr

Cr

Credit f

edit f

edit f

edit f

edit for Income

or Income

or Income

or Income

or Income T T T T T ax

ax

ax

ax

axes P

es P

es P

es P

es Paid to

aid to

aid to

aid to

aid to Another Sta

Another Sta

Another Sta

Another Sta

Another State.

te.

te.

te. See instr

te.

See instr

See instr

See instructions

See instr

uctions

uctions

uctions, , , , , page 20.

uctions

page 20.

page 20.

page 20.

page 20.

Attach a copy of the

1

1 .

Idaho tax, line 39, Form 40 ......................................................................

income tax return and

2

2 .

Other state's adjusted income ..................................................................

a separate Form 39 for

3

3 .

Idaho adjusted income from line 29, Form 40 .........................................

each state for which a

%

credit is claimed.

4

4 .

Divide line 2 by line 3. Enter percentage here. .......................................

5 .

5

Multiply line 1 by line 4. Enter amount here. ..................................................................................

6 .

Other state's tax due from its tax table or rate schedule less its income tax credits ...................

6

7 .

Enter the smaller of lines 5 or 6 here and on line 40, Form 40.

7

E. E. E. E. E. Maintaining a Home f

Maintaining a Home f

Maintaining a Home f

Maintaining a Home f

Maintaining a Home for a F

or a F

or a F

or a F

or a Family Member

amily Member

amily Member

amily Member

amily Member Age 65 or Older

Age 65 or Older

Age 65 or Older

Age 65 or Older

Age 65 or Older, , , , , or a F

or a F

or a F

or a F

or a Family Member

amily Member

amily Member

amily Member

amily Member W W W W W ith a

ith a

ith a

ith a

ith a

De

De

De

De

Dev v v v v elopmental Disa

elopmental Disa

elopmental Disa

elopmental Disability

elopmental Disa

bility

bility

bility. . . . . See instr

bility

See instr

See instr

See instr

See instructions

uctions

uctions

uctions

uctions, , , , , pages 20 and 21.

pages 20 and 21.

pages 20 and 21.

pages 20 and 21.

pages 20 and 21.

1 .

Did you maintain a home for an immediate family member age 65 or older and provide more

Yes

No

than one-half of his/her support? You and your spouse do not qualify. ........................................

2 .

Did you maintain a home for an immediate family member with a developmental disability and

Yes

No

provide more than one-half of his/her support? You and your spouse may qualify. .....................

If you answered YES to either question, complete lines 3 and 4.

3 .

List each family member you are claiming:

Name of Family Member

Check here if

Social Security Number

Relationship to Person

Date of Birth of

developmental

of Family Member

Filing Return

Family Member

disability

4 .

Total amount claimed ($100 for each qualifying member but not more than $300).

4

Enter on line 64, Form 40.

1

1 2

2