Instructions For Form Ftb 3586 - 2016

ADVERTISEMENT

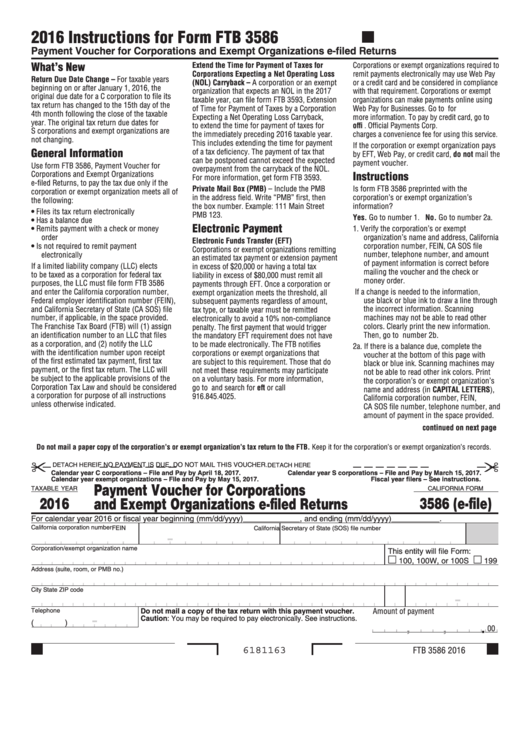

2016 Instructions for Form FTB 3586

Payment Voucher for Corporations and Exempt Organizations e-filed Returns

What’s New

Extend the Time for Payment of Taxes for

Corporations or exempt organizations required to

Corporations Expecting a Net Operating Loss

remit payments electronically may use Web Pay

Return Due Date Change – For taxable years

(NOL) Carryback – A corporation or an exempt

or a credit card and be considered in compliance

beginning on or after January 1, 2016, the

organization that expects an NOL in the 2017

with that requirement. Corporations or exempt

original due date for a C corporation to file its

taxable year, can file form FTB 3593, Extension

organizations can make payments online using

tax return has changed to the 15th day of the

of Time for Payment of Taxes by a Corporation

Web Pay for Businesses. Go to ftb.ca.gov for

4th month following the close of the taxable

Expecting a Net Operating Loss Carryback,

more information. To pay by credit card, go to

year. The original tax return due dates for

to extend the time for payment of taxes for

. Official Payments Corp.

S corporations and exempt organizations are

the immediately preceding 2016 taxable year.

charges a convenience fee for using this service.

not changing.

This includes extending the time for payment

If the corporation or exempt organization pays

General Information

of a tax deficiency. The payment of tax that

by EFT, Web Pay, or credit card, do not mail the

can be postponed cannot exceed the expected

payment voucher.

Use form FTB 3586, Payment Voucher for

overpayment from the carryback of the NOL.

Instructions

Corporations and Exempt Organizations

For more information, get form FTB 3593.

e‑filed Returns, to pay the tax due only if the

Private Mail Box (PMB) – Include the PMB

Is form FTB 3586 preprinted with the

corporation or exempt organization meets all of

in the address field. Write “PMB” first, then

corporation’s or exempt organization’s

the following:

the box number. Example: 111 Main Street

information?

• Files its tax return electronically

PMB 123.

Yes. Go to number 1.

No. Go to number 2a.

• Has a balance due

Electronic Payment

• Remits payment with a check or money

1. Verify the corporation’s or exempt

organization’s name and address, California

order

Electronic Funds Transfer (EFT)

corporation number, FEIN, CA SOS file

• Is not required to remit payment

Corporations or exempt organizations remitting

electronically

number, telephone number, and amount

an estimated tax payment or extension payment

of payment information is correct before

If a limited liability company (LLC) elects

in excess of $20,000 or having a total tax

mailing the voucher and the check or

to be taxed as a corporation for federal tax

liability in excess of $80,000 must remit all

money order.

purposes, the LLC must file form FTB 3586

payments through EFT. Once a corporation or

and enter the California corporation number,

If a change is needed to the information,

exempt organization meets the threshold, all

Federal employer identification number (FEIN),

use black or blue ink to draw a line through

subsequent payments regardless of amount,

the incorrect information. Scanning

and California Secretary of State (CA SOS) file

tax type, or taxable year must be remitted

number, if applicable, in the space provided.

machines may not be able to read other

electronically to avoid a 10% non‑compliance

The Franchise Tax Board (FTB) will (1) assign

colors. Clearly print the new information.

penalty. The first payment that would trigger

an identification number to an LLC that files

Then, go to number 2b.

the mandatory EFT requirement does not have

as a corporation, and (2) notify the LLC

to be made electronically. The FTB notifies

2a. If there is a balance due, complete the

with the identification number upon receipt

corporations or exempt organizations that

voucher at the bottom of this page with

of the first estimated tax payment, first tax

are subject to this requirement. Those that do

black or blue ink. Scanning machines may

payment, or the first tax return. The LLC will

not meet these requirements may participate

not be able to read other ink colors. Print

be subject to the applicable provisions of the

on a voluntary basis. For more information,

the corporation’s or exempt organization’s

Corporation Tax Law and should be considered

go to ftb.ca.gov and search for eft or call

name and address (in CAPITAL LETTERS),

a corporation for purpose of all instructions

916.845.4025.

California corporation number, FEIN,

unless otherwise indicated.

CA SOS file number, telephone number, and

amount of payment in the space provided.

continued on next page

Do not mail a paper copy of the corporation’s or exempt organization’s tax return to the FTB. Keep it for the corporation’s or exempt organization’s records.

IF NO PAYMENT IS DUE, DO NOT MAIL THIS VOUCHER.

DETACH HERE

DETACH HERE

Calendar year C corporations – File and Pay by April 18, 2017.

Calendar year S corporations – File and Pay by March 15, 2017.

Calendar year exempt organizations – File and Pay by May 15, 2017.

Fiscal year filers – See instructions.

Payment Voucher for Corporations

TAXABLE YEAR

CALIFORNIA FORM

2016

3586 (e-file)

and Exempt Organizations e-filed Returns

For calendar year 2016 or fiscal year beginning (mm/dd/yyyy)_____________, and ending (mm/dd/yyyy)___________.

California corporation number

FEIN

California Secretary of State (SOS) file number

Corporation/exempt organization name

This entity will file Form:

m

m

100, 100W, or 100S

199

Address (suite, room, or PMB no.)

City

State

ZIP code

Amount of payment

Do not mail a copy of the tax return with this payment voucher.

Telephone

Caution: You may be required to pay electronically. See instructions.

(

)

.

00

,

,

6181163

FTB 3586 2016

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2