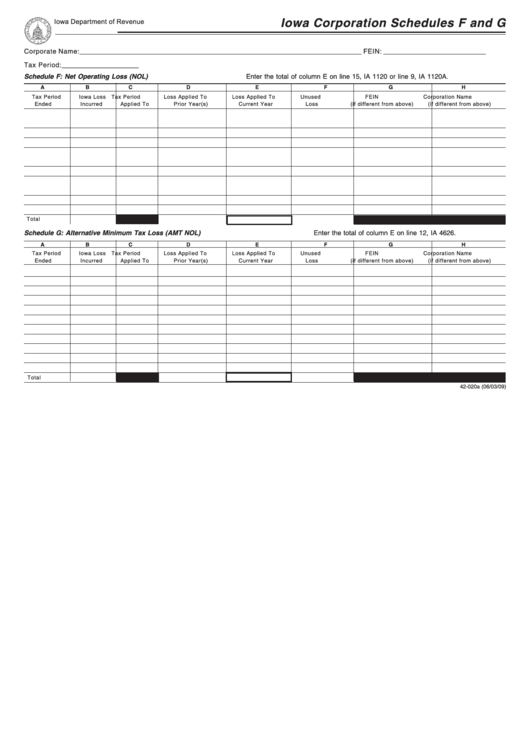

Form 42-020a - Iowa Corporation Schedules F And G

ADVERTISEMENT

Iowa Corporation Schedules F and G

Iowa Department of Revenue

Corporate Name: _____________________________________________________________________________ FEIN: ____________________________

Tax Period: _____________________

Schedule F: Net Operating Loss (NOL)

Enter the total of column E on line 15, IA 1120 or line 9, IA 1120A.

A

B

C

D

E

F

G

H

Tax Period

Iowa Loss

Tax Period

Loss Applied To

Loss Applied To

Unused

FEIN

Corporation Name

Ended

Incurred

Applied To

Prior Year(s)

Current Year

Loss

(if different from above)

(if different from above)

Total

Schedule G: Alternative Minimum Tax Loss (AMT NOL)

Enter the total of column E on line 12, IA 4626.

A

B

C

D

E

F

G

H

Tax Period

Iowa Loss

Tax Period

Loss Applied To

Loss Applied To

Unused

FEIN

Corporation Name

Ended

Incurred

Applied To

Prior Year(s)

Current Year

Loss

(if different from above)

(if different from above)

Total

42-020a (06/03/09)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2